Now Is the Time to Sell Your Insurance Agency

If you own an independent insurance agency and have not grown in revenue in the last two years, and you do not have a business plan to change course, it’s time to sell your agency.

I do not write these words lightly, but if you continue forward, you are now gambling with time and the value of your agency.

The last few years have provided independent insurance agencies with unprecedented levels of growth due to the rate environment. According to IA Valuations data, average agencies experienced 9% commission growth in 2024 and 13% in 2025, and a combined 11% commission growth over the last two years. If your agency did not experience growth in that time period and you are one of the 47% of agencies that do not have a business plan according to the 2024 Agency Universe study, it is time to sell before you lose further value.

As an advisor to insurance agency owners, I have witnessed the shifting dynamics of the IA system. For many years, it has been difficult to get aging agency owners to seriously consider business planning or internal perpetuation and have continued forward with running their agency as a lifestyle instead of a business. The IA system is notorious for giving owners the ability to retire in place and reap the benefits of high recurring revenues.

IA Valuations believes the option to retire in place ended with the conclusion of the hard market, and now many agency owners find themselves at a crossroads: growth has plateaued in the best of times, and the absence of a strategic business plan makes the path forward unclear. If this scenario resonates with you, it may be time to seriously consider selling your agency.

In this article, I will outline six reasons why now is an opportune moment to sell and how this decision can benefit your long-term interests.

1. It’s a Sellers’ Market – Market Conditions Favor Sellers… For Now

The current IA system market is experiencing consolidation, with larger agencies, publicly traded, and private equity-backed brokers actively completing an average of 912 agency acquisitions over the past 5 years, according to Optis Partners data. Timing is ripe to sell. This demand means that well-established, profitable agencies – even those not currently growing – can attract competitive offers.

Buyers are often searching for agencies with a profitable book of business, established client relationships, and carrier partnerships. Even if you lack a growth trajectory or formal plan, your existing infrastructure and client base are valuable assets. Selling now allows you to leverage these strengths in favorable conditions while they are still attractive to acquirers.

While “uncertainty” was the theme of the US economy in 2025, it appears we are headed towards more of the same in 2026. While the interest rate environment appears to be helping the deployment of dry capital powder, it is unclear what a sizeable pullback in the stock market, employment rate, or change in power of Congress could do to the macro economy.

2. Lack of Growth in a Hard Market Signals Significant Challenges in an Agency

Stagnant growth is often a red flag for potential buyers. If your agency’s commission revenues have leveled off in this market, it may indicate that the business has reached its natural limits under your current management style and resources. Many buyers will look past a declining policy in force (PIF) count; however, they will not look past a declining PIF count and declining commission revenue.

Rather than waiting for a change in agency profitability, potential staff departures, or other actions that could compound the factors causing decline in agency value, selling now may allow you to maximize your agency’s value and exit on your own terms.

3. The Importance of a Business Plan

Agencies without a clear business plan often struggle to set goals, hold themselves accountable to do the things needed to grow, adopt technological advancements, and deal with evolving customer expectations.

Without strategic direction, it’s difficult to reinvigorate growth or maintain competitiveness. Prospective buyers, however, may still see value in a profitable book of business and untapped potential with the current staff that they can unlock with new leadership and fresh strategies.

4. Softening Market Means Organic Growth Will Get Greater Focus

When the insurance market softens, commission growth gets far more difficult because now the industry is measuring true organic growth (PIF count), not just commission revenue growth from increasing premiums. If your agency has struggled with commission growth in the hard market, it will be increasingly more difficult to grow in a market where rates are flat or declining.

5. Agency Values May Flatline

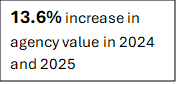

According to IA Valuations, agency values are up 13.6% over the past two years. That increase has been largely fueled by the collective growth in commission revenue, M&A activity, and investment in the IA system.

However, there will be a ceiling for agency values. It is hard to say whether we have hit it, but at some point, buyers cannot afford to pay much higher EBITDA and revenue multiples than they are today. In competitive agency acquisitions, it is more likely that buyers are already having to wait 7 to 10 years before they make a penny off their initial investment.

If you are not growing and do not have a business plan, your agency value has likely peaked. Waiting too long to sell could diminish your agency’s value and make it harder to attract quality buyers. Selling proactively helps you avoid these pitfalls and secures your financial future while values are still favorable, even for stagnant agencies.

6. Technology Advances in the IA System

In this world of rapid technological advancement, if an agency does not have an active relationship with technology, it will be increasingly more difficult to compete in the modern insurance marketplace. If you are a classic generalist agency and are operating without modern technological capabilities, you will be able to continue to exist, but growth in revenue and value will be exceedingly difficult, if not impossible.

A technology strategy is a core component of any business plan. If you lack both and are at an age or a mindset where you do not want to invest in technology, sell now. Your value will not increase if you continue operating in this manner. Agency owner Brad Hosket summed up this point best by stating, “It’s not that the big will eat the small, rather the fast will eat the slow.”

Conclusion

The advice provided in this article to sell your agency is completely contrary to the business interests of the state association, Ohio Insurance Agents Association (OIA), which I lead. However, I believe that in today’s dynamic insurance landscape, hesitating to make strategic decisions can be costly. If your agency is not growing and lacks a business plan, now is an ideal time to consider selling.

The current market environment, combined with buyer demand and the risks of stagnation, makes this moment uniquely favorable for agency owners ready to transition. I encourage you to take this confidential Agency Ownership Transition Self-Assessment, so you can objectively assess your situation and take action to secure the best possible outcome for your agency’s future. Please contact me at jeff@iavaluations.com if you would like to discuss further.

By: Jeff Smith, JD, CIC

About IA Valuations and Agency Link – Founded in 2017, the IA Valuations team has performed over 350+ valuations to independent insurance agencies across the U.S. Our advisors have 25+ years of experience guiding agency owners on maximizing their agency value, planning, and legal needs for ownership transition. In addition, IA Valuations has provided perpetuation planning, financial modeling and business planning for independent insurance agencies. Finally, IA Valuations has advised dozens of agency owners on selling their agencies through our Agency Link process. Agency Link is a platform that connects buyers and sellers together to further the growth and strength of the IA system. To learn more about IA Valuations, please visit IAValuations.com or contact@iavaluations.com.

The information provided in these documents is general in nature and shall not be construed as personal legal, tax or financial advice for your situation. Please contact@iavaluations.com to discuss your personal situation.