As Tax Day 2024 approaches, we encourage independent agency owners to meet with their tax expert to review their current tax structure and to better understand the tax implications of a potential sale now, or sometime in the future. Ask your tax expert to lay out various scenarios for you and to help you determine if you are structured to minimize your yearly tax burden, and the tax liability you will face when you eventually sell your agency.

Current Law

The Tax Cuts and Jobs Act went into effect in 2018, and the law had specific implications for independent insurance agencies, depending on how their business is organized. Agencies that are organized as C-Corps received a substantial cut to their corporate tax rate, which was lowered from 35% to 21%. These tax cuts are permanent.

Agencies organized as pass-through entities (S-Corps, Partnerships, LLCs, and Sole Proprietorships) also received favorable treatment under the new tax code. The new law provides a 20% deduction of their qualified business income on their taxes, regardless of their income level. This law will expire in 2025 unless Congress acts.

2024 Election Cycle

With the approaching election for President, House, and Senate seats, there could be changes to the tax code in the near future, depending on who controls the White House and Congress. President Biden has already indicated that he would like to double the capital gains rate from 20% to 39.6% to ensure that the wealthy pay their fair share. If the Democrats win both the White House and control of Congress, we could see this change as early as the first half of 2025. By working with your tax pro, you will better understand how any potential changes could impact your estate.

In the Future

Your corporate structure is a key determinant that will drive a future sale toward a stock or an asset purchase.

In a deal, acquirers prefer to purchase the assets of an agency, and not the stock. This is because there are tax benefits tied to asset purchases in addition to reduced liability exposure to the acquirer. Furthermore, an agency structured as an S-Corp or LLC will avoid double taxation when the assets are sold, compared to the sale of assets from a C-Corporation.

During an asset sale, the buyer acquires all of the intangible assets and most of the tangible assets from the agency but avoids inheriting the liabilities of the agency. Buyers, in general, prefer asset deals, whereas sellers prefer stock deals

During a stock sale, the seller receives capital gains treatment on all the proceeds, meaning, the amount of time that the stock was held before being sold determines its capital gains for tax purposes. Additionally, the seller leaves all of the agency’s liabilities, known and unknown, and contractual relationships with the entity, which is a disadvantage to the buyer.

There are additional tax implications, depending on if it is a stock or asset sale. In an asset sale, the tax advantages of capital gains income are not realized in a C-Corp. Proceeds from the sale paid to shareholders are not tax deductible to the corporation, but to the stockholders, as double taxation. For an S-Corp, there is no double taxation as the proceeds from an asset sale pass through the agency to the individual owners, where tax is paid at their personal rate.

The Data

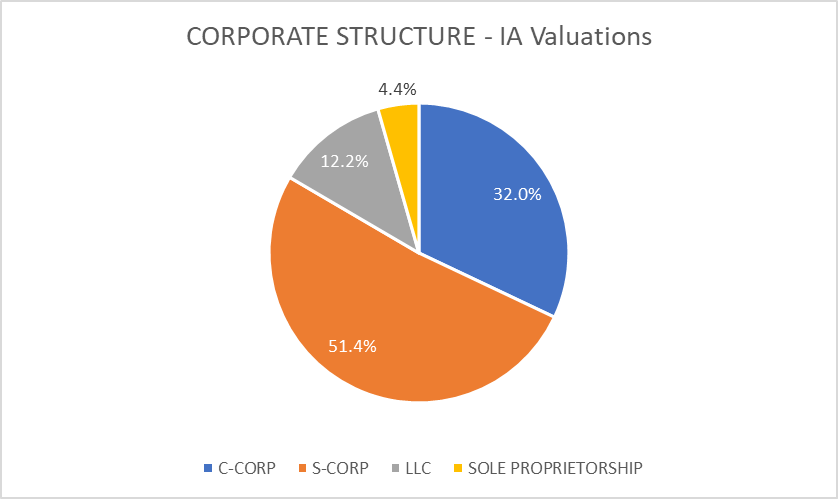

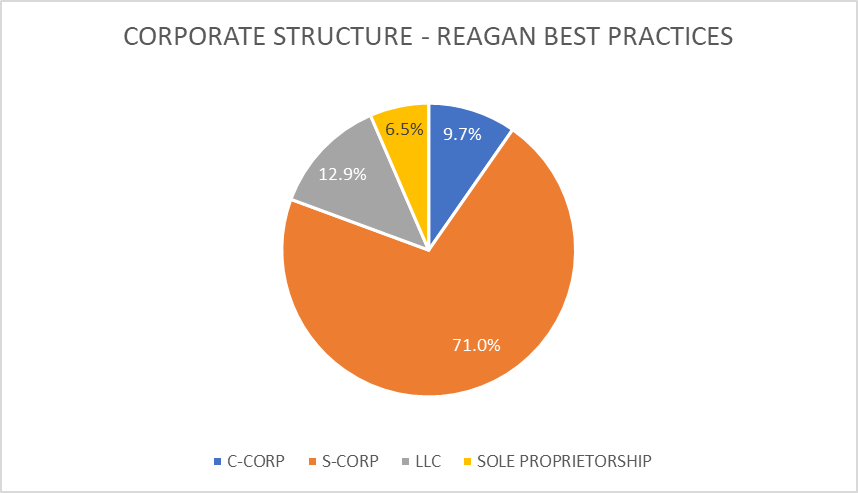

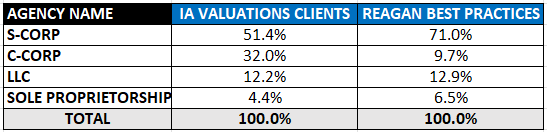

IA Valuations has completed several hundred valuations over the past 6 years. From the agencies we have worked with, we discovered that 32% were still structured as C-Corporations. Additionally, the average owner age of those structured as C-Corporations was 58.6. Lastly, over 23% of the owners of C-Corporations were past the age of 65. When compared to the 2022 Reagan Best Practices study of similarly sized agencies, there is a profound difference when comparing the S-Corporations with the C-Corporation structures.

What is Right for Your Agency?

Even if an agency structured as a C-Corporation isn’t considering a sale right now, it could be beneficial to convert to a different structure sooner rather than later, as there is a waiting period of 5 years to realize the tax benefits in a sale. IA Valuations recommends that its clients consult with their accountants, attorneys, and consultants to determine how they will be affected by the tax code based on their individual circumstances. The right professionals can help you understand the best options for your agency now and in the future.

By: Craig Niess, CVA, MBA, Director of Business Planning & Valuations

About IA Valuations and Agency Link – Founded in 2017, the IA Valuations team has performed over 220 valuations to independent insurance agencies across the U.S. Our advisors have 25+ years of experience guiding agency owners on maximizing their agency value, planning, and legal needs for ownership transition. In addition, IA Valuations has provided perpetuation planning, financial modeling and business planning for independent insurance agencies. Finally, IA Valuations has advised dozens of agency owners on selling their agencies through our Agency Link process. Agency Link is a platform that connects buyers and sellers together to further the growth and strength of the IA system. To learn more about IA Valuations, please visit IAValuations.com or contact@iavaluations.com.

The information provided in these documents is general in nature and shall not be construed as personal legal, tax or financial advice for your situation. Please contact@iavaluations.com to discuss your personal situation.

Copyright ©2024 by IA Valuations and Ohio Insurance Agents Association (OIA). All rights reserved. No portion of this document may be reproduced in any manner without the prior written consent of IA Valuations or OIA. In addition, this document may not be posted as a link on any public or private website without the prior written consent of IA Valuations or OIA.