It’s still early in the year and your community was just ravished by another convective storm, tornado, wildfire, mass flooding, or another widespread CAT loss. This story is becoming all too familiar across the country as natural weather events are happening at a higher rate.

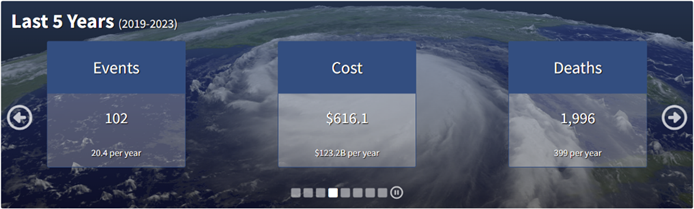

Over the last five years, 2019-2023, the National Centers for Environmental Information (NCEI) reported over 20 CAT events per year, with a total cost estimated at $616.1 billion. The increase in catastrophic events and higher loss ratios extends farther than just immediate damage; they are beginning to shake the foundation of the P&C insurance system and could significantly affect the independent agencies in the long run and, specifically, their agency valuations.

Let’s consider, for example, an agency who has over 80% of its business written in a three-county region. A single CAT event in this locality, resulting in widespread property damage, can lead to a significant number of claims for this agency. This agency could have over 200 claims from this single event, causing a massive spike in its loss ratio for the year, and pressure on your carrier partners to process claims quickly and keep your clients happy. This single event is going to have many financial implications for this agency, on top of long-term issues that will arise in the community suffering from the CAT.

Financial Implications of CAT Losses

There are several lasting financial implications of CAT losses on the IA community, including the following:

- Profit Sharing and Revenue Impact. CAT losses directly impact an agency’s profit-sharing performance with its carriers. Profit-sharing typically accounts for 6-10% of an agency’s annual revenue and it is contingent (pun intended) on maintaining favorable loss ratios in your book. While profit-sharing is never guaranteed and therefore not budgeted for, the absence of this revenue can still strain your financial resources and profitability of an agency. One year can be sustained, however if your agency is located in a CAT-prone area, the revenue impact can be much greater over an extended period of time.

- Carrier Relationship and Stability. CAT losses can jeopardize an agency’s relationship with its carriers in two primary ways. First, it may impact the stability of your carrier, particularly if it has substantial exposure to the affected region. The impact on the value of your agency will depend on how much business you have placed with that carrier and the role they play in your agency. This instability can cascade down to the agency, affecting its ability to offer competitive policies and maintain customer trust. Second, repeated CAT losses over several years can lead carriers to reassess their relationship with the agency. If an agency consistently generates high loss ratios, carriers may reconsider their appointments, preferring to work with agencies that present lower risks.

- Utilization of Excess and Surplus (E&S) Lines Brokers. In the wake of catastrophic events, standard carriers may become more cautious, tightening their underwriting criteria, and forcing you to place more business through excess and surplus line brokers. Commission splits are typically less favorable than with direct appointments, which can further diminish your agency’s revenue. This shift will affect your agency’s overall market positioning and attractiveness to potential buyers on top of affecting its profitability.

Long-Term Affects of CAT Losses

While the aforementioned points affect the revenue and financial stability of an agency, this all accumulates into the long-term affects on agency value. In this section, we will explore the ways in which CAT losses affect underlying value.

- Impact on Agency Appointment. Continuous CAT losses can jeopardize your agency’s appointments with carriers. Losing a direct appointment can be detrimental, as it can reduce your ability to offer diverse and competitive insurance products to your clients. The reliance on fewer carriers or E&S brokers can make the agency less appealing to clients and potential buyers. IA Valuations heavily considers the stability and diversity of carrier relationships when evaluating an agency, and any perceived instability shows risk and can lead to a lower valuation.

- Operational and Reputational Considerations. Managing a high volume of claims efficiently is crucial for maintaining your agency’s reputation. Any delays or perceived inadequacies in handling CAT claims can damage client trust and satisfaction. Reputational damage can be as detrimental as financial losses, which affects customer retention and new client acquisition. When evaluating an agency, potential buyers consider both financial performance and market reputation. A tarnished reputation due to poor claims management during CAT events can thus lower your agency’s valuation.

- Local Economic Effects. The economic impact of a CAT event on a community can trickle down to having both short-term and long-term effects on an insurance agency. Without sounding crass, there is typically a short-term economic boost of sorts for the community as they begin the recovery and rebuild process. Local businesses can quickly get stimulated and create jobs due to the event. This short-term silver lining may be less optimistic if the region is prone to frequent CAT events – when property values may decline, businesses may relocate, population may decrease, etc. All of these potential outcomes could shrink your agency’s potential customer base, on top of all the other implications we’ve already discussed. The economic volatility in this scenario could lead to a more conservative valuation of your agency to reflect the increased risk and uncertainty.

Mitigating the Impact of CAT Losses

To mitigate the impact of CAT losses on your valuation, you can adopt several strategies:

- Diversification. If you can reduce the reliance on a specific geographic region by diversifying your portfolio, you can mitigate the impact of localized CAT events. You can achieve this by expanding into different regions or different lines of business to stabilize the revenue streams the same way insurance carriers do.

- Strengthening Carrier Relationships. You can work closely with your carriers to develop thorough risk management and loss prevention programs. By doing this, you can demonstrate a proactive approach to mitigating risk that can build a stronger relationship and secure more favorable appointments.

- Investing in Technology. You can enhance your operational efficiency, and therefore your client satisfaction, by utilizing technology for efficient claims handling and ensuring you can operate if your agency’s location is affected by the CAT damage. As stated above, this will help preserve your agency’s reputation and bolster customer loyalty, even during high-stress times, such as in the wake of a catastrophic event.

- Financial Planning and Reserves. Building financial reserves and adopting conservative financial practices can provide a buffer during periods of high losses and economic uncertainty caused by CAT damage.

Conclusion

Helping clients and communities recover from CAT events is why the insurance industry and independent agency system exist. Almost every CAT event results in loss of life and massive destruction. It is a sad and tragic experience.

However, when tragedy strikes is when the insurance industry and independent agents shine. It is where your knowledge and experience advising your clients on their risk and insurance program take center stage in protecting their businesses, families, and wealth. It is where the hugs and handshakes begin the rebuilding process.

With that, CATs can cause significant challenges for insurance agencies, affecting their financial stability, carrier relationships, and overall valuation. For an agency with a high concentration of business in a vulnerable region, the impact of CAT losses can be profound and far-reaching.

By understanding these risks and adopting strategic measures, you can better navigate the complexities of catastrophic events, preserving your value and ensuring your long-term success. The key lies in proactive risk management, diversification, and maintaining strong relationships with carriers and clients. If you find yourself in a region subject to increasing CAT events or are curious how other factors may affect your agency’s value, please reach out to Jeff Smith at jeff@iavaluations.com to learn more and get started.

By: Jeff Smith, JD, CIC, CAE and Colleen Barbara

This article was produced with the assistance of Chat GPT.

About IA Valuations and Agency Link – Founded in 2017, the IA Valuations team has performed over 220 valuations to independent insurance agencies across the U.S. Our advisors have 25+ years of experience guiding agency owners on maximizing their agency value, planning, and legal needs for ownership transition. In addition, IA Valuations has provided perpetuation planning, financial modeling and business planning for independent insurance agencies. Finally, IA Valuations has advised dozens of agency owners on selling their agencies through our Agency Link process. Agency Link is a platform that connects buyers and sellers together to further the growth and strength of the IA system. To learn more about IA Valuations, please visit IAValuations.com or contact@iavaluations.com.

The information provided in these documents is general in nature and shall not be construed as personal legal, tax or financial advice for your situation. Please contact@iavaluations.com to discuss your personal situation.

Copyright ©2024 by IA Valuations and Ohio Insurance Agents Association (OIA). All rights reserved. No portion of this document may be reproduced in any manner without the prior written consent of IA Valuations or OIA. In addition, this document may not be posted as a link on any public or private website without the prior written consent of IA Valuations or OIA.