The Private Equity (PE) infusion into the system is a fairly recent phenomenon that has created a fundamental realignment of the IA business model. It has also created an unprecedented amount of myths and misperceptions about agency values and selling options

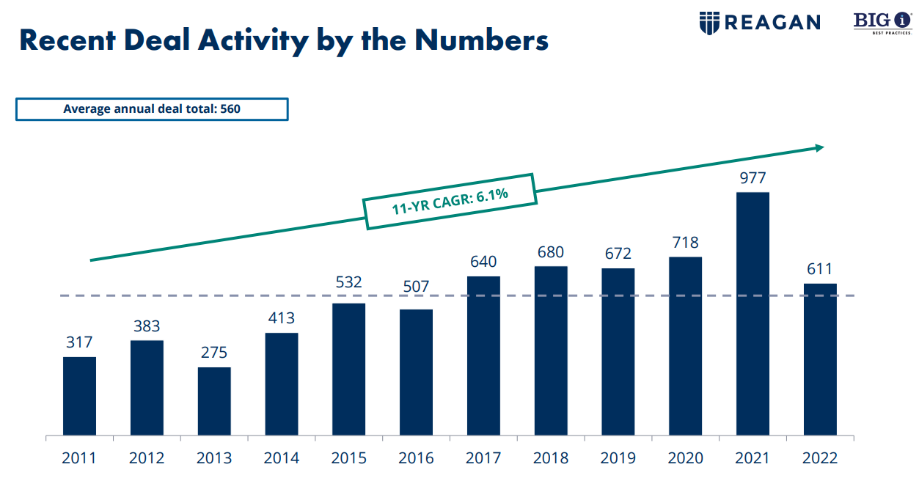

With estimates of $25 to $35 Billion invested in the IA system in the past 10 years, PE investors have discovered the sound fundamentals of IA businesses and have created more options than ever before for agents looking to sell their agency, retire or change their day-to-day business activities. While we experienced a pullback in mergers and acquisitions (M&A) in 2022, the IA system is continuing to experience record levels of M&A activity and we expect 2023 and beyond to continue this trend.

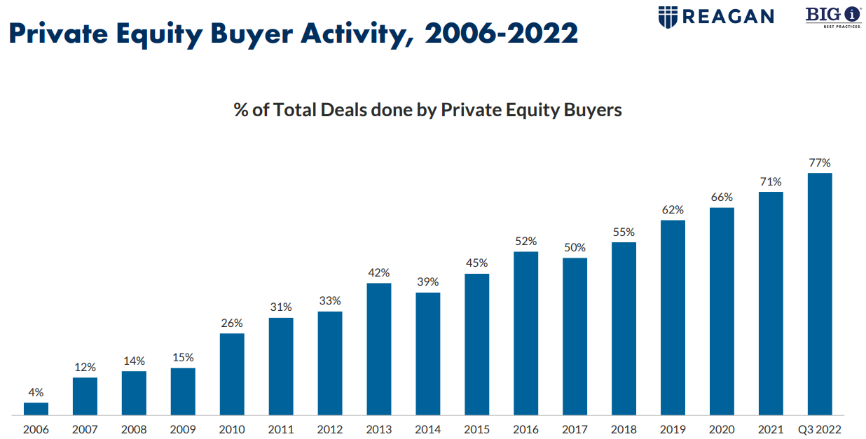

Recent estimates according to SNL, reported that PE buyers are responsible for 77% of all of the publicly reported acquisitions in the IA system. As evidenced in this graph from SNL and Reagan/Big I Best Practices Symposium, the role PE buyers have played in the M&A space has become increasingly prevalent over the past decade plus.

The result of the increased M&A activity and PE buyers has helped drive agency values higher and created a significantly broader marketplace for buying and selling independent insurance agencies. While the rising tide has lifted all IA “boats”, how high each agency has been lifted varies greatly based on the profile and performance of each agency.

In this article, we want to try to level set some of the misperceptions about PE buyers and provide insights to privately held retail agencies about how you can increase your agency value and create a broader marketplace for selling your agency if that is the path you choose.

Let’s start with this common conversation between agency owners and the myths and misperceptions contained in it:

Agency Owner 1: “My agent buddy told me they just sold their agency to ABC PE broker and got 3x agency revenue, guaranteed cash paid in a lump sum. He is now planning to retire in 6 months and move south.”

Agency Owner 2: “That sounds amazing. I am going to approach ABC PE broker to buy my agency too. What did he do to sell the agency?”

Agency Owner 1: “Nothing, he just responded to a call from ABC PE broker. They made a cash offer, conducted the due diligence and 30 days later purchased the agency. In fact, he got multiple calls from various brokers interested in buying his agency.”

Agency Owner 2: “I’ve got to get in on this. If that agency sold for 3x, I think can sell for 4x revenue, my agency is worth way more than theirs.”

Myth #1 – Multiple PE buyers will make generous offers to buy your agency.

Fact – Agency owners have more options to sell their agencies than ever before. This includes all buyer options: PE buyers, publicly traded brokers, banks and privately held retail agencies.

Myth Buster – You may get multiple, lucrative offers for your agency if it generates over $1M in revenue, has 3 consecutive years of double digit organic growth, operates at a 35% EBITDA profitability margin, is 70% commercial lines, is located close to a growing major metropolitan area and has validated young producers. These agencies exist however they are not the norm.

The average agency has 7 employees, generates $600K in revenue, has flat to single digit growth, has a 15% to 25% EBITDA profitability margin and is 50% CL/50% PL split. Therefore, the average agency is not likely to draw much interest from PE buyers.

Depending on the PE buyer platform, the average agency may be considered as a tuck-in acquisition opportunity but the offer is going to vary greatly based on the factors mentioned above. If you want to maximize your value and attractiveness to PE buyers, do the following: grow by double digits, manage your profitability margin to 35% and focus on commercial lines. Doing all of those simultaneously is very, very difficult.

Myth #2 – PE buyers will pay a lump sum 3x annual revenue for my agency.

Fact – If you require it, every buyer in the marketplace will pay you something up front for your agency. The multiple that any buyer will pay will vary greatly depending on the past and future performance of the agency.

Myth Buster – Unless you are planning to severely discount the price of the agency, it is unlikely any buyer will offer you the highest value in a lump sum cash payment. Almost all PE buyers are going to structure their offers in this manner – a meaningful lump sum guaranteed payment up front, a 3-year earnout, equity in the PE broker, a salary/commission for your continued services and benefits as an employee.

The likelihood that you will get 3x annual revenue guaranteed up front is slim. Again, if you are a top tier Best Practices agency this is possible, however it is highly unlikely for the overwhelming majority of agencies. If PE buyers are interested in your agency, they will likely structure a deal with you in the manner described above.

Myth #3 – PE buyers will buy my agency in 30 days and allow me to retire within 6 months.

Fact – a PE buyer is highly unlikely to be involved in this scenario. They expect the owners to stay on board and help grow the agency. Many require the owner to take an equity position in the company as part of the overall financial package to ensure they stay committed to growth.

Myth Buster – PE buyers are investing in growing assets. Gone are the days where PE buyers purchased declining agency assets, gutted the expenses, sent the accounts to service centers and hoped to hold onto as much revenue as possible.

PE buyers are sophisticated in their due diligence process however I am unaware of any operation that completes it in 30 days. Most are going to take between 90 to 180 days from the first conversation to an NDA, offer, LOI and purchase agreement to complete the transaction. During the due diligence process you will have to gather all financial reports, carrier production and performance related reports for the buyer to analyze.

For the most part, these are highly sophisticated operations being built for future growth. If they are not already, these operations are going to be your most fierce competition for large and middle market commercial and high net worth personal lines accounts.

They actively recruit producers, they have training programs, focus on specialization and manage accountability around organic growth. PE buyers operating in this environment are unlikely to pay top dollar for your agency and have you retire in short order.

Myth #4 – Nothing will change after you sell your agency.

Fact – Everything will change when you sell your agency.

Myth Buster – Aside from the fact that you will no longer be the owner of your agency, will be accountable to someone else and will be giving up your autonomy, many things will change. It is possible the name of the agency may be retained, you will still manage the local operation and from the outside looking in will still maintain the perception of owner/leader of the operation.

However, the culture of the agency will change. Technology systems, carrier relationships, staff accountability and expectations will all change. Marketing budgets, support of your local community and brand will all change. Growth goals, activity tracking and expense management will all change.

These factors are arguably more important than any of the financial factors that we have discussed above. Specifically, cultural fit and finding the right values are of critical importance in this process. You want to be happy after the sale and feel confident that your clients, community, employees, carrier partners and legacy will all be taken care of after the deal closes.

For Sellers

- Test the market, engage an M&A advisor to approach PE buyers on your behalf.

- Compile all of your financial, carrier production and performance related information in advance.

- Execute NDAs with every potential buyer.

- Be sure to analyze the entire package. You only get one chance to sell the agency.

For Buyers

- Encourage the seller to get an independent valuation so they can better understand their agency’s true market value.

- Help them understand the due diligence process, whether it is with you or another potential buyer.

- Provide realistic timing and expectations.

If you are thinking about selling your agency, we encourage you to connect with Jeff Smith, JD, CIC at jeff@iavaluations.com to discuss your situation and how we may be able to be of assistance.

About IA Valuations and Agency Link – Founded in 2017, the IA Valuations team has performed over 200 valuations to independent insurance agencies across the U.S. Our advisors have 25+ years of experience guiding agency owners on maximizing their agency value, planning, and legal needs for ownership transition. In addition, IA Valuations has provided perpetuation planning, financial modeling and business planning for independent insurance agencies. Finally, IA Valuations has advised dozens of agency owners on selling their agencies through our Agency Link process. Agency Link is a platform that connects buyers and sellers together to further the growth and strength of the IA system. To learn more about IA Valuations, please visit IAValuations.com or contact@iavaluations.com.

The information provided in these documents is general in nature and shall not be construed as personal legal, tax or financial advice for your situation. Please contact@iavaluations.com to discuss your personal situation.

Copyright ©2023 by IA Valuations and Ohio Insurance Agents Association (OIA). All rights reserved. No portion of this document may be reproduced in any manner without the prior written consent of IA Valuations or OIA. In addition, this document may not be posted as a link on any public or private website without the prior written consent of IA Valuations or OIA.

By: Jeff Smith, JD, CIC, CAE