In our last article, we noted the impact of contingent income on agency profitability. We found that 34.3% of the agencies in our database rely on contingent income to be profitable, and that too many agencies are running their businesses as though contingent commissions are guaranteed each year.

To further emphasize the importance income to the day-to-day operations of an agency, we looked at contingent income through the lens of several key operating metrics. What we found is that many agencies are dependent on contingent income to help cover day-to-day operating expenses. Further, we found that for many agencies, contingent income exceeded pre-tax profits.

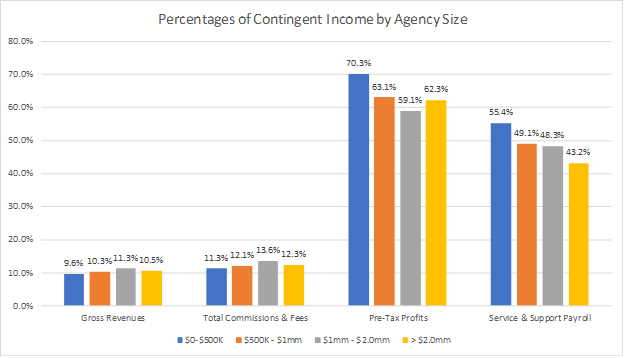

Gross Revenue – Contingents as a percentage of gross revenue ranged from 9.6% to 11.3%, depending on the revenue band. The average for all agencies was 10.4%.

Total Commissions & Fees – Contingents as a percentage of total commissions & fees ranged from 11.3% to 13.6%. The average for all agencies was 12.2%.

Pre-Tax Profit – Contingents as a percentage of pre-tax profits ranged from 59.1% to 70.3%. The average for all agencies was 64%.

Agency Owners need to be aware of the financial impact that contingent income has on their business. Best-in-class agency owners do not rely on contingents to support expense loads. Instead, they budget and operate their businesses without a reliance on them.

About IA Valuations and Agency Link – Founded in 2017, the IA Valuations team has performed over 200 valuations to independent insurance agencies across the U.S. Our advisors have 25+ years of experience guiding agency owners on maximizing their agency value, planning, and legal needs for ownership transition. In addition, IA Valuations has provided perpetuation planning, financial modeling and business planning for independent insurance agencies. Finally, IA Valuations has advised dozens of agency owners on selling their agencies through our Agency Link process. Agency Link is a platform that connects buyers and sellers together to further the growth and strength of the IA system. To learn more about IA Valuations, please visit IAValuations.com or contact@iavaluations.com.

The information provided in these documents is general in nature and shall not be construed as personal legal, tax or financial advice for your situation. Please contact@iavaluations.com to discuss your personal situation.

Copyright ©2023 by IA Valuations and Ohio Insurance Agents Association (OIA). All rights reserved. No portion of this document may be reproduced in any manner without the prior written consent of IA Valuations or OIA. In addition, this document may not be posted as a link on any public or private website without the prior written consent of IA Valuations or OIA.

By: Craig Niess, CVA, MBA