It is contingency season and like any bonus, it can either bring excitement or disappointment. Given the current hard market conditions, contingency season has brought more disappointment than excitement.

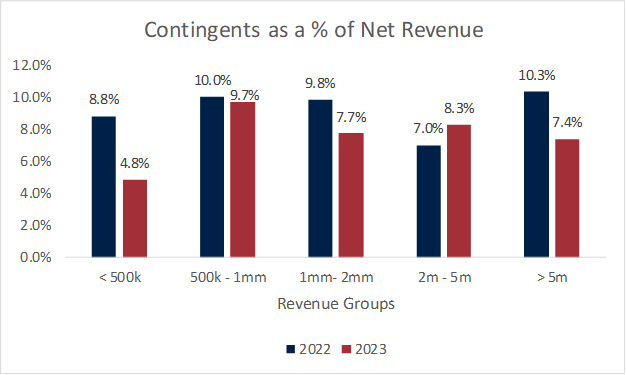

In this article, we will break down contingency performance for small- to mid-size agencies as it relates to a percentage of annual revenue. Spoiler alert: with the exception of one revenue category, every other agency contingency performance was down in 2023.

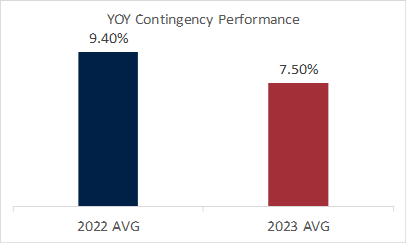

In 2022, all agency revenue categories were averaging 9.4% contingency bonuses as a percentage of annual operating revenue. Across all revenue categories, the lowest percentage of contingency payments to revenue was 7% in 2022. This performance was at the top end of the standard revenue categories for agency performance of 6 – 10% of annual operating revenue from contingency payments.

In 2023, IA Valuations saw agencies receive less in contingencies than in 2022, with the exception of the $2mm-$5mm revenue group. For all revenue categories, the average was 7.5% in 2023, representing a 2% drop in contingency performance. While 2% does not sound like a lot, to provide great context, for a $1M agency, the 2% reduction is a $20k reduction in revenue. Across the agency platform, 2% represents millions of dollars not being paid to agencies because of the hard market conditions.

This trend is not shocking, since in 2022 the property and casualty insurance industry experienced a net underwriting loss of $24.9 billion according to AM Best and 2022’s results are the basis for 2023’s contingency bonuses.

For context on this poor year for insurance, automobile insurance reported its worst losses in over two decades. Catastrophic events created $165 billion in costs, which is the third highest annual price tag for catastrophic events, behind 2005 and 2017. So, carriers were left with much less profit in 2022, and agencies felt the impact with their 2023 contingency checks.

As agencies receive their contingency checks in Q1 2024, IA Valuations is cautiously optimistic that agencies will see larger paydays than they saw in 2023, but expectations should be tempered by the fact that 2023 was another poor-performing year for the industry. In 2023, the net underwriting loss for the property and casualty insurance industry was $21.2 billion with a record number of CAT property loss events.

These loss results are only marginal improvement over 2022, likely not enough improvement to drastically change contingency results. Carriers are still making the adjustments they need to fix their loss and combined ratios from the previous two years. Carriers have taken rate where necessary, become more restrictive in their underwriting, removed unprofitable accounts and lines of business, and withdrawn from poorly performing geographic areas. The benefits of these changes take time and agency owners will need to be patient with their carriers.

No matter what your agency’s results this cycle were, we encourage you to review your key carrier contingency plans in your contracts and closely monitor your loss ratios in your monthly production reports. Carriers’ contingency plans are strategic, as should be the agency’s use of them!

Some carriers’ contracts are designed to benefit all sized agencies, including small- to mid-size, while some are geared towards larger brokers. Try and gauge which carriers’ plans are optimized for the size of your agency. By doing so, not only will your bottom-line increase, but your carrier relationship will flourish as you place profitable business with your key partners, and your agency shares in that benefit.

While contingency performance has been down for the past two years, we expect this trend to pass. Positioning your agency to optimize contingency performance when the hard market thaws will improve your profit margins and value. If your agency has questions about your contingency performance and you’re interested in discussing how it affects your agency value, please contact Jarod Steed at jarod@iavaluations.com.

By: Jarod Steed, Business Planning and Valuations Analyst

About IA Valuations and Agency Link – Founded in 2017, the IA Valuations team has performed over 250 valuations to independent insurance agencies across the U.S. Our advisors have 25+ years of experience guiding agency owners on maximizing their agency value, planning, and legal needs for ownership transition. In addition, IA Valuations has provided perpetuation planning, financial modeling and business planning for independent insurance agencies. Finally, IA Valuations has advised dozens of agency owners on selling their agencies through our Agency Link process. Agency Link is a platform that connects buyers and sellers together to further the growth and strength of the IA system. To learn more about IA Valuations, please visit IAValuations.com or contact@iavaluations.com.

The information provided in these documents is general in nature and shall not be construed as personal legal, tax or financial advice for your situation. Please contact@iavaluations.com to discuss your personal situation.

Copyright ©2024 by IA Valuations and Ohio Insurance Agents Association (OIA). All rights reserved. No portion of this document may be reproduced in any manner without the prior written consent of IA Valuations or OIA. In addition, this document may not be posted as a link on any public or private website without the prior written consent of IA Valuations or OIA