You just got one of your least favorite notices: one of your key carrier partners has given you the dreaded 180-day written notice to terminate your agency agreement. Whatever the reason given, it likely does not matter because it is damaging to your business on so many levels.

It will impact your relationship with your clients, retention rate, growth, stress on your staff, carrier lineup, profitability, and agency value.

For the purposes of this article, we are going to explore how it will impact value and what to do about it to preserve your agency’s value.

How a Key Carrier Contract Cancellation Impacts Agency Value

First and foremost, it comes with an emotional blow. One of your key carrier partners has made the decision to terminate your relationship. It hurts. You built your business with them, you gave them good, profitable business for years, but after a few years of low growth and/or high loss ratios, the longstanding relationship is now over and you both must move on.

The emotional turmoil is arguably the hardest to overcome. While this stings especially in a relationship business, remember, the company made a business decision that they feel is in its best business interest, and now you must do the same. You have clients, staff, a reputation, and a legacy that you need to protect. It’s time to act. Clear your head, develop a plan to move on, and do it quickly, as you’ve got a lot of business to move.

Second, this cancelation questions the practical impact of your credibility with your clients. You’ve been insuring your clients with this carrier for years, and now they are going to get a cancellation notice from the carrier if you don’t move them first. You must get out in front of the carrier communication.

Once you receive notice from the carrier notifying you of the pending termination, run a list of your clients with the carrier, prepare a professional communication, and reassure them that the relationship is with you, not the carrier, and that you have other options.

Third, it brings additional stress to have to move the book of business you have with that carrier, particularly in a hard market. The stress level on your staff will vary depending on the size and complexity of the book, your other carrier options and whether they are open for a book roll, and your staff’s experience with moving a book in a condensed timeframe.

In every valuation analysis conducted by IA Valuations, we evaluate your carrier concentration and strength of relationships with your carrier partners. We base this on the longevity of the relationship, loss ratio, growth, profit-sharing, and percentage of business with each carrier.

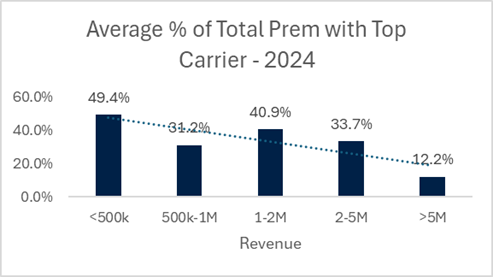

In our analysis, we have found that small to mid-sized agencies are often top heavy with their lead carriers. In fact, our data shows that small agencies typically place almost 50% of their business with their lead carrier. With the exception of agencies over $5M in revenue, every other agency category on average exceeds the recommended percentage of business with their lead carrier.

We recommend an agency limit their carriers to no more than 25% market share. If you have 30% – 80% of your business with one carrier and that relationship ends, it will have a profoundly greater impact than if you have 15% – 25% of your business with the same carrier.

This is why we recommend every agency have a diverse mix of carrier relationships to meet the needs of their agency and clients. We focus much of our valuation analysis on the top 5 carrier relationships in an agency because, in most small to mid-size agencies, the top 5 carriers average as high as 89% and 71% of written premium in the agency. This represents an ideal balance, spread out enough to reduce risk but not so spread out that the agency misses out on the benefit of the carrier enticements like profit-sharing, overrides, personal underwriting, trips, and advisory councils. This type of spread in an agency keeps you relevant with all 5 carriers and gives you options in the event one relationship changes.

As to the profile of those carriers should be will depend on your business plan and goals, location, and many other factors. Generally speaking, IA Valuations would recommend you have an anchor carrier partner relationship with a super-regional carrier like Cincinnati, Auto Owners, Erie, Hanover, Selective, or other carrier of this size. You should add two to three regional and small mutual carriers into your lineup like Westfield, Grange, Encova, Ohio Mutual, Donegal, Utica, and Central to name a few. Finally, your agency should have at least one national carrier relationship like Nationwide, Liberty Mutual/Safeco, Travelers, Progressive, or other national option. It may also be beneficial for your agency to have a relationship with some of the new tech-driven specialty carriers like weSure, Branch, and some of the other recent startup insurers.

One of the pillars of the IA system is having multiple carrier options. If an agency chooses to place a majority of its business with one carrier, that creates a higher risk and is much more akin to the captive business model than the independent. A higher concentration of business with one carrier has benefits of being in the President’s Club, qualifying for company trips, higher profit-sharing checks, and more attention from the carrier reps and leadership. The tradeoff is greater risk to the agency’s stability and value if the relationship changes, the carrier’s underwriting appetite changes, or the carrier has a string of bad years.

How to Protect Your Agency Value with Your Carrier Relationships

First, understand the provisions and protections in your agency agreement and state law. In your state, it is likely the law establishes the procedures a carrier must follow in order to cancel an agency agreement. If your agency agreement is at risk, you should contact your state insurance agents association to get an interpretation of the law. In addition, you should become familiar with the provisions in the agency agreement that cover termination.

Document all the steps the carrier is taking to make sure they are incompliance with the agency agreement and law. Carriers do not take those actions lightly, so it is likely they are working with their legal counsel to ensure they are following the letter of the law. In the event they have not followed the required steps, you should appeal the termination decision to the carrier leadership and ask for a reconsideration of the decision or a delay in the action.

Second, do an analysis of your book of business with that carrier. Get an understanding of the number, type, loss history, and complexion of your accounts. Run reports in your agency management system and the carrier portal to get all the information you can on your book with the carrier terminating your appointment. Know the book of business inside and out – what are the good accounts that you must save, which are the middle accounts that you want but do not absolutely need, and which are the accounts that you have been looking for a reason to part ways with? Prioritize the accounts in order of importance to your agency.

Third, develop a plan to retain the business. Prepare your staff with training, create a communication plan with your clients, and develop an appetite guide to market the accounts with your existing carriers and prospective carriers. Approach your current carriers with the opportunity to move that book of business and find out who is willing to work with you to take it on. Prospect new carrier(s) that may be a good fit for the book of business and agency long-term. Do your research on prospective partners so you don’t find yourself in a similar situation in the future.

Finally, move the business with purpose and precision. Retaining business is far easier than getting new business, so prioritize this effort with your team. Create goals and incentives with the team to get the book moved within the timeframe allotted by the agency agreement or state law, typically 180 days after notification of termination. Know you are going to bleed some business when word leaks out in the community that you have lost a key appointment, but do all you can to save those accounts and your business.

Conclusion

Agency-carrier relationships are prone to change. An agency must be prepared to deal with sudden, unexpected changes to key carrier relationships. Diversifying your agency relationships will ensure that your agency can survive unexpected carrier relationship changes – be it a termination, change in underwriting appetite, acquisition by another carrier, or a carrier pulling out of a geographic location or type of business.

If you find yourself in this situation, we encourage you to reach out to IA Valuations CEO, Jeff Smith, at jeff@iavaluations.com to help you prepare for this process.

By: Jeff Smith, JD, CIC, CAE

About IA Valuations and Agency Link – Founded in 2017, the IA Valuations team has performed over 300 valuations to independent insurance agencies across the U.S. Our advisors have 25+ years of experience guiding agency owners on maximizing their agency value, planning, and legal needs for ownership transition. In addition, IA Valuations has provided perpetuation planning, financial modeling and business planning for independent insurance agencies. Finally, IA Valuations has advised dozens of agency owners on selling their agencies through our Agency Link process. Agency Link is a platform that connects buyers and sellers together to further the growth and strength of the IA system. To learn more about IA Valuations, please visit iavaluations.com or contact@iavaluations.com.

The information provided in these documents is general in nature and shall not be construed as personal legal, tax or financial advice for your situation. Please contact@iavaluations.com to discuss your personal situation.

Copyright ©2024 by IA Valuations and Ohio Insurance Agents Association (OIA). All rights reserved. No portion of this document may be reproduced in any manner without the prior written consent of IA Valuations or OIA. In addition, this document may not be posted as a link on any public or private website without the prior written consent of IA Valuations or OIA.