Almost every M&A article on the IA system written in the past 10 years typically focuses on the increasing number of transactions Private Equity (PE) is responsible for. It is undeniable that PE transactions are increasing. The latest studies estimate that PE accounted for 77% of the M&A transactions in 2022.

However, what every M&A article on the IA system fails to capture and discuss is the amount of local, privately held retail agency to retail agency transactions happen every year.

This article has two parts and purposes. The first is to share some additional data on what is happening outside of the publicly reported M&A transactions that highlight the growing presence of PE buyers. The second is to share some insights on how local, privately held retail agencies can compete with PE buyers for acquisition opportunities.

The Unreported M&A Activity – What is happening beyond the headlines with M&A in the IA System

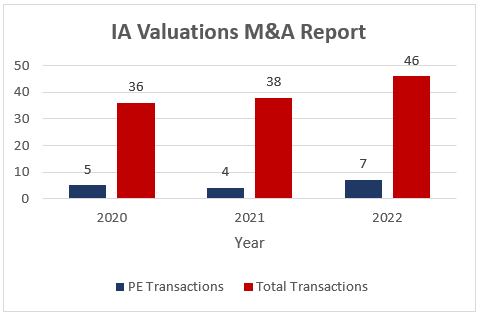

In our studies of the local M&A marketplace, we are finding that PE transactions only make up approximately 13.3% of the annual transactions taking place every year. We reviewed 174 M&A transactions and have data on the seller and buyer for 120 of the transactions. According to our data, only 16 of the 120 transactions (13.3%) from 2020 – 2022 involved PE buyers.

This data point suggests that there are a significant number of unreported M&A transactions in the IA system that are taking place between local, privately held retail agencies.

Admittedly, our data is not a complete picture of the IA M&A marketplace. From that standpoint it is similar to the M&A studies produced by S&P, Optus Partners, Piper Sandler, however it should be considered as an additional data point to consider in the discussion of M&A in the independent agency and broker space.

This is significantly different than the 77% of PE transactions we discussed earlier, however this data correlates with the previous three-year study (2016 – 2018) that we completed when we found that only 9% of the transactions in our marketplace were completed by PE buyers. While the percentage of transactions has increased by 4%, it continues to show that local, privately held retail agencies may be responsible for the overwhelming majority of M&A activity in the IA space – not necessarily by revenue or premium volume but by volume of transactions.

No firm or institution has a comprehensive record or dataset on all of the M&A transactions in the IA system. The transactions that we have data on represent millions in annual revenue, premium volume and significant movement in market share in local insurance markets.

Does any of this matter? We believe it does. It should give all owners of local, privately held retail agencies confidence that they can compete in the M&A space with a few tweaks to their M&A approach and offering.

How local, privately held retail agencies can structure acquisitions to compete with PE Buyers

Proactively scout acquisition opportunities:

Like you do with business and recruiting new producers, always be looking for opportunities to acquire books of business and agencies. You have a plan and strategy when it comes to growing your book, make a comparable plan to grow by acquisition. When attending the annual carrier meeting, trip or association conference, use your networking with other agents to get to know them and start to plant the seed for an acquisition or merger opportunity.

In addition, talk to you carrier reps when they visit about other agents in the area. These folks are a great referral source for acquisitions. Schedule a follow up visit with the prospective agents and let them know that you are an option when they start considering their ownership transition.

When competing for an acquisition, offer a meaningful upfront cash payment:

Be competitive with PE on the initial upfront offer. Work with an IA centric banker (Westfield, Insurbanc, Live Oak to name a few), an M&A advisor and do the math on the acquisition opportunity.

Every acquisition is just a math problem. No entity, be it PE, publicly traded, bank owned or privately held is going to pay you more than what they can get as an ROI for the agency or book of business. Run the numbers on the prospective agency’s P&L and proforma to come up with the most competitive first offer that includes a meaningful down payment. If you are not in the ballpark with the first offer you are typically out of the running before the negotiation starts.

Generally speaking, a competitive first offer will include a lump sum payment that is at least 7x EBITDA or 2x revenue multiple. Those multiples account for what is happening in the agency marketplace right now. Every agency/book’s value is going to vary greatly so those suggestions are just a rule of thumb and we encourage you to get a valuation on the book of business.

Offer an earnout incentive for growth:

In addition to the upfront payment you are offering for the agency, offer a 3 year earnout opportunity to the seller. It is standard practice for a buyer to withhold 25% of the total purchase price in an earnout.

While not all deals are going to offer this opportunity as you may be buying a book of business with a retiring producer, those that do you should seriously consider offering the option. Specifically for those acquisitions where the owner has 3 – 5 years of work left, package up some of the financial opportunity in an earnout. As a buyer, you will be surprised how hard the seller will work to attain the earnout and you will be insulated from risk as your earnout payout will be directly connected to the growth achieved. It will further delay the ROI on the acquisition but it will make the acquisition worth more in the long run.

Offer an equity opportunity for the seller:

One of the most distinguishing and attractive offerings from PE buyers is the equity they offer to sellers. Typically a PE buyer will award 15 to 25% of the initial lump sum payment as stock in the PE broker. This allows the PE firm to keep the owner engaged in growing the operation as they have a continued equity interest in the growth.

In addition, many PE firms forecast a 3x return on the stock with the opportunity to sell at the next equity event and it allows an agency owner to get the proverbial “second bite at the apple.” While your ownership opportunity may not appreciate at that rate, you can still use the most powerful tool in the IA system – ownership – to incentivize additional growth, engagement and successful transition of the business.

While offering equity is not commonplace with the traditional acquisition approach for local, privately held retail agencies, you will have to get creative if you want to recruit and acquire other successful entrepreneurial agency owners and producers into your operation and compete with PE. Outside of mega agency/broker purchases, none of these transactions are creating generational wealth. Therefore you shouldn’t be ruled out for acquisition opportunities but rather must get creative with equity offerings as part of the acquisition. Creating a separate entity, offering additional classes of shares in your agency or selling part of the agency as component of the transaction are possible ways to offer equity.

In conclusion, of the 120 M&A transactions we studied over the past 3 years, 5 privately held retail agencies completed 4 or more transactions during that time frame. Their names will not show up in any Insurance Business America studies on M&A, fastest growing or largest brokers lists. The deals were not likely 8 figures and some were not likely 7 figures.

Yet, they are all significant to the seller, buyer and parties affected by the ownership transition. Every one of these transactions played a significant role in the retirement or transition of one agent and growth of another. All of these were local, privately held retail agency to retail agency.

If you are considering selling your agency, we recommend you reach out to Jeff Smith, JD, CIC with IA Valuations at jeff@iavaluations.com to help understand your options and the selling process. On the flip side, if growth by acquisition is part of your strategy, we encourage you to register with Agency Link to get access to acquisition opportunities when they arise.

About IA Valuations and Agency Link – Founded in 2017, the IA Valuations team has performed over 200 valuations to independent insurance agencies across the U.S. Our advisors have 25+ years of experience guiding agency owners on maximizing their agency value, planning, and legal needs for ownership transition. In addition, IA Valuations has provided perpetuation planning, financial modeling and business planning for independent insurance agencies. Finally, IA Valuations has advised dozens of agency owners on selling their agencies through our Agency Link process. Agency Link is a platform that connects buyers and sellers together to further the growth and strength of the IA system. To learn more about IA Valuations, please visit IAValuations.com or contact@iavaluations.com.

The information provided in these documents is general in nature and shall not be construed as personal legal, tax or financial advice for your situation. Please contact@iavaluations.com to discuss your personal situation.

Copyright ©2023 by IA Valuations and Ohio Insurance Agents Association (OIA). All rights reserved. No portion of this document may be reproduced in any manner without the prior written consent of IA Valuations or OIA. In addition, this document may not be posted as a link on any public or private website without the prior written consent of IA Valuations or OIA.

By: Jeff Smith, JD, CIC, CAE