When perpetuating an agency, it is important to remember that the earlier you start your planning, the more options you will have, and having more options increases your value. Agencies that wait too long or don’t plan effectively will have fewer viable options and may not realize the full potential value of their agency. Time is of the essence.

Perpetuation is a Process

Keep in mind that agency perpetuation is not an event but a process. By carefully planning and executing the gradual transfer of stock, the agency can transition to the next generation of leaders and position itself for a successful future.

The key is to start with the end-goal in mind and build a practical plan to get there. Then, make sure you are revisiting and revising the plan often. By revisiting the plan regularly, you can make sure you are on track, and if not, you can revise the plan to reflect changes in the agency or in the perpetuation goals.

Internal vs. External Perpetuation

Agencies have several options when perpetuating. In an internal perpetuation, agencies transfer agency stock, relationships, and leadership to the next generation of family and/or other key employees with the intention to remain a viable operation. To perpetuate externally, an agency could consider merging with another agency, or selling outright to another agency, broker, bank, or private equity firm.

The goal of an internal perpetuation is to keep the agency legacy alive in the community for the next generation of employees or to keep the agency in the family. This method of perpetuation takes the most time with the most planning and follow-through to be done correctly. For agencies that wait too long to create and execute their plan, an external perpetuation will likely be their only option.

In most cases, deal values for external sales exceed the prices paid for internal perpetuation by a wide margin. You will want to make sure your end-goal is achieved by establishing a plan versus a panicked fire sale at the end of your career because you failed to plan. No matter what your exit strategy is, it is imperative to start planning early to give yourself the most options. Options have value.

Planning Pre- and Post-Pandemic

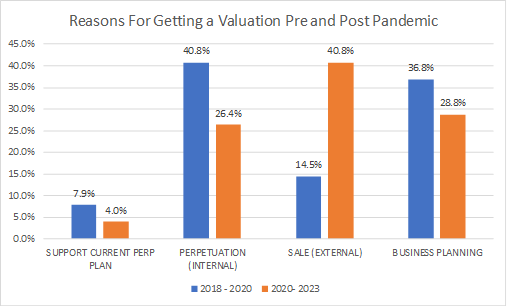

IA Valuations started working with agencies in the first quarter of 2018. Since then, we have done several hundred valuations of independent agencies throughout the country. As part of the data-gathering process, we always ask agency owners what the purpose of their valuation is. We compared data from the beginning up through the pandemic – to data from the pandemic until now.

The most striking thing we see in the data is a huge increase in those agencies getting a valuation to prepare for an external sale, compared to before the pandemic. While the mergers & acquisition market remains robust, the data suggests that fewer agencies are using the valuation as a tool for business planning or internal perpetuation. Those that do it for those purposes will likely have more options and greater value, even if they decide to sell externally eventually.

Would you like to learn more about using an agency valuation as a planning tool? Reach out to me at Craig@IAValuations.com today to learn more.

About IA Valuations and Agency Link – Founded in 2017, the IA Valuations team has performed over 200 valuations to independent insurance agencies across the U.S. Our advisors have 25+ years of experience guiding agency owners on maximizing their agency value, planning, and legal needs for ownership transition. In addition, IA Valuations has provided perpetuation planning, financial modeling and business planning for independent insurance agencies. Finally, IA Valuations has advised dozens of agency owners on selling their agencies through our Agency Link process. Agency Link is a platform that connects buyers and sellers together to further the growth and strength of the IA system. To learn more about IA Valuations, please visit IAValuations.com or contact@iavaluations.com.

The information provided in these documents is general in nature and shall not be construed as personal legal, tax or financial advice for your situation. Please contact@iavaluations.com to discuss your personal situation.

Copyright ©2023 by IA Valuations and Ohio Insurance Agents Association (OIA). All rights reserved. No portion of this document may be reproduced in any manner without the prior written consent of IA Valuations or OIA. In addition, this document may not be posted as a link on any public or private website without the prior written consent of IA Valuations or OIA.

By Craig Niess, CVA, MBA