Despite what the industry trade publications are sharing, our data does not reflect a slowdown in agency M&A transactions in 2023. Through October 2023, our data shows another year of record level M&A transactions with the highest number of transactions typically taking place in Q4.

Our data tracks both the publicly reported and silent transactions in the industry, representing retail agencies buying other retail agencies. It has often been estimated that the publicly reported M&A transactions only comprise 35% of the actual number of transactions happening in the system.

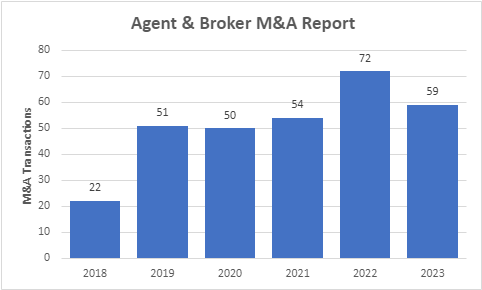

As it relates to the publicly reported M&A transactions, there has been a slight pullback in the number of transactions. When compared with the record M&A numbers in 2021 and 2022, 2023 will fall short of that level for publicly reported M&A activity.

This is not surprising, given the increase in interest rates and impact that has had on the cost of capital for private equity (PE) buyers. We have seen a noticeable decline in the number of transactions by PE backed leaders like Acrisure, PC, and High Street; however they have been replaced by Broadstreet Partners, Hub, and Inszone. In some ways, the top 10 acquirers are akin to the top 10 college football rankings. They move up and down during each season, but year to year the consistently high performers are at the top executing a strategy and plan to acquire and consolidate the IA system.

The Long View on Agency M&A and the Fundamentals Driving M&A in the IA System

According to Optis Partners, there have been over 6,811 broker and agency acquisitions through Q3 2023. M&A in the IA system started out with 200-300 transactions and felt like a glacial drip. There are not between 800-1,000 M&A transactions a year, which is much more like glacial calving and at the rate we are going we will be looking back in 3-5 years and an entire portion of the traditional IA business model (large and mid-sized agencies) will have vanished.

The effect of change is always overstated in a year; it is when you look back over 10 years that you see the big changes.

The fundamentals driving M&A are still solid and will lead to the long-term realignment of the IA system. Those fundamentals include the following: agencies are profitable and growing, baby boomers own 30% of agencies, it is a scalable business model, and consolidation being driven by PE backed brokers is a long-term strategy.

First, independent insurance agencies continue to remain both profitable and growing. In the face of a turbulent time for the insurance industry, independent agencies continue to produce an average of 24% profit margins. Given the increasing loss ratios, this will likely change for many agencies in Q1 2024 when profit sharing results are finalized. Anecdotally, we are hearing many agencies do not expect to receive any profit sharing and those that do are expecting it to be a small portion of what they have received in the past few years.

Second, baby boomers continue to own over 30% of the agencies in the US according to the Agency Universe Study. This factor alone will drive significant M&A transactions over the next decade. In fact, 60% of owners are over the age of 51, so the volume of sales over the next decade will be unprecedented and further reinforce the concept of the IA system going through the “greatest wealth transfer” ever.

While the IA system has turned over as many as six generations since its existence, there are two significant changes to the modern perpetuation model. One is the lack of family and young producers interested and able to purchase many third and fourth generation agencies. The second factor is the increase in selling options that did not exist 10 years ago. Not long ago, the only options for selling were internal perpetuation or selling to friendly competition. There is now a cottage industry of M&A brokers and headhunters looking to help buy and sell independent agencies.

Third, the independent agency business model is one that can be scaled for efficiencies and growth. While independent agencies are all unique in their brand, culture, markets, and community engagement, one constant is the similarities in their income and expense categories. Due to the similarities in the business model, it makes it scalability of back-office functions, technology, and service models very attractive and attainable. You can take a highly independent, fragmented business and roll it up under a centralized hub to create efficiencies in the least appealing functions for the insurance producer – administrative work that takes them away from solving risk problems and engaging with clients.

Finally, PE backed brokers are bullishly committed to the industry for the long-term. There does not appear to be any shortage of PE funds eager to invest in the IA system. While they may pullback from time to time based on the financial environment and become pickier in their acquisition approach, it does not appear that their strategy of growth by acquisition is heavily changing, rather merely pivoting during the high interest rate environment. As of 2022, there were 17 brokers with over a billion dollars in annual revenue in the US and climbing. All have implemented one common growth strategy over the past 10 years – acquisition of independent agencies. We fully expect that to continue.

If you find yourself being approached by PE backed buyers or friendly competitors, we encourage you to connect with Jeff smith, JD, CIC at jeff@iavaluations.com so we can have a conversation about your situation and help set you up for success in this consolidating environment.

About IA Valuations and Agency Link – Founded in 2017, the IA Valuations team has performed over 250 valuations to independent insurance agencies across the U.S. Our advisors have 25+ years of experience guiding agency owners on maximizing their agency value, planning, and legal needs for ownership transition. In addition, IA Valuations has provided perpetuation planning, financial modeling and business planning for independent insurance agencies. Finally, IA Valuations has advised dozens of agency owners on selling their agencies through our Agency Link process. Agency Link is a platform that connects buyers and sellers together to further the growth and strength of the IA system. To learn more about IA Valuations, please visit IAValuations.com or contact@iavaluations.com.

The information provided in these documents is general in nature and shall not be construed as personal legal, tax or financial advice for your situation. Please contact@iavaluations.com to discuss your personal situation.

Copyright ©2023 by IA Valuations and Ohio Insurance Agents Association (OIA). All rights reserved. No portion of this document may be reproduced in any manner without the prior written consent of IA Valuations or OIA. In addition, this document may not be posted as a link on any public or private website without the prior written consent of IA Valuations or OIA.

By: Jeff Smith, JD, CIC