Staffing your agency with an effective, experienced, and professional staff is one of the most important components of maintaining and growing your agency value. It is a key risk factor in completing an agency valuation, and typically the first question a prospective buyer will inquire about when considering an acquisition.

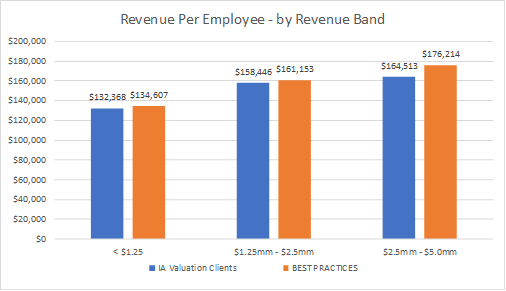

To better understand the impact revenue per employee plays on agency value, we reviewed the data from our IA Valuations clients to see how they stacked up against the Reagan Consulting – Big I 2022 Best Practices Study. Our goal was to establish the correlation between profitable, high performing agencies across the board, whether they were Best Practice agencies or not.

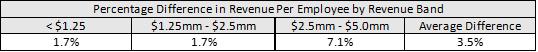

We began by looking at the revenue per employee metrics for every agency that has completed a valuation in the past 5 years. Historically, this was the gauge for measuring how productive and efficient independent insurance agency employees were. At first blush, we saw that our clients stacked up favorably against the Best Practices Study participants. The average gap between each group was only 3.5%.

We wanted to dive deeper to see if this measure was meaningful by itself, or if we needed to consider other factors. For instance, as the market hardens and we see increases in P&C rates, agencies are seeing revenue growth without substantial changes to the servicing staff. The result is an increased revenue per employee, without any fundamental changes to the agency itself.

Furthermore, when comparing your agency to peer agencies, this measure would only have meaning if premiums, commissions, and employee wages were relatively the same throughout the market. We know this is not true, as an agency’s location – rural, urban, or suburban – can impact each of these items.

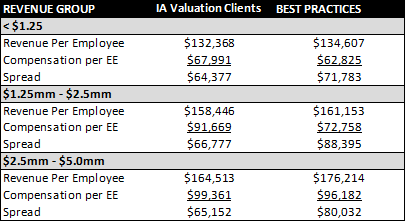

Comparing Revenue Per Employee to Compensation Per Employee = Spread

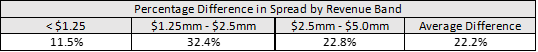

So, how do we get a better understanding of an agency’s productivity and efficiency? We need to compare revenue per employee to compensation per employee to get a better idea. Spread per employee measures the difference between revenue per employee and compensation per employee. It is the best determination of productivity for agency staff, and the best measure when comparing your performance to peer agencies. To illustrate this point, we compared the spread of IA Valuations agencies to the Best Practices Agencies.

To illustrate the point, we compared the spread of IA Valuations agencies with the Best Practices agencies.

Whereas the revenue per employee numbers were closely aligned, we see that the Best Practices agencies are much more efficient based on the spread. On average, they are outperforming our clients by 22.2%.

What conclusions can we draw from this analysis? This type of control of their agency expenses is likely another attribute that makes them a Best Practices agency. Agencies operating outside of Best Practices, are likely operating in a less profitable manner than the BP peers.

Every agency owner must decide how they want to allocate expenses to enhance the value of their agency. In lower spread agencies, it is likely that owners are consciously making the decision to operate with higher payroll expenses and take less in operating profits. In an effective business planning exercise, it is important that owners understand these non-compensation expense dollars are available to an agency to be deployed on profits or overhead, and they are choosing overhead. Operating at a 22.2% less profitable margin could have a meaningful single-digit impact on the value of an agency, which in many instances, could be tens to hundreds of thousands of dollars to the agency’s valuation.

While our database inevitably contains a handful of Best Practices agencies, the bulk of them are not part of that study but are yielding similar results when looking at revenue per employee by agency size. This is an encouraging sign as it signals most agencies are operating in a fairly efficient manner as it relates to payroll expenses. However, the main difference between the groups can be determined only by looking at the spread, which is an important business planning tool and should be utilized by agency owners.

To better understand how your agency’s spread is impacting your agency value, please reach out to Craig Niess at craig@iavaluations.com.

About IA Valuations and Agency Link – Founded in 2017, the IA Valuations team has performed over 220 valuations to independent insurance agencies across the U.S. Our advisors have 25+ years of experience guiding agency owners on maximizing their agency value, planning, and legal needs for ownership transition. In addition, IA Valuations has provided perpetuation planning, financial modeling and business planning for independent insurance agencies. Finally, IA Valuations has advised dozens of agency owners on selling their agencies through our Agency Link process. Agency Link is a platform that connects buyers and sellers together to further the growth and strength of the IA system. To learn more about IA Valuations, please visit IAValuations.com or contact@iavaluations.com.

The information provided in these documents is general in nature and shall not be construed as personal legal, tax or financial advice for your situation. Please contact@iavaluations.com to discuss your personal situation.

Copyright ©2023 by IA Valuations and Ohio Insurance Agents Association (OIA). All rights reserved. No portion of this document may be reproduced in any manner without the prior written consent of IA Valuations or OIA. In addition, this document may not be posted as a link on any public or private website without the prior written consent of IA Valuations or OIA.

By: Craig Niess, MBA, CVA