Choose Your Carrier Partners Wisely

Carrier Relationships Significantly Impact Agency Value

The carriers you choose to partner with in your agency are arguably the most important decision you will make in building your business. The impact on agency value is hard to precisely quantify, but it is safe to say it has a profound impact on your valuation.

When developing the carrier business strategy in your agency, we suggest adhering to the age-old advice that everything is good in moderation. We recommend our clients keep the percentage of business with their carrier partners between 25% and 8% of written premium in the agency. Anything more than 25% starts to create some risks in the relationship. If the carrier’s appetite changes, the relationship with that carrier changes.

On the other side, anything less than 8% doesn’t allow the agency to establish a meaningful relationship with the carrier partner. Below that percentage, there’s rarely a mutual commitment on either side of the relationship, and the agency is always at risk for a potential termination of the appointment. Plus, with that size of written premium, it is unlikely the agency would qualify for profit-sharing in a meaningful way.

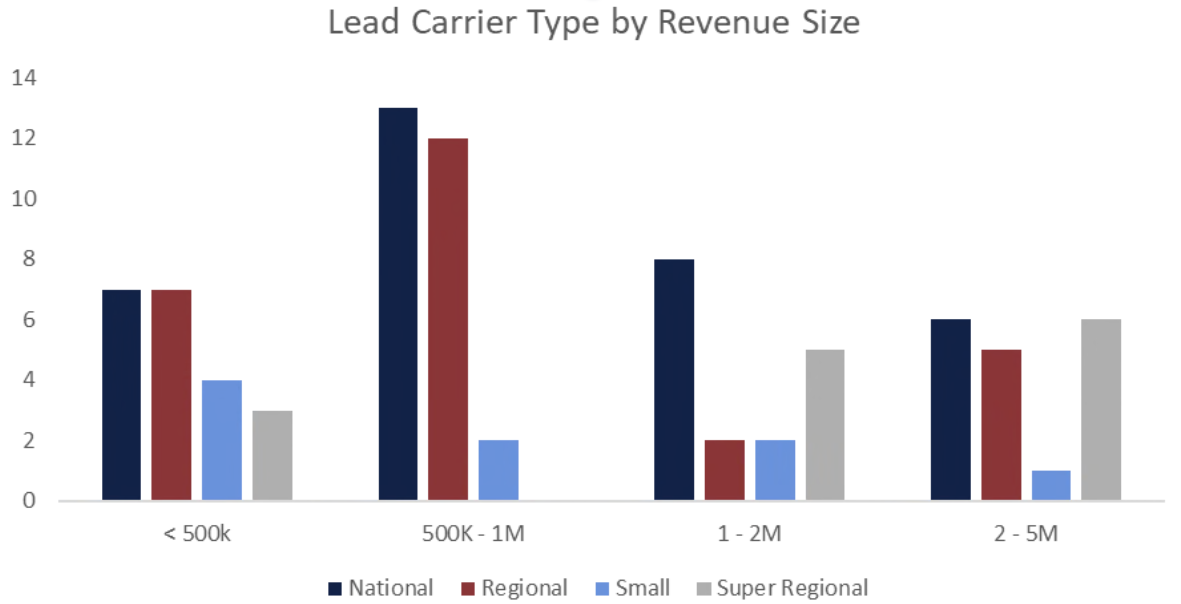

For large to mid-size privately held retail agencies, 4 to 5 core carriers are likely sufficient for the needs of your agency. Pair that with a few specialty carriers that meet the needs of your niche business, and it is likely your contracted carrier needs are satisfied. In addition to those relationships, the agency will need to leverage the services of a wholesale broker/ MGA and a market access platform for a handful of accounts that accumulate over time. This strategy ensures that the agency can optimize the relationship with its core admitted carriers and maximize profit-sharing opportunities.

For small agencies, 3 to 4 core carriers should be sufficient. A combination including a super regional and a small carrier partner is likely the best combination. Agencies can access national carriers through market access platforms. This approach allows the small agency to grow with a few core relationships, and as those expand, they can consider bringing on new strategic carrier partnerships.

As for which carriers to build your business around, IA Valuations’ studies have shown that agencies with the highest values lead with a super regional relationship. These are typically carriers with between $5B and $20B in written premium and have a diverse enough geographic footprint throughout the country that no single weather event in a particular region ruins their annual loss ratio. Super regional carriers have traditionally been completely committed to the independent agency distribution system and are fully invested in the relationships with their agents. They have enough size and scale to compete with the nationals, but can still maintain relationships like a small carrier. Super regional carriers still care about franchise value and are typically fairly restrictive on which agencies they will appoint and where.

In this edition of Valuation Views, we will dive into the data on the importance of your carrier relationships to the value of your agency.

2025 AGENCY OVERVIEW

Insurance agencies delivered another powerhouse year of growth, profit, and ascending value, solidifying their status as one of the most lucrative industries to be a part of today.

To be a valuable business, you must generate cash flow and grow. This is simple in concept, but can be extremely difficult in practice…. unless you are an insurance agent.

Congratulations, agents, your hard work and perseverance through hard market conditions has benefitted the entire IA distribution system. 2025 marked another high growth year for agency value, pro forma profitability, and commissions revenue.

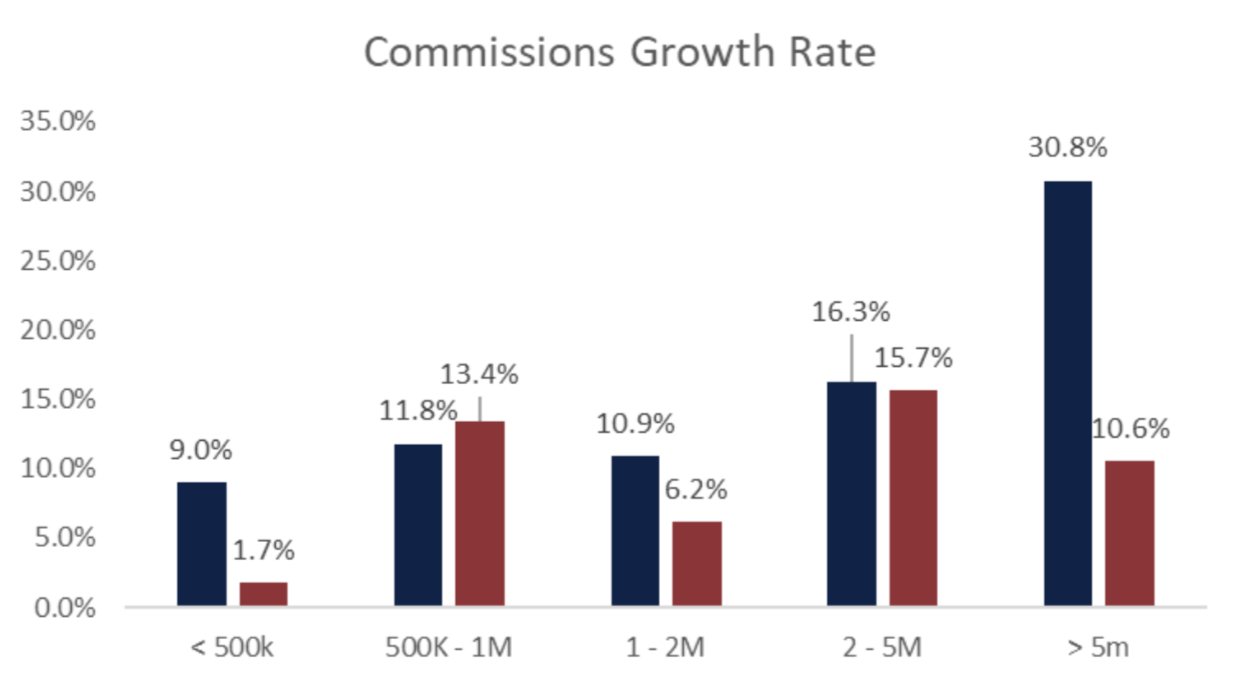

Commission Growth*

Across all revenue groups, the average commissions growth went from 9.2% all the way up to 13% in the latest valuation year. You are a part of a great industry. For agencies evaluated in 2025, they represent another epic year of commissions growth. The smallest and the largest groups set the pace in the latest valuation year. There is still high growth due to the high rate environment of the hard market. For the largest revenue band, acquisitions also played a meaningful role in their commissions increases.

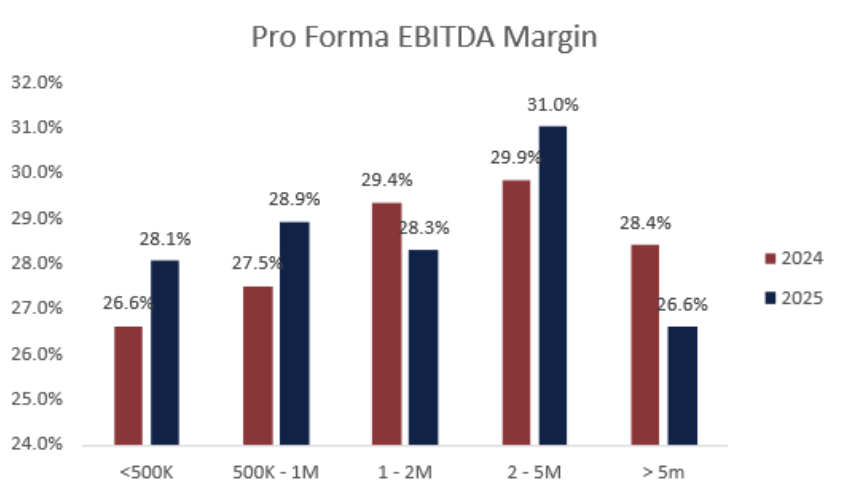

Profitability Margins

Pro forma EBIDA margin reflects an agency’s profitability after owner discretion expenses and non-insurance related revenues are removed from the agency’s financials. We can see that pro forma profitability has yet to dip below 25% for insurance agencies in our sample. The most profitable agencies have been the $2M – $5M revenue group, as they are beginning to benefit from economies of scale. However, as they grow, their profitability declines due to rising expenses associated with scaling.

SALES GROWTH & VALUE

The Key Performance Indicator

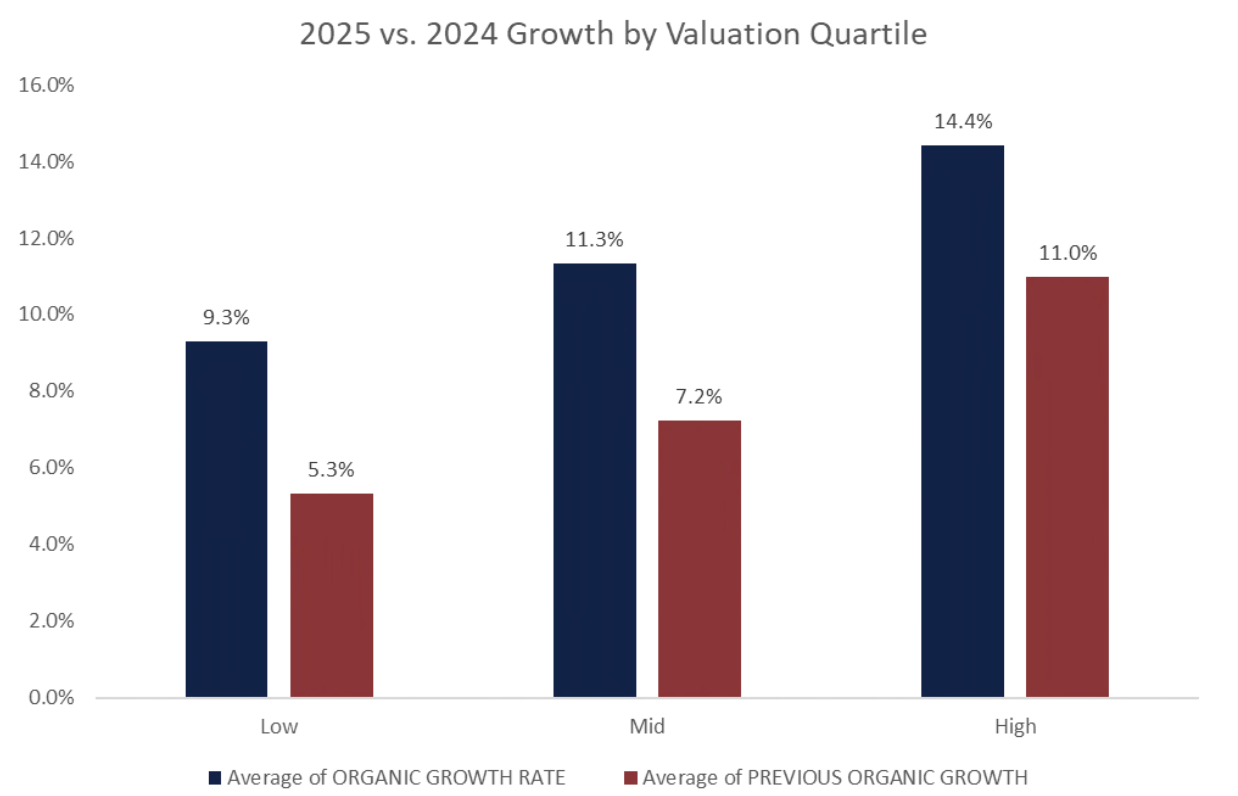

The “low” section represents EBITDA Multiple scores in the bottom quartile.

The “mid” section represents value scores in the middle 50%.

The “high” section represents value scores in the top 25%.

All-Agency Average

In 2025, the average organic growth rate across our sample was 13%. This is still remarkably strong. The 2025 numbers reflect a mixture of 2024 and 2025 valuations. The industry still beat 2023 – 2024’s growth. Can this upward momentum continue? It’s possible, but it is more likely that we’ve seen the peak in 2025 for some time. The market is softening and many agencies grew primarily due to rate hikes. These agencies may become more exposed as we head into 2026.

CARRIER RELATIONSHIPS & AGENCY VALUE

What’s more valuable, to be concentrated or diversified with your carriers?

There will not be a one-size-fits-all answer, but let’s see what the profile of concentration is across agency values.

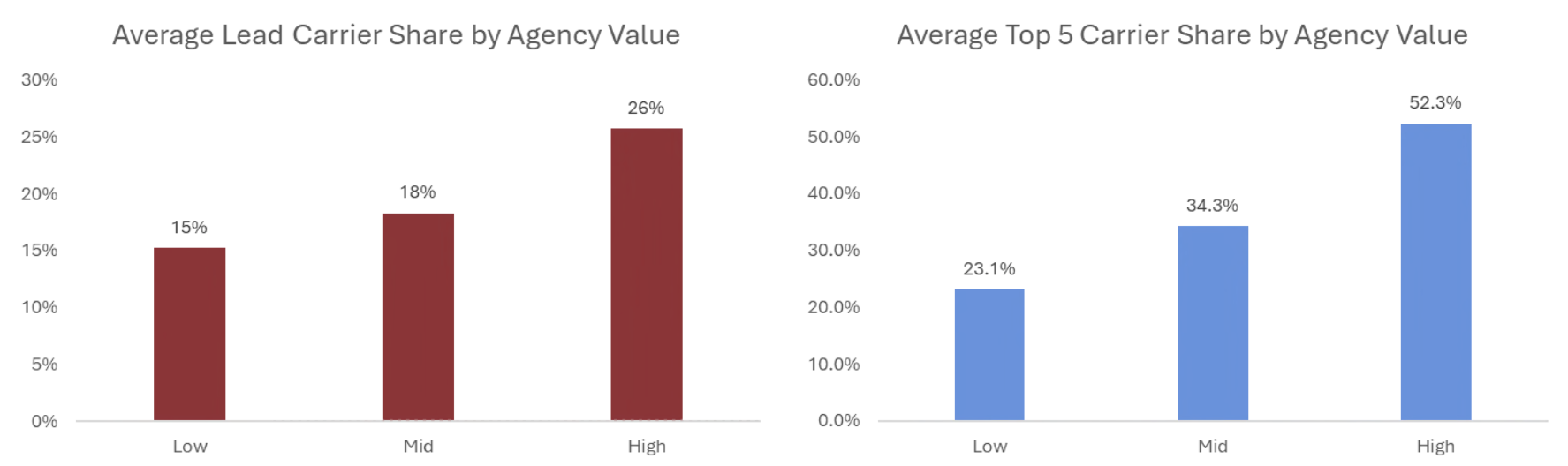

Below, we look at a sample of 100 agencies over the last couple of years and split them into our low quartile, our middle fifty, and our high quartile valuations.

As seen above, agencies with higher values are more highly concentrated with their strongest carrier relationships!

However, being too concentrated with one carrier still poses objective risk to your agency. This is why it is important to get a fair market valuation for your agency to better understand your specific strengths and risks.

TOP CARRIER PROFILE

Does Your Lead Carrier Type Matter?

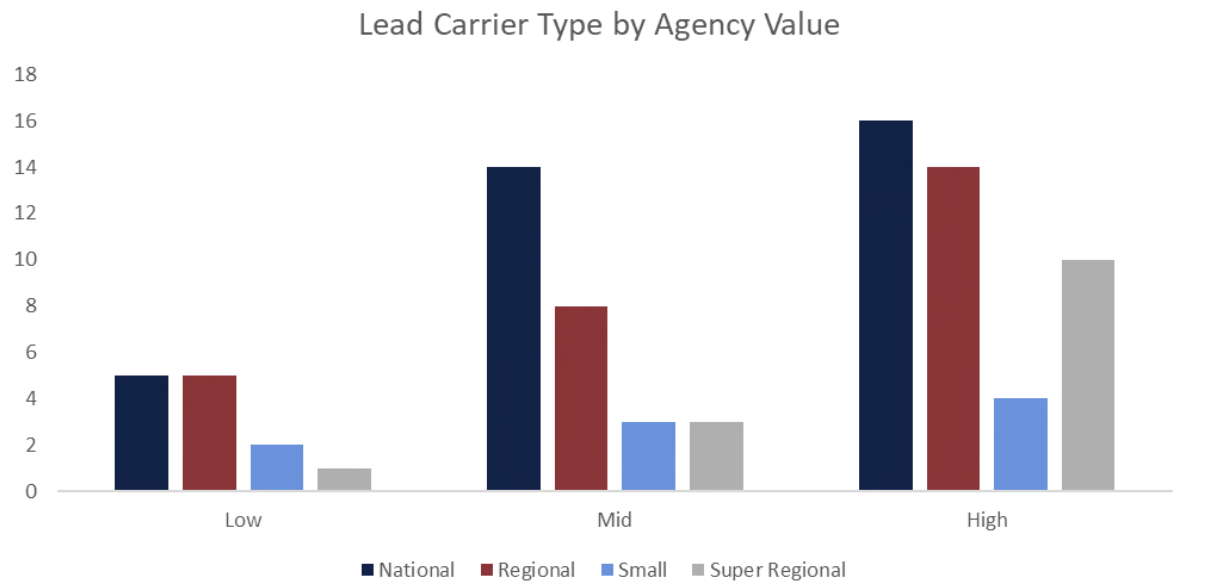

Small = <$500M DWP, Regional = $500M – $2.5B DWP, Super Regional = $2.5B – $10B DWP, National = >$10B DWP

National and Regional Carriers are common lead carriers, but having Super Regionals as a lead carrier is a distinct characteristic of high-value agencies.

Regional carriers are a key piece of a carrier lineup, but as we move up the value range, they are overtaken by Super Regional carriers. Regional carriers are the second most common lead carrier as agencies increase in value. It is very uncommon to be a high-value agency and have your lead carrier either as a national or small carrier.

VALUATION MULTIPLES

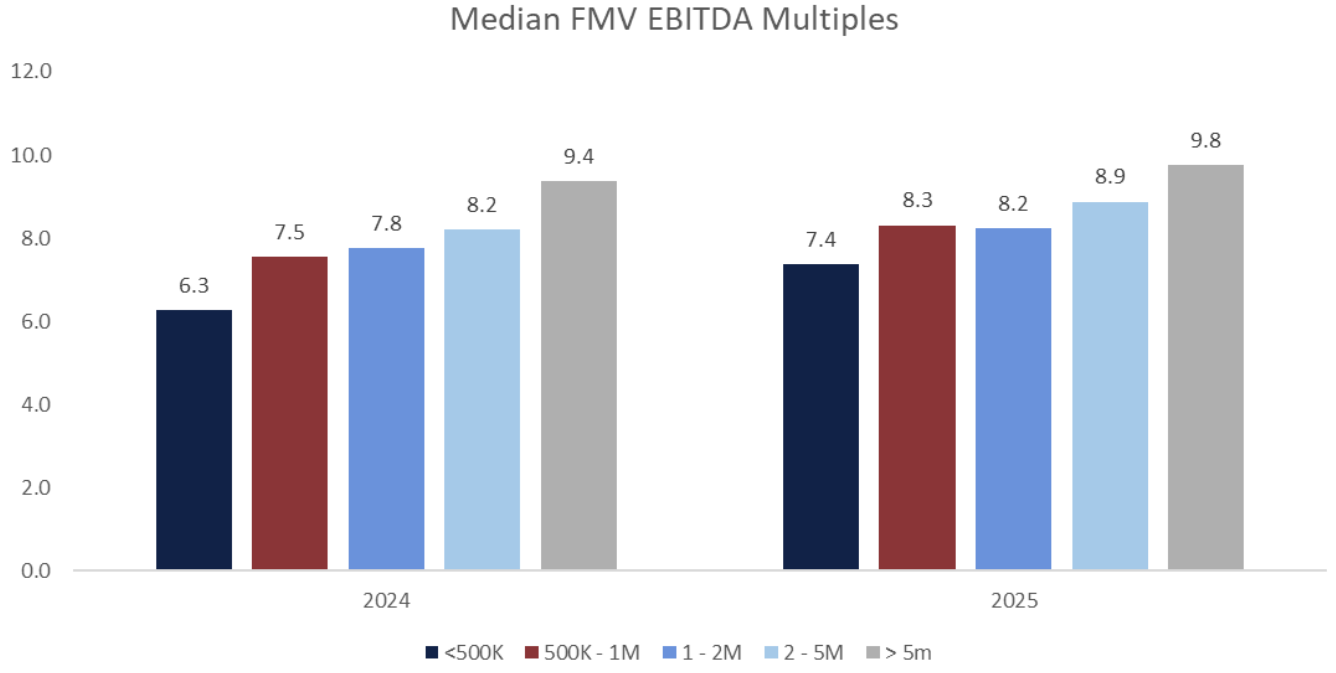

The insurance agency value outlook is strong.

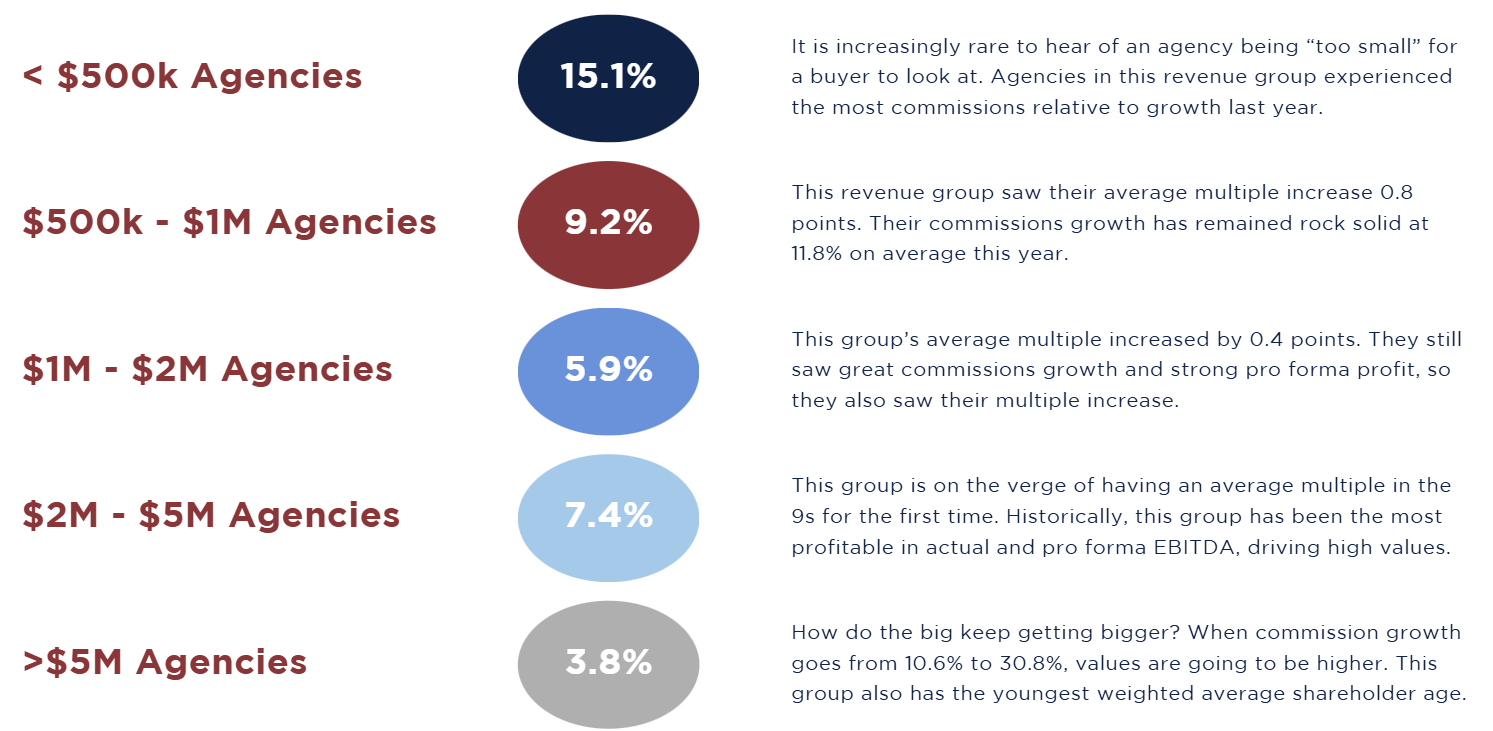

Insurance agencies had another fervent year of value increase along all revenue groups. This growth is driven by high demand as well as private equity interest forcing all buyers to put together lucrative financial packages to sellers.

AVERAGE INCREASES OVER 2024

A BOUTIQUE BROKERAGE BUILT TO ENDURE

The BlueStone Advisors Growth Story

Husband and wife duo, Andrew Royce and Tracie Rasmussen, started BlueStone Advisors over a decade ago, and in that time, they’ve built a firm rooted in purpose, innovation, and lasting impact.

Andrew brings a deep insurance background to the table. Prior to launching BlueStone, he worked at multiple agencies that were eventually acquired by PE brokers. Through those roles, he gained experience in the independent agency space, managed large global accounts, and refined his approach to client execution and white-glove customer service. Over time, however, he realized he no longer wanted to work in environments where acquisitions and the top line growth took precedence over clients and culture.

Tracie’s background is in computer programming, but her career evolved into operations and financial leadership. Working at a small business in Chicago, she gained firsthand insight into what it takes to run a successful organization. When that company was ultimately acquired by private equity, Tracie chose to step away – an experience that further shaped her perspective on leadership and long-term value.

Together, Andrew and Tracie recognized an opportunity. They saw a gap in the market for an independent broker focused on the middle and upper-middle market, one that could leverage their combined expertise to innovate and elevate the insurance experience. Their complementary education, skills, and experience gave them the confidence to take a leap and open BlueStone Advisors in 2012.

Success didn’t come overnight, but BlueStone has found its stride over the past decade and a half. The firm describes itself as a “boutique commercial agency,” and has developed a rhythm that works for its team and clients alike. BlueStone’s organic growth can be attributed to a multitude of key factors, including a shift toward industry specialization, strong alignment with carrier partners, winning on brokerage value, cross-training producers, delivering consistent white-glove service, identifying its brand, and investing heavily in staff development.

In 2025, BlueStone Advisors was named Big “I” Illinois’ Agency of the Year – an incredible recognition for their team from their state association! Before Tracie and Andrew could focus on growth, they determined they needed to create a great place where people genuinely wanted to work. That commitment began with culture and operations. Drawing from their diverse professional backgrounds, they applied practical insights to help understand how a successful business is run. While this effort started gradually, it became a formal company priority about 18 months ago.

As part of that initiative, they created a Best Places to Work Committee, made up of their employees who provide real feedback and help shape internal initiatives. One of the biggest things they learned was the team’s desire for greater community engagement. As Andrew and Tracie put it, “When employees can be impactful, they feel more connected.” In response, BlueStone is launching a foundation in 2026 to give back to the Chicago community.

Their advice for other independent agency leaders is simple but powerful: invest in the development of your people. Employees who feel valued and supported by their company are more engaged, and this commitment directly benefits clients. Their employees are happy to be at BlueStone, and it shows in their work, day in and day out with their clients. While organic growth is essential, the firm believes success ultimately depends on consistently delivering on its promise of white-glove service. The success isn’t driven by leadership alone; it’s made possible by the individuals who make up their team.

Another defining element of BlueStone’s leadership approach is its strong female leadership. While this industry continues to evolve towards greater inclusivity, BlueStone was ahead of the curve. Tracie’s leadership has been instrumental in shaping the firm’s culture and success, and her influence remains invaluable to the organization.

BlueStone Advisors has also engaged IA Valuations multiple times to support business growth and strategic planning. The firm has found the benchmarking tools especially valuable, providing insight into management and operations that only a trusted third-party advisor can offer. Just as importantly, third-party validation has reinforced their strategy and business plan. As the duo notes, “It’s nice to know that we’re on the right track.”

As BlueStone Advisors looks to the future, its commitment to independence, intentional growth, and people-first leadership remains unwavering. By combining deep industry expertise with a clear vision for the future, community impact, and client service, Andrew and Tracie have built a successful business designed to endure the test of time. BlueStone’s journey is a testament to what’s possible when values drive strategy and growth is pursued with purpose.