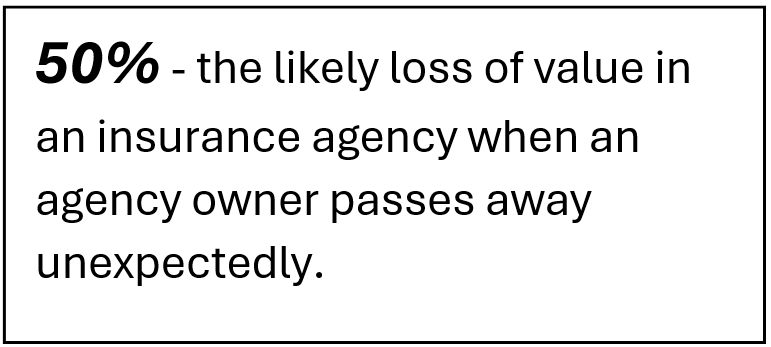

In almost every scenario, the unexpected passing of an agency owner will have a profoundly negative impact on the value of an agency.

With 39,000 independent insurance agencies in the US, sadly, unexpected deaths of agency principals are an everyday occurrence. Particularly when you factor in that 22% of agency owners are over the age of 66 and 37% are over the age of 61. Knowing this and the fact that agency owners are in the profession of protecting their clients’ assets when the unexpected happens, it is shocking how many agency owners are ill-prepared for their unexpected passing.

Thinking about our mortality is a morbid but very real topic. Insurance agencies are built on relationships and expertise, and in most situations the agency owner is the foundation of these pillars.

When those two key components of relationships and expertise are taken out of the equation, the value of an agency drops dramatically.

There are many legal and operational challenges created by an agency owner not having a plan for their unexpected passing. Those issues include legal ownership and the probate process if the business does not have a written succession plan. The estate may owe estate taxes, which would require the business sale to cover the liabilities. Disputes may arise among heirs. Creditors may demand repayment of all loans if the owner personally guaranteed the loans. The agency may survive these challenges, but it will be very disruptive to the operation and greatly impact value.

Now we will explore the factors that will have the greatest bearing on determining how agency value will be negatively impacted following the unexpected passing of the agency owner:

- Leadership of the Agency – If the agency owner is the internal leader, leading producer, networker, carrier relationship manager, and identity (literally – the agency name) of the agency, this is a huge risk. If you are an aspiring agency owner or employee, you would be concerned about working in a situation like this, with all of your eggs in one basket. The loss of the leader will be demoralizing beyond just the passing; it will cause great uncertainty in your life as an employee. This is hard to quantify, but it could impact agency value by 30 – 35%.

- Top 10 Accounts Percentage of Agency Revenue – If the Top 10 accounts make up more than 10% of the agency’s revenue and they are primarily the relationships of the agency owner, this is a big risk factor for agency value. This could swing agency value by 10 – 20%.

- Commercial Lines (CL) vs. Personal Lines (PL) split – This is the one exception where a higher volume of PL business may be of greater value to an agency than CL. Pl, while highly vulnerable to commoditization, is much stickier in a transition and is less connected to the relationship of an agency owner. Even a sympathetic buyer is going to greatly discount the value of a heavy CL agency that no longer has its leading producer and relationship; this could impact agency value by 15 – 20%.

- Insurance Experience – In most situations, agency owners have the most insurance and risk management experience and expertise. Depending on the CL/PL split, if you have a lot of unique and complex risks, this loss will be detrimental. If you take that away abruptly and without a plan, it could impact value by 10 – 15%.

- Culture of the Agency – The loss of a leader is transformational, regardless of whether there was any preparation in place. To lose a leader without notice or a plan is a double-whammy. It will impact the culture in untold ways. It is hard to quantify the impact on value, but it could be significant, especially if the staff loses energy, becomes disengaged under the new leadership, or decides to leave.

These are just some of the ways in which agency value could be impacted by the unexpected loss of an agency owner. In our work with insurance agencies, we have seen this happen time and time again.

The most vulnerable agencies, and the most common, are small to midsize single-owner agencies. They typically are built entirely around the personality, relationships, and skills of the agency owner. For some reason, the owners feel invincible, and yet it is so obvious to everyone around them how risky their situation is.

The unexpected loss of the agency owner has a profound trickle-down effect on the owner’s family, the staff, clients, and carrier relationships. There are several actions you can take that will not compromise your current growth plan or agency in the event of an untimely passing.

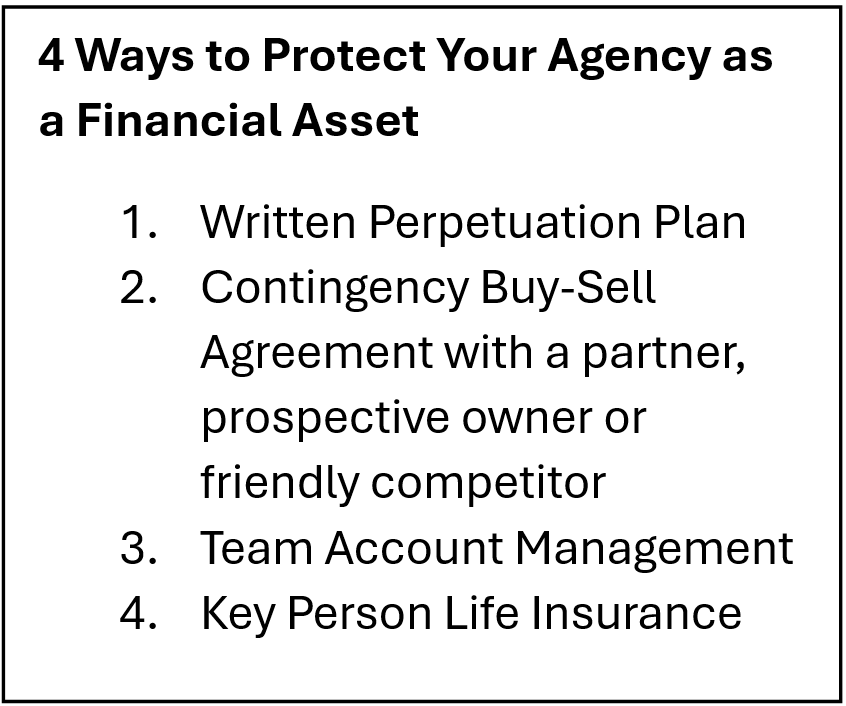

Those actions start with developing a written perpetuation plan and sharing it with the parties that are part of the plan. Once you have an agreement amongst the parties, turn the plan into a legal contingency buy-sell agreement. Develop a team-based account management approach. It is fine for the owner to be the relationship holder at first, but be sure to spread that relationship across the team. Get your clients comfortable with all of the members of the team who are going to touch their account. Finally, invest in Key Person Life Insurance so your heirs and the agency can be taken care of in the event of your unexpected passing.

In conclusion, every time an agency owner unexpectedly passes without a plan, it has a sharp and immediate negative impact on agency value. By how much and for how long, really depends on how well your agency has addressed the 4 items mentioned above.

Don’t let this happen to you. Whether you are the longtime, majority owner or a young, aspiring owner, start planning for the unexpected today. Practice what you preach to your clients and protect your agency as a financial asset. If this situation resonates with you or you have questions related to your agency value, please contact IA Valuations CEO Jeff Smith at jeff@iavaluations.com.

By: Jeff Smith, JD, CIC, CAE

About IA Valuations and Agency Link – Founded in 2017, the IA Valuations team has performed over 320 valuations to independent insurance agencies across the U.S. Our advisors have 25+ years of experience guiding agency owners on maximizing their agency value, planning, and legal needs for ownership transition. In addition, IA Valuations has provided perpetuation planning, financial modeling and business planning for independent insurance agencies. Finally, IA Valuations has advised dozens of agency owners on selling their agencies through our Agency Link process. Agency Link is a platform that connects buyers and sellers together to further the growth and strength of the IA system. To learn more about IA Valuations, please visit IAValuations.com or contact@iavaluations.com.

The information provided in these documents is general in nature and shall not be construed as personal legal, tax or financial advice for your situation. Please contact@iavaluations.com to discuss your personal situation.

Copyright ©2024 by IA Valuations and Ohio Insurance Agents Association (OIA). All rights reserved. No portion of this document may be reproduced in any manner without the prior written consent of IA Valuations or OIA. In addition, this document may not be posted as a link on any public or private website without the prior written consent of IA Valuations or OIA.