It is undeniable that the independent agency system is undergoing massive consolidation. In what we have dubbed “the greatest wealth transfer in the history of the independent agency system,” we are experiencing a realignment of the IA business model.

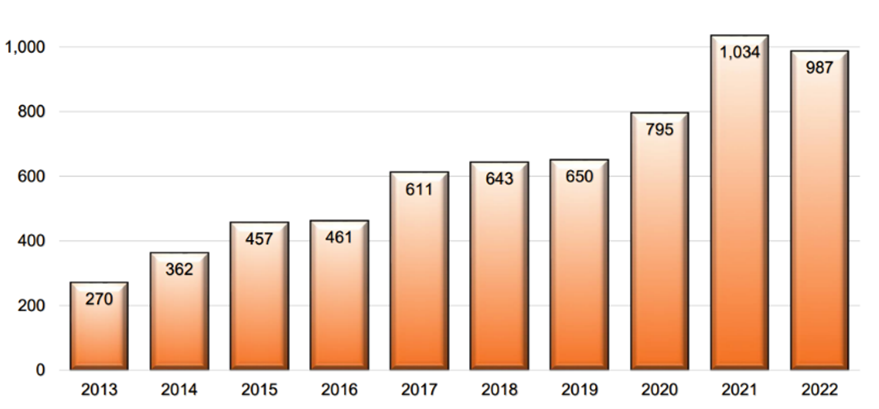

Over the past 10 years, according to Optis Partners, the IA system has experienced a 250% increase in the number of reported M&A transactions. In that time period, 6,270 M&A deals have been announced. In our estimation, this is likely only one third of the actual ownership transactions taking place in the IA system. Between unannounced external sales, internal sales, and perpetuations, we believe there were tens of thousands of additional ownership transitions in the marketplace over the past decade with many more forecasted over the next ten years.

While we do not anticipate another level of ratcheting up of M&A, we do expect the level of transactions to remain at 2017 levels and above. This is being fueled by unprecedented investment of Private Equity (PE) dollars in the IA system, an increasing number of PE buyers, an aging ownership population, and healthy number of agencies remaining in the system. This means we will experience even greater consolidation in the coming years as the big PE buyers continue to get bigger.

Learning from Consolidation Experience

As an independent agency owner, you are likely wondering what this means to you, your long-term financial well-being, and the value of your agency.

First and important to note, IAs are not the first profession to experience industry consolidation driven largely by PE and the evolution of the business model. Many other mature industries have come before us, including medical, dental, pharmacists, nursing homes, law, accounting, financial advisors, and auto dealers to name a few.

To understand what IAs are experiencing, look no further than your book of business and the accounts you have lost to M&A over the past decade. You will likely identify clients that were in mature businesses in traditionally stable industries that produce consistent profit margins and undergoing some degree of change due to technology and economic evolution. Those lost M&A accounts are likely going through similar consolidation experiences in their industry.

Based on my past, the experience that is closes to me is the consolidation of independently owned medical practices and hospitals. I worked in the health care industry almost twenty years ago and witnessed the medical profession being predominantly independently owned medical practices and hospitals. In the early 2000s we started to see some consolidation; little did we know it was just the tip of the iceberg.

Fast forward to 2023 and we see the majority of medical practices are now owned by health systems, physicians are employees of those health systems, and local hospitals are almost extinct as most have been consolidated under several large multibillion dollar health system brands.

For those of you who currently or previously insure the local medical practices and hospitals in your county, you have likely experienced this consolidation firsthand or are anticipating that it could happen to you at any moment.

Understanding what drove this consolidation will help us further understand what it means to the IA system. For starters, health care is a massive 4.3 Trillion – yes, that is Trillion – dollar industry and is continuing to grow. PE investors take notice of this and invest their resources in growing parts of the economy.

Second, there were many inefficiencies in how independent medical practice and hospitals were developed and in need of modernization in order to meet the demands of an increasingly complex healthcare system. The industry was largely paper based, disconnected, and incredibly complex for patients to navigate. Technology is rapidly changing this with electronic medical records, customer portals, and other tools to empower patients.

Third, physicians are medical practitioners first and foremost. Their focus is on patient care, not the business of running a medical practice. Any entity that can eliminate the challenges and pressures of running a medical practice were met with enthusiasm.

Fourth, while healthcare is a growing industry, it is under constant cost-cutting pressures. Patients, politicians, employers, and health insurers are all constantly advocating for relief from the ever-increasing healthcare costs.

PE, health systems, and other consolidators stepped in to take advantage and solve many of these challenges. In the process, the entire healthcare system has undergone a fundamental realignment of its business model.

Consolidation in the IA System

While the IA system is different in so many ways, the consolidation parallels we are experiencing are also so similar. Think about your agency in a similar manner as to what you have witnessed with independently owned medical practices and hospitals. Sound familiar? It sure does to me. We are in the eye of the storm. Consolidation is upon us, and it is fast and big, complex and sophisticated, disruptive and efficient. There may be moments where it feels like things are quiet and calm but make no mistake, we are under a massive consolidation effort that is fundamentally altering the IA business model.

First, the IA system is massive. The US P&C market alone is comprised of an estimated $890 Billion in premium and growing by 8% per year.

Second, the IA system has traditionally been highly inefficient, segregated by proprietary systems and largely paper-based.

Third, insurance agents while entrepreneurial, tend to be risk advisors first. Many agents enjoy assessing risks, selling the insurance product needed for their clients and then moving onto the next opportunity. Most agents that we interact with do not like the responsibility of managing employees, financials, marketing, technology systems, and the other duties of running a business.

Fourth, while the IA system continues to grow, there are increasing pressures on agent commissions and profit-sharing agreements with carriers. With carriers experiencing mounting profitability challenges, it is trickling down to agents to figure out greater efficiencies to remain profitable.

All this leads to the perfect environment for industry consolidation. Insert PE investments and now you have all the resources to consolidate an entire industry in a few short decades.

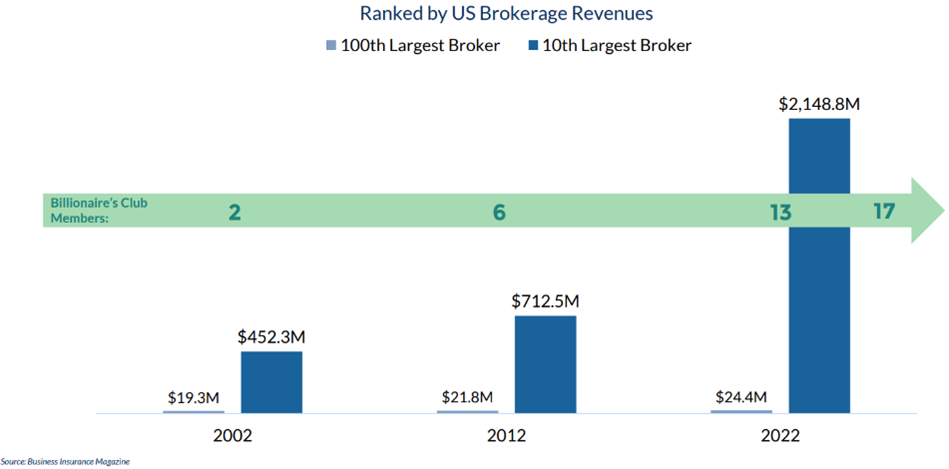

This is unquestionably happening as we watch the big get demonstratively bigger. As evidenced by the graph compiles by Reagan Consulting and Insurance Journal, you can see there are now 17 billion-dollar brokers whereas 10 years ago there were 6. It is no longer like flipping homes for short-term gain, many of the PE buyers are now advancing with both an acquisition and organic growth-oriented mindset.

While we are not yet in the midst of consolidation phase of “why buy your business when I can take your business in many parts of the country,” as the PE buyers build scale, sophistication, and technology they represent a new competitive threat which retail agencies have not experienced thus far.

What Does this Mean to Independent Agency Owners?

First, your agency has great value and we do not see that changing anytime soon. The infusion of PE money and massive consolidation has resulted in record high agency valuations. Your agency is likely worth double what it was 10 years ago just due to the market factors and conditions we have experienced. We believe as long as your agency is growing profitably you will continue to see your value increase in the coming years. In the coming years, the type of business will likely become a greater factor but as of now, profitable growth is of paramount importance.

Second, in this era of consolidation it is very important to know your strategy for growth and long-term viability if you choose to remain an independent insurance agency owner. The pressures to manage and lead your business effectively will become more important as competitors take different shapes and sizes. That means you must continue to grow organically, achieve consistent profitability margins, and have an active relationship with technology.

Third, have a documented transition plan and revisit it annually. Whether you are an owner in your 30s, 70s, or somewhere in between, it is important for you to have a written transition plan that spells out your plans from year to year. The market is changing quickly and agents are changing their minds quickly; having a plan that is your true north will help you stay focused on playing the long game.

Fourth, it is important to have a solid understanding of the current fair market value of your agency, future projected earnings, and risk factors in your agency. It is likely you are already fielding calls about selling your agency – if not, they are coming. Every PE buyer in the marketplace has field staff (think recruiters/headhunters) whose sole responsibility is to identify good acquisition targets, develop relationships, and pursue those opportunities. Take the opportunity to listen to the pitch, learn about the market but then come back to your documented plan and evaluate whether it connects with where you are headed.

Conclusion

Consolidation in our industry is real. Every part of the insurance industry and IA system will be affected by it at some time. It is outside of our control and the scope of most retail agency owners. The IA system will look significantly different in 5-10 years as consolidation continues to play out.

Despite the consolidation happening in the IA system, it is a great time to be an independent agency owner. The IA market continues to increase year over year, billions of dollars are being invested annually to grow the IA system, your asset has doubled in value, and there are now more options than ever before to transition your agency.

For help in understanding how all of these factors impact your agency, we encourage you to reach out to the IA Valuations team at Jeff@IAValuations.com or visit iavaluations.com.

About IA Valuations and Agency Link – Founded in 2017, the IA Valuations team has performed over 200 valuations to independent insurance agencies across the U.S. Our advisors have 25+ years of experience guiding agency owners on maximizing their agency value, planning, and legal needs for ownership transition. In addition, IA Valuations has provided perpetuation planning, financial modeling and business planning for independent insurance agencies. Finally, IA Valuations has advised dozens of agency owners on selling their agencies through our Agency Link process. Agency Link is a platform that connects buyers and sellers together to further the growth and strength of the IA system. To learn more about IA Valuations, please visit IAValuations.com or contact@iavaluations.com.

The information provided in these documents is general in nature and shall not be construed as personal legal, tax or financial advice for your situation. Please contact@iavaluations.com to discuss your personal situation.

Copyright ©2023 by IA Valuations and Ohio Insurance Agents Association (OIA). All rights reserved. No portion of this document may be reproduced in any manner without the prior written consent of IA Valuations or OIA. In addition, this document may not be posted as a link on any public or private website without the prior written consent of IA Valuations or OIA.

By: Jeff Smith, JD, CIC, CAE