It has been 10 years since McKinsey published The Agent of the Future: The Evolution of Property and Casualty Insurance Distribution Report. In that report, McKinsey predicted a bleak future for the local insurance agent, which translated into another doom and gloom message for independent insurance agents (IAs).

As soon as the report was published, IAs were once again having to defend their profession and role in the risk advising process. One chapter was titled, “The End of an Era for the Local Insurance Agent,” and it focused on five parts of the insurance distribution model to back up their conclusion that the local insurance agent was facing a grim future. The points included: a diminished role in risk selection and pricing, the rise of multichannel, the ascendance of the carrier brand, commoditization of personal auto, and commission rates under pressure.

Let’s consider all of these points and the impact they have had on the IA system. Many of these points were true in 2013, and even more prevalent in 2023.

Diminished Role in Risk Selection and Pricing

It is true that carriers increasingly and almost exclusively rely on algorithms and predictive modeling to underwrite risk and develop pricing. However, even with that evolution, agents continue to play a very meaningful role in identifying and advising their clients on their risks, evaluating the right carrier and policy to properly protect their assets, and bringing profitable business to their carrier partners.

Rise of Multichannel

Multichannel distribution is growing and will continue to grow as business evolves. In 2013, the strategy from national carriers was to pummel consumers with billions of dollars of ads dumbing down insurance and commoditizing the insurance product and selection process. While that strategy has not changed much, the world has. It has become increasingly more complicated and riskier. Insurance is still incredibly complex and dull. Consumers continue to recognize this and are choosing a trusted advisor to guide them in protecting their assets, similar to the way they engage with their tax, financial, and legal advisors.

Ascendance of the Carrier Brand

The ascendance of the Carrier brand is largely true for the top 5 carriers in the US – State Farm, Allstate, Progressive, Geico, and Liberty. While these insurance brands have succeeded in achieving household brand recognition, the hundreds of other P&C carriers have been left behind and would face an insurmountable task of catching up with those brands. It would take sustained multi-hundred million dollar spends to develop strong brand awareness and new policyholder conversion.

Commoditization of Personal Auto

Commoditization and reduction in the private passenger auto market has had an effect on both captive and independent agents as that market shifts to the direct model. While this has a negative impact on agents in the short and mid-term, the recent increase in loss ratios, the struggle with cost containment, and adjustments to electric vehicles are proving this to be an incredibly challenging line of business.

Not to mention, the future of private passenger auto likely has an expiration date. While it may be decades in the future, embedded insurance offerings from auto manufacturers spurred by data collection and autonomous vehicles are a very real threat to this line of business for all distribution channels. Many IAs have invested in a “hold onto what you have” strategy but seek growth in more profitable and sustainable lines of business.

Commission Rates Under Pressure

Commission rates are under pressure – this is true and will likely always be a concern for agents as long as they rely on a carrier relationship to fulfill their promise to their clients. Anytime two parties have to rely on each other for their profitability, there will inevitably be times of friction. We are facing that with the current hard market as carriers feel financial stress and look for cost containment initiatives. Even with the pressures agents have felt on commission, agencies have been able to maintain their growth and increase revenues over the past decade.

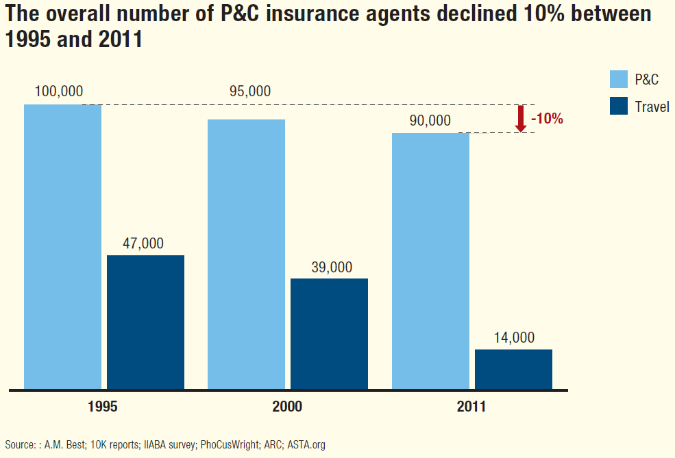

Looking at another point in the report, McKinsey used the comparison to travel agents to support their conclusions on the decline of the local insurance agent. They used data trends showing that the number of insurance agents had been declining for 15 years leading up to the study. McKinsey used the other 10% reduction in the P&C agent force to predict further decline in the future.

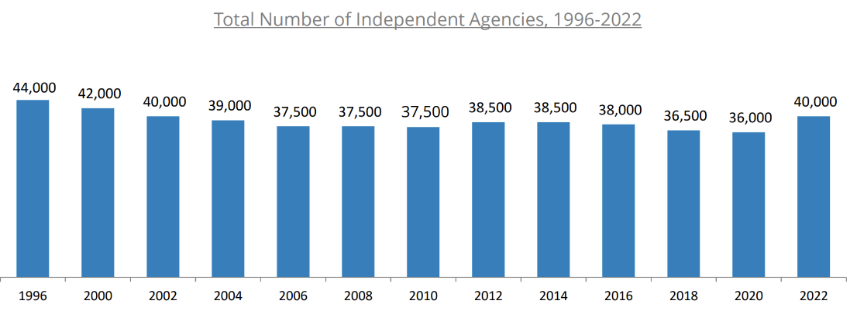

A couple of observations on this point. First, the decline in agencies was a glacial drip, not a cliff. While it continued through 2020, the 2022 Agency Universe Study showed the IA system experienced a 10% increase in the number of agencies rebounding to 2002 levels. This shows both the resiliency of the IA profession and appeal outsiders have for the agency business. It is undeniable that IAs have a challenge recruiting producers and service staff to join their agencies, however there is no sign that this is slowing the growth of the IA market share.

All that being said, it is true that IAs are facing consolidation in the agency ranks. However, thus far there are no predictions that there are going to be less insurance agents, perhaps agencies as we consolidate under large enterprises, but we expect a growing number of insurance agents and risk advisors to be needed.

3 Outcomes that Actually Happened over the Past 10 Years in the IA System

- Independent insurance agents have increased their market share over the past 10 years. While direct to consumer insurers have increased as well, IAs have experienced a similar growth trajectory over the past decade. AM Best market share data shows IAs have enjoyed a 5% increase in the P&C market while directs have grown by 8%. The market share gains for both channels appear to be coming from the captive agent/carrier distribution channel as that model has decreased by 14% since 2013. This decline has caused traditionally captive carriers like Nationwide to completely change their distribution model and has created constant chatter in the insurance industry as to which captive carrier is next. It is to be determined but it would not be surprising to eventually see State Farm standing alone in the captive carrier distribution model.

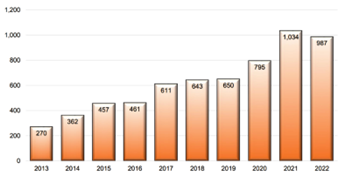

2. Private Equity (PE) companies have made unprecedented levels of investment into the IA system since 2013. Many estimates put the capital infusion amount between $25 to $35 billion invested into the IA system. PE investors tend to be smart and sophisticated investors. They are using their money to purchase the local independent insurance agent, keep the presence, staff, and office local, but centralize many of the back-office functions to improve the efficiency and profitability. According to Optis Partners, over the past 10 years, estimates show the top PE brokers have acquired more than 5,000 local IAs.

The PE fund managers are not out to lose money and it is unlikely they would be investing billions in a distribution system that they thought was going to decline in value in the immediate future. In addition to the PE brokers, publicly traded brokers are enjoying high levels of YOY organic growth, record high share value, and profits. While these types of brokerages are in many ways different than the traditional “local insurance agent,” they provide similar services, have similar presence in many communities around the country, and their successes are signs of health and vibrancy for the IA channel.

3. Independent agency valuations are at record levels. According to Reagan Best Practices, in the past 10 years, IAs have enjoyed the greatest growth in wealth in the history of the IA system. Generally speaking, agency valuations have doubled in the past 10 years. This does not represent a declining asset with a bleak future. While we may not see agency valuations double again over the next 10 years, there are no predictions that agency valuations will drastically decline over that time period.

McKinsey got some things right and wrong 10 years ago. When they talked about the end of an era for the local insurance agent, they should have included “captive” and focused primarily on that component of the distribution system. By painting all local insurance agents with the same brush, they clearly got it wrong with the IA channel. If you consider market share, private investment, and valuations, independent agents are more alive than they have ever been.

One statement that McKinsey got right in 2013 is fairly simple and obvious: “Local agents are not in danger of extinction, but the role they will play will continue to evolve.”

For the independent agents that bought into the McKinsey report in 2013 and sold their agencies prematurely, you lost out on the best of times and likely a significant amount of wealth. One thing I have learned in my 10 years working for independent agents is that you always bet on the entrepreneur – which is in the DNA of an independent agent. Always bet on those whose core business principal is taking care of their community. Always bet on those who solve complicated problems and do so in a noble and honorable way.

No one knows what the future holds for any industry or profession. However, if the world continues to get riskier and more complex, it is safe to bet on independent agents being needed to solve problems and manage risk. The end result will be continued growth in market share and enhancing the value of the IA system.

If you ever want to further this conversation or have thoughts on what the next 10 years will look like for you and your agency, please reach out to me at jeff@iavaluations.com. We would love to have a conversation with you and help propel your agency forward.

About IA Valuations and Agency Link – Founded in 2017, the IA Valuations team has performed over 200 valuations to independent insurance agencies across the U.S. Our advisors have 25+ years of experience guiding agency owners on maximizing their agency value, planning, and legal needs for ownership transition. In addition, IA Valuations has provided perpetuation planning, financial modeling and business planning for independent insurance agencies. Finally, IA Valuations has advised dozens of agency owners on selling their agencies through our Agency Link process. Agency Link is a platform that connects buyers and sellers together to further the growth and strength of the IA system. To learn more about IA Valuations, please visit IAValuations.com or contact@iavaluations.com.

The information provided in these documents is general in nature and shall not be construed as personal legal, tax or financial advice for your situation. Please contact@iavaluations.com to discuss your personal situation.

Copyright ©2023 by IA Valuations and Ohio Insurance Agents Association (OIA). All rights reserved. No portion of this document may be reproduced in any manner without the prior written consent of IA Valuations or OIA. In addition, this document may not be posted as a link on any public or private website without the prior written consent of IA Valuations or OIA.

By: Jeff Smith, JD, CIC, CAE,