One of the factors that we consider when determining the risk of an agency is whether or not the agency has producer agreements and employment agreements in place. It is essential for agencies to have both non-competition and non-solicitation agreements in place with their employees during normal operations, and especially when going through an ownership transition.

An employment agreement is a contract between the agency and the employee that delineates the expectations of both parties. Employment agreements typically cover items such as compensation, duties, length of employment, and specifics about termination.

To make the employment agreement stronger for producers, an agency should address ownership of the book of business, non-solicitation, and non-competition. These additional factors will bolster the underlying value of the agency by protecting the renewal revenue stream.

In this article, we will explore the various provisions in an insurance agency employment agreement, the importance of having these agreements in place, the impact they have on agency valuations, and the risk over 30% of agencies are taking by not having employee agreement.

Core Components of an Insurance Agency Employment Agreement

Every employee agreement has standard provisions, including duties of the parties, consideration, term, termination, indemnification, confidentiality, severability, assignment, waivers, jurisdiction, and other standard miscellaneous provisions. However, insurance agency employment agreements have several additional provisions that provided added protections for agency owners to ensure they can effectively protect their businesses, invest in employees, and have mutual benefit for the parties.

The following provisions are essential to insurance agency employment agreements.

Ownership of the Book of Business

In the producer agreement, it is essential that an agency stipulates exactly who owns the book of business. If it is not explicitly stated in the agreement, the agency will face exposure and a potential loss of revenue, along with a decrease in agency value.

Non-Solicitation

A strong non-solicitation clause ensures that, upon termination, the producer will not prospect or solicit the agency’s clients. Non-solicitation agreements typically stipulate the time period (normally one or two years) that the solicitation of agency clients on behalf of any person, firm, corporation, or partnership is prohibited.

Non-Competition

The non-competition language in a producer agreement is meant to protect the agency from the direct competition of a former producer, either as an individual or as part of another firm, for an agreed amount of time. The language is usually structured in a way that will not unreasonably prevent the ability of the ex-employee to find other employment. Sometimes there are geography clauses inserted that stipulate that the ex-employee cannot compete in a radius of “X” miles from the agency.

While these agreements are coming under federal scrutiny with the recent Federal Trade Commission (FTC) proposal to ban non-compete agreements, we still strongly recommend agencies include these provisions in their employment agreements. While it is possible the FTC could ban these provisions, it will take some time for them to reach that decision, it will likely be contested in the court system and Congress, and will include many exceptions.

During Normal Operations

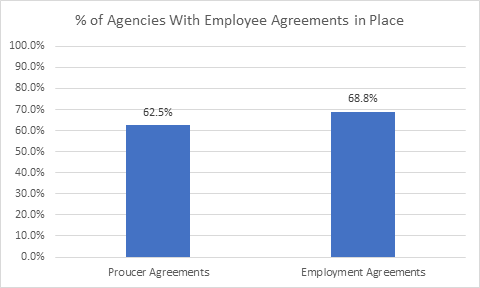

It should be a matter of routine for agency owners to have both producer and employment agreements in place to protect the value of what is likely their largest asset. But, according to the data we have collected on hundreds of mid-sized independent agencies, that is not necessarily the case. We found that only 62.5% of agencies had producer agreements, and only 68.8% had employment agreements in place.

Well over 30% of the agencies we have worked with are taking large risks by not having these agreements in place. With the increasingly competitive landscape for talented insurance agency professionals, are you exposing your agency by not having agreements in place?

We strongly recommend that you adopt employment agreements with all of your employees as a best practice.

Change in Ownership

When you eventually sell your agency, either internally to key staff or family or via an external sale, the buyers will want everyone at the agency to have signed either a producer or employment agreement. The value of the agency is tied to the ownership of the book of business and the recurring revenue stream tied to that. If key employees with key accounts have not signed the agreements, the result will be a substantial suppression of agency value.

Protect Yourself

We encourage every agency to review their policies regarding producer and employee agreements. While it is key to focus on producers, realize that all of your employees have access to both client information and proprietary knowledge of the agency’s operations, so extending it to everyone is imperative.

Please reach out to me at craig@iavaluations.com for more info on this subject or for sample agreements.

About IA Valuations and Agency Link – Founded in 2017, the IA Valuations team has performed over 200 valuations to independent insurance agencies across the U.S. Our advisors have 25+ years of experience guiding agency owners on maximizing their agency value, planning, and legal needs for ownership transition. In addition, IA Valuations has provided perpetuation planning, financial modeling and business planning for independent insurance agencies. Finally, IA Valuations has advised dozens of agency owners on selling their agencies through our Agency Link process. Agency Link is a platform that connects buyers and sellers together to further the growth and strength of the IA system. To learn more about IA Valuations, please visit IAValuations.com or contact@iavaluations.com.

The information provided in these documents is general in nature and shall not be construed as personal legal, tax or financial advice for your situation. Please contact@iavaluations.com to discuss your personal situation.

Copyright ©2023 by IA Valuations and Ohio Insurance Agents Association (OIA). All rights reserved. No portion of this document may be reproduced in any manner without the prior written consent of IA Valuations or OIA. In addition, this document may not be posted as a link on any public or private website without the prior written consent of IA Valuations or OIA.

By: Craig Niess, CVA, MBA