As we near the dreaded Tax Day, we urge all independent agency owners to take some time to review your corporate structure with your tax expert. A review will determine if you are best positioned to reduce your yearly tax burden, and to better understand the tax liability you will face when you eventually sell your agency.

In this article we will discuss some of the options, benefits, and considerations you should undertake when reviewing your agency structure. The focus will be on tax laws and consequences, however there are many factors you should consider when analyzing your corporate structure.

The Current Tax Laws

The Tax Cuts and Jobs Act went into effect in 2018, and the law had specific implications for independent insurance agencies, depending on how their business is organized. For agencies organized as C-corps, there was a substantial cut to the corporate tax rate, which was lowered from 35% to 21%. These tax cuts are permanent.

Agencies organized as pass-through entities (S-corps, Partnerships, LLCs, Sole Proprietorships) also received favorable treatment in the revised tax code. The new law provides a 20% deduction of their qualified business income on their taxes, regardless of their income level. This law will expire in 2025 unless Congress acts.

While permanency and expiration are gray terms in government, the current status of our tax laws should be a consideration with your current tax structure however those could change based on the funding needs of the federal government and are one factor in your consideration.

Future Tax Consequences and Laws

When you are looking to sell your agency, your corporate structure is the key determinant that drives the deal toward a stock or an asset purchase.

In a deal, acquires normally prefer to purchase the assets versus the stock of an agency, as there are tax benefits tied to asset purchases in addition to reduced liability exposure. Furthermore, an agency structured as an S-corporation or an LLC avoids double taxation if the assets are sold compared to a C-corporation.

During an asset sale, the buyer acquires all of the intangible assets and most of the tangible assets from the agency but avoids inheriting the liabilities of the agency. Buyers, in general, prefer asset deals, whereas sellers prefer stock deals.

During a stock sale, the seller receives capital gains treatment on the proceeds. Meaning, the amount of time that the stock was held before being sold determines its capital gains for tax purchases. Additionally, the seller leaves all of the agency’s liabilities, known and unknown, and contractual relationships with the entity, which is a disadvantage to the buyer.

Additionally, there are tax implications tied to whether it is a stock or asset sale. In an asset deal, the tax-advantages of capital gains income are not realized in a C-corp. Proceeds from the sale paid to shareholders are not tax deductibles to the corporation, but to the stockholders, as double taxation. For an S-corp, there is no double taxation as the proceeds from an asset sale pass through the agency to the individual owners, where tax is paid at their personal rate.

How Are Agencies Currently Structured?

Agency owners have several options when deciding on the corporate structure. Whether you are a multi-generation family agency or a start-up agency, understanding what your long-term goals and plans are will help you decide on the best corporate structure for you and any future owners of the agency.

Traditionally independent agencies were predominantly structured as C-corps. However, that trend is fading fast and the predominant tax structure for agencies is S-corps, with a growing number of owners opting for LLCs due to the operating flexibility and legal benefits of the pass-through entities.

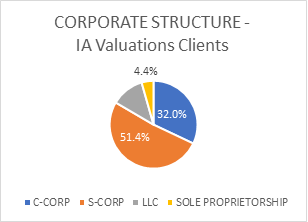

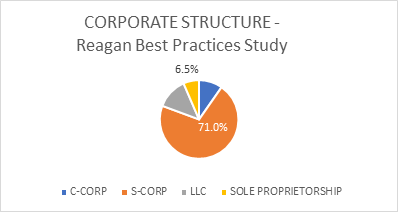

IA Valuations has completed several hundred valuations over the past five years. From the agencies we have worked with, we discovered that 32% were still structured as C-corp. Furthermore, the average owner age of those structured as C-corps was 58.6.

Lastly, over 23% of the owners of C-corporations were past the age of 65. This is concerning because, as we will explore later, selling an agency through an asset sale can have significant tax consequences on the owner and conversation from a C to an S Corp takes at least 5 years.

When we compare the IA Valuations data to the 2022 Reagan Best Practices Study of similar sized agencies, there is a profound difference to the S- and C-Corp structures. The Best Practices Study reports a 71% utilization of S-corps and only 9.7% structured as C-corps.

So, what is driving the discrepancy of the corporate structures between IA Valuations clients and Best Practices agencies? We have a hypothesis: The difference is likely that many of our clients are legacy agencies coming to us as they prepare to sell whereas the Best Practices agencies are in a growth mode and structured for the long haul. The legacy Best Practices agencies have likely converted from a C to an S-corp.

As we previously mentioned, the trends over the past couple of decades have been a migration towards S-corps and LLCs. It is rare that we see an agency formed in the past twenty years that opted for a C-corp structure. This does not mean that C-corps are facing extinction for independent insurance agencies, rather it requires agency owners to work closely with their tax and legal advisors when contemplating the right structure for their business goals.

Why Does it Matter and What is Right for Your Agency?

While tax structure may seem like something you should just let your accountant and lawyer decide on, it can have a significant impact on your agency’s value if you sell externally. Even if an agency structured as a C-corp is not considering a sale right now, it could be beneficial to convert to a different structure sooner rather than later, as there is a waiting period of several years to realize the tax benefits in a sale.

To convert to an S-corp, the only requirement is to complete and submit Form 2553 with the IRS. All shareholders must sign the form. For the tax election to have effect for the full year, the form needs to be filed any time in the previous year until March 15th of the year in which you want the tax election to take effect. The recognition period for the conversion from C-corp to S-corp is five years.

We recommend that agency owners consult with their accountants, attorneys, and other advisors to determine how they will be affected by the tax code based on their individual circumstances. The right professionals can help you do scenario planning to discover the best option for your agency now, and for when you retire. Keep in mind that when you eventually sell your agency, it is more about how much money you end up with, not how much you sold it for.

Taxes are a necessary part of living in this amazing country. With every profit and transaction, you are going to have to pay some portion of the proceeds to the government. Working with your tax and legal advisors on the right corporate structure for your agency will help you enhance your agency’s value and the proceeds of your transaction. For more information on tax consequences on agency value, please contact Craig Niess, MBA, CVA at craig@craigiavaluations.com.

About IA Valuations and Agency Link – Founded in 2017, the IA Valuations team has performed over 200 valuations to independent insurance agencies across the U.S. Our advisors have 25+ years of experience guiding agency owners on maximizing their agency value, planning, and legal needs for ownership transition. In addition, IA Valuations has provided perpetuation planning, financial modeling and business planning for independent insurance agencies. Finally, IA Valuations has advised dozens of agency owners on selling their agencies through our Agency Link process. Agency Link is a platform that connects buyers and sellers together to further the growth and strength of the IA system. To learn more about IA Valuations, please visit IAValuations.com or contact@iavaluations.com.

The information provided in these documents is general in nature and shall not be construed as personal legal, tax or financial advice for your situation. Please contact@iavaluations.com to discuss your personal situation.

Copyright ©2023 by IA Valuations and Ohio Insurance Agents Association (OIA). All rights reserved. No portion of this document may be reproduced in any manner without the prior written consent of IA Valuations or OIA. In addition, this document may not be posted as a link on any public or private website without the prior written consent of IA Valuations or OIA.

By: Craig Niess, CVA, MBA