2025 Q1 MARKETPLACE REPORT – AGENT/BROKER M&A ACTIVITY

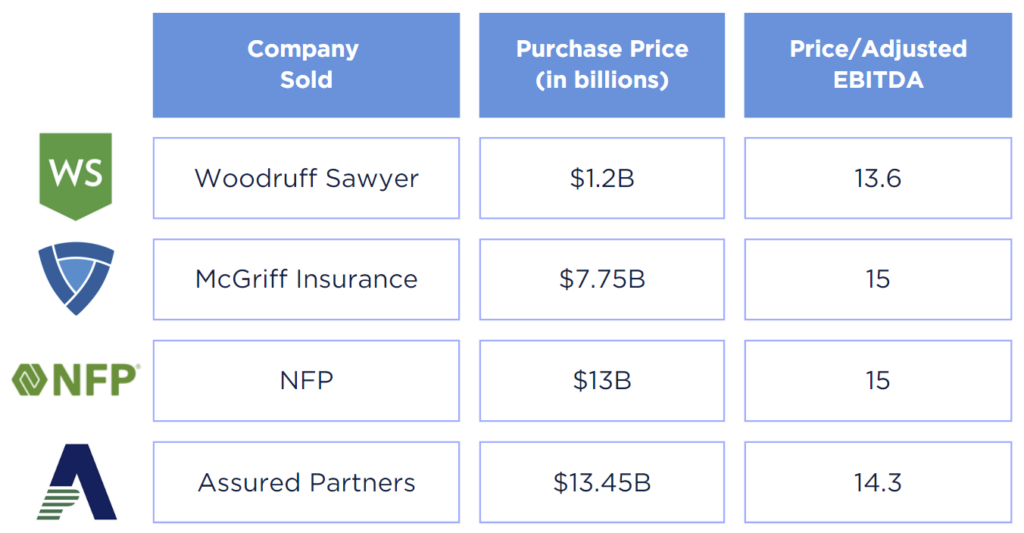

2024 was the year of the Mega Mergers & Acquisitions (M&A). With four deals accounting for over $35B in M&A activity, 2024 represented another year of consolidation in the independent agency space. The IA system has been experiencing heavy M&A activity since 2014 when Private Equity (PE) buyers entered the space in a significant way.

Up until last year, there was a high volume of activity, but not many mega M&A transactions like what transpired between the parties in 2024. According to Optis Partners, there were 750 M&A transactions last year, down 10% from 833 in 2023. PE buyers still accounted for the overwhelming majority of M&A deals at 72%, while publicly traded brokers became more active in the acquisition space, making up 10% of the publicly reported deals.

It is important to note that our data shows that publicly reported deals likely only represent 30-40% of the deal activity in the independent agency space. The highest volume of M&A transactions are those between private retail to retail agencies that are never reported in trade journals. These transactions often do not involve advisors and are exchanges between friendly retail competitors.

Overall, 2024 was still a very active year in the M&A space. While down from record levels in 2021 and 2022, the 750 transactions likely established a new floor for M&A activity. Almost all agencies we engage with have an acquisition interest and appetite. They are developing acquisition strategies and proactively looking to grow through acquisitions. If you are interested in agency acquisitions, we encourage you to submit your agency profile on Agency Link to access the many opportunities that IA Valuations and our partners help prospect to potential buyers and sellers.

FAQ: PRO FORMA EBITDA

Why does pro forma EBITDA matter?

If an agency owner is interested in selling their agency, either internally or externally, a pro forma analysis of the agency will be conducted by a lender or a buyer. These parties need to know what sort of cash flow they can reasonably expect to generate from an agency, not just what actually happened due to potential variability. An agency owner needs to understand pro forma EBITDA because it could very tangibly impact how much capital a buyer or seller would justify injecting into an agency sale or purchase.

What does pro forma mean?

Pro forma is any number that is not only based on actual results. Pro forma is used to describe a number where a scenario or set of assumptions have been added on top of or used instead of actuals.

What’s the difference between EBITDA and pro forma EBITDA?

EBITDA is based solely on actuals. Pro forma EBITDA is the projected EBITDA of a business, or insurance agency, after accounting for non-recurring revenues and expenses, future business context, and variable incomes and expenses.

Why not just use actual EBITDA?

The problem with using actual EBITDA is that it is based solely on the past. With a pro forma EBITDA, there is effort made to take into account the future context of the business and arrive at an estimation of cash flow from there.

What are some common adjustments made to go from actual to pro forma EBITDA?

- Averages used for variable incomes, i.e. contingents, overrides, etc.

- Non-recurring revenues and expenses

- Payroll adjustments

- Operating expense adjustments

How do I get a higher pro forma EBITDA?

There is no blanket answer to this question; however, generally speaking, if your agency already operates with high margins, that correlates with a higher pro forma EBITDA. If you engage an advisor or other professional to perform a valuation, get as detailed as you can in regards to the agency’s profit and loss and make sure they understand what expenses you do or do not expect in the future!

KEY TAKEAWAYS FROM ACTUAL AND PRO FORMA RESULTS THROUGH Q1 2025

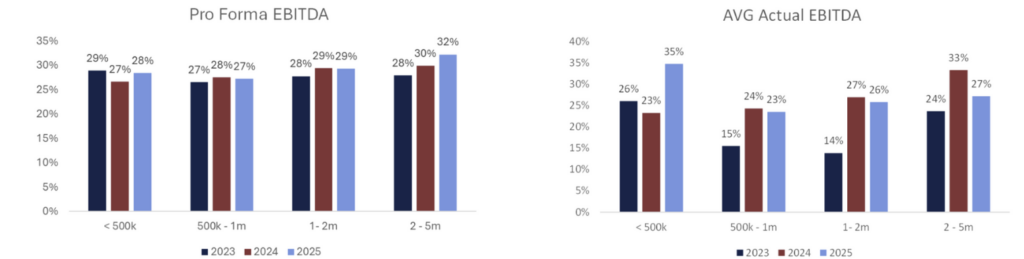

- The pro forma results are generally a lot smoother, as you can tell from the graphs below. This is expected as the pro forma analysis attempts to smooth variability. The lowest average pro forma result is 27% over the last 2.25 years, while the highest is 32%. Compared to the actual where the low is 14% and the high is 35%.

- Pro forma profitability tends to increase as agency revenue increases. As agencies grow, they unlock more economies of scale. These efficiencies lead to greater confidence in a more profitable operation.

- The actual results experienced a low in 2023, but the $500k-$1M and $1-2M revenue groups have rebounded in 2024 and 2025.

FAQ: EBITDA MULTIPLES

What is a multiple of EBITDA?

A multiple of EBITDA is a financial ratio that takes a financial metric divided by a company’s EBITDA. For public companies, oftentimes the number being divided is their enterprise’s value.

Why do multiples of EBITDA matter?

These ratios matter to the everyday agent because the multiples that public insurance brokers are trading for inform and trickle down to what privately held agencies trade for.

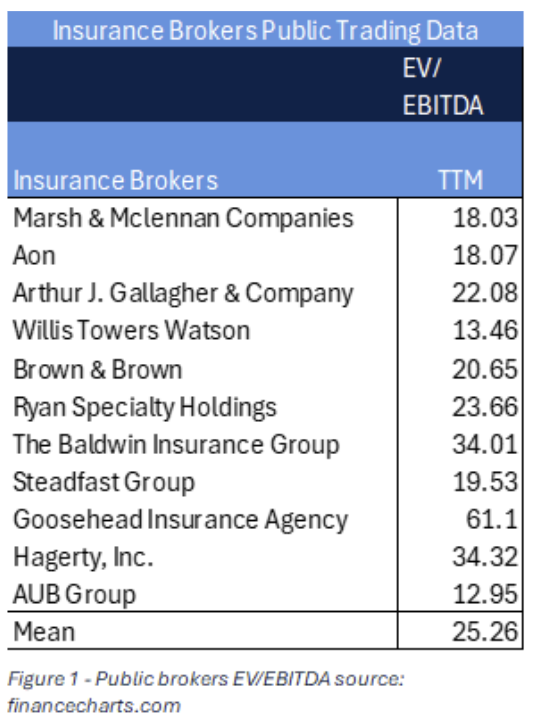

What multiples do public insurance brokers trade at?

The average multiple of EBITDA that some of the largest public brokers trade at is 25X. Details can be seen at the table to the right.

Should I expect my agency to trade at a 25X multiple of EBITDA?

The short answer is no. Think of the 25X multiple as a maximum on a scale. Then at the minimum on a scale we have a privately held, single-owner agency with anywhere from $100-$300k in revenue. Their fair market value multiple, based on what IA Valuations sees, will typically be around 7-8X. Main drivers of these changes in multiple is buyer appetite and the availability of capital to buyers.

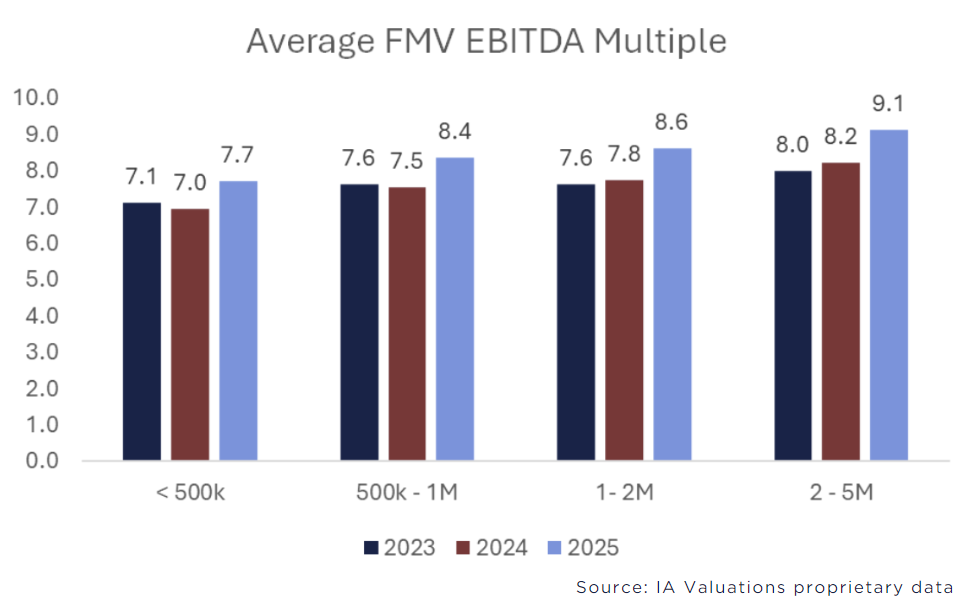

KEY TAKEAWAYS FROM ACTUAL FAIR MARKET VALUE RESULTS THROUGH Q1 2025

- For all revenue groups, their values are rising in 2025. This is driven by the sustained higher sale prices for insurance agencies. Fair Market Value multiples will never be as high as actual external sale multiples, but they are informed by them.

- $<500k revenue and $500k-$1M groups have average values now closer to and above 8, respectively. The trickle down of higher insurance agency values is increasing its effect on these size agencies.

- The $2-5M revenue group’s average Fair Market Valuation eclipsed 9 for the first time. We expect to see this trend of higher averages as the revenue sizes increase.

THE POWER OF PREPARATION – HOW ASKING FOR HELP CAN DRIVE GROWTH

Background

One of the most noble things you can do as a business owner is recognize when you need help and to ask for it. Dan Kiesewetter, of Kiesewetter Insurance in Farmington, IL, began contemplating selling his agency when he came to terms with the fact that internally perpetuating his small agency in rural Illinois at this stage in his career was not going to be an easy task with everything he faced. They weren’t big enough to specialize and they didn’t have the resources or the markets to remain competitive.

Step-By-Step Thinking

When agency owners begin thinking of who to sell their agency to, the thought process often goes: “I’ll sell to my kids; if they don’t want it, I’ll sell to my producer; if they don’t want it, I’ll find a new young producer to take over; if they don’t want it, I’ll sell to a friendly competitor; if they don’t want it, I guess I’ll sell to private equity.” This is the exact stream of consciousness that Dan experienced as he began thinking about this transition 5 years ago – he explored each option, speaking to his kids, moving on to his employees, interviewing outside candidates, until he eventually entered into an NDA with a friendly competitor, Unland Insurance, in 2022. All was going to plan, until Unland suddenly was bought by a PE firm – Foundation Risk Partners.

“My customers are my family, my friends, my employees, my neighbors. I want the best for these people, and this was the only way I could get that.” Dan’s first plan was not to sell to PE, but he felt like he had appropriately entertained every option leading up to it. He trusted Unland, and therefore FRP, completely – though not naively – and after putting the sale on hold for a year, decided to lean in and allowed FRP to pursue the sale of Kisewetter Insurance. One of the easiest decisions he made in this journey was embracing FRP because of the trust they had in him. He was able to retain the agency name, staff, locations, and operations exactly the same, which was incredibly important to him.

Asking for Help

Before he began the process, Dan got connected with IA Valuations through their partnership with Big “I” Illinois. He quickly realized he was in over his head on the contractual side and knew he did not want to try to tackle this himself. He obtained an agency valuation, so he knew his value going into the sale, but he continued to work with IA Valuations through negotiations. “Having an independent third party was incredibly helpful. This is a once in a lifetime deal for me – I have been in the business for 44 years and there’s too much emotional attachment. I needed a third party to feel objective throughout, plus they helped me negotiate for more for the agency!”

Heed His Advice

When we asked Dan about any advice he had for agencies as they embark on a transition like this, he had several pieces.

- Due diligence, due diligence, due diligence. He ran a small, rural agency that he took over from his father. They had a lot of handshake deals, verbal agreements, and informal partnerships. These types of deals can work great, but in reality, they make an official deal “excruciating,” to use his words. It takes a lot to dig up proof of these deals, and outside accountants might not take your word for it. His advice: pay more attention to small details, specifically broker and carrier contracts. His late father was still named on some of his contracts over a decade later; these details matter.

- Patience is key. He was ready to come out in full force with his newly unlocked resources – but things take time. Markets and resources will come, but the transition is not going to happen overnight. Transitioning AMS technology was also a headache he anticipated but is still taking time to get used to. His advice: never go into a deal without at least one very capable and experienced agency manager. His long-time, loyal, and upbeat agency manager, Kristie, has helped ease their way through this transition because of her patience and talent.

- Don’t do it alone. While he already had a sophisticated buyer in mind, he knew he could not represent himself in this sale. His advice: work with at least one third party who can remain objective and honest. For him, it was IA Valuations. The transition is working out the way he anticipated, and he attributes the ease of sale to the help he had.

Dan has stayed on as an employee of FRP and receives a salary, commission, and benefits. He gave an exit timeline of 3-5 years, but he loves his staff, this business, and his new partners, so he can’t say if he’ll be gone by then. Dan remains dedicated to his community, ensuring that his family, friends, employees, and neighbors continue to receive the same care and attention they’ve always known, now and in the future.