After much consideration, you’ve made the decision to purchase your father’s insurance agency. He’s been dreaming of this moment since you were a child; this day has felt inevitable for you since childhood. He always brought you into the office on the weekends, having you file papers, shovel snow, vacuum the floors, and had you begin to learn the insurance business as his apprentice.

You worked there occasionally through high school; you know the staff like they are family and are familiar with the names of the carriers from their placards on the wall. You left for college and studied Business, Finance, Communications, or some related major so you would have options in the event the insurance business wasn’t the right fit for you.

Throughout your college career, Dad kept bringing you back into the office, talking to you about the family insurance business over dinner, and preparing you to join in the agency. However, he had one rule: before you join the agency, you must work for an insurance carrier so you can learn the business’s insurance side from them. He helped you get multiple interviews with the agency’s lead carriers, and you’re able to land an entry-level underwriting job. Your insurance career is officially underway.

Fast forward 3 to 4 years and you’ve done various rotations at the insurance carrier and are ready to move back home, start a family, and join the family agency. You work out an agreement with your dad to join him as a CSR with the expectation that you will grow into a producer and then eventually the agency owner.

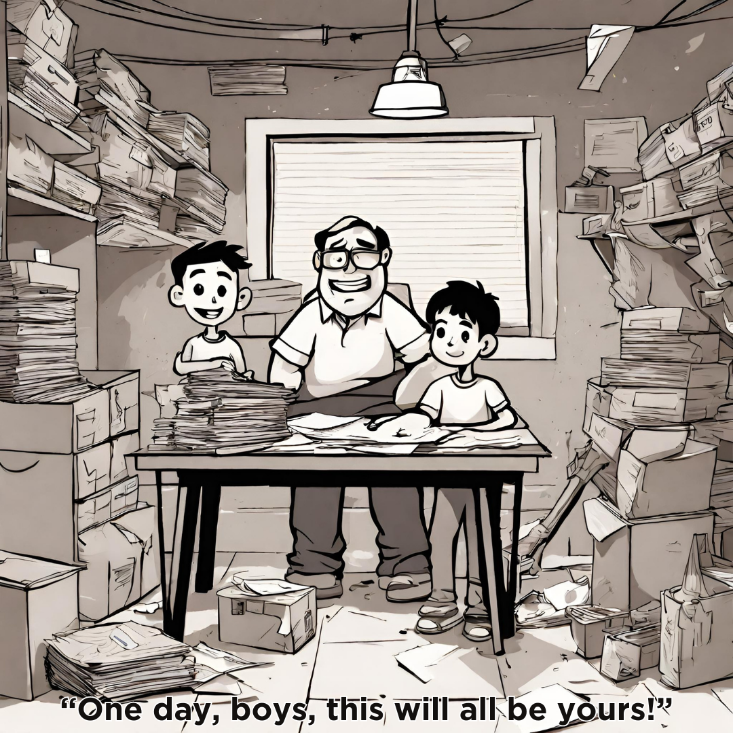

This all sounds great, a well-scripted plan to take over the legacy family business that has been good to you and your family for decades. It all sounds too good to be true, until you look under the cover, get access to the finances, and picture yourself working in this setting for the next 35-40 years. You are sitting in an office that has wallpaper from the 1980s, mismatched furniture, the old-school high-back dark leather chair in your father’s office, and filing cabinets with paper everywhere.

All of a sudden reality settles in and you are questioning your life decisions to this point. Okay, now is a good time to pause, take some deep breaths, and begin envisioning what the future of the insurance agency could be, not what it currently is. Follow these 6 steps as you prepare to become the agency owner and you will be infinitely better prepared than if you just wing it.

Be Grateful

You have just been given an amazing opportunity based on what your father has built. It’s important to recognize that it is his life’s work and has great value. It provided a means for you and your family to live a comfortable life, go to college, and set him and your mom up for a nice retirement. While there are likely many things you would like to change about the agency, be grateful for the opportunity you have been given. To own a business with established recurring revenue, carrier appointments, and a (hopefully) good reputation in the community is a huge privilege and advantage. Many young agents would switch positions with you in a heartbeat.

Be Respectful

This is somewhat redundant to the first point but is distinct enough that it needs its own section. As you identify all the ways in which you are going to change the agency when you get the keys to the door, be sure to be respectful of the foundation he built and the decades of hard work that your father has put in to establish the agency and put you in this position. Engage your father in discussions on the business and be sure to socialize any big changes you are contemplating well in advance for a more seamless transition.

No Major Changes for 12 Months

Take stock of what you have as the new owner but do not make any major changes for 12 months. As the Executive Director of OIA and the CEO of IA Valuations, I count this among the best advice I received when I started my current role. OIA’s previous Executive Director served for 32 years in the role. He did a phenomenal job serving the members and building the organization. However, after 2.5 years working on staff at OIA, I was ready to implement massive changes the first month I took over. Then I got some sage advice from an insurance association veteran, Dave Evans, who wisely encouraged me to take a breath, learn the role, identify the challenges and opportunities, make a plan, and then implement changes.

The fundamental business principles of how your father built the business will apply to you. You will have to learn the technical aspects of insurance coverage, advise your clients on their risks, find the proper insurance protection for them, and network, market, and sell insurance to a broader prospect of customers. No matter how much technology we implement in our agencies, the aforementioned principles will not change.

Knowing this, we recommend you establish a process early in your ownership and leadership on how you are going to implement change. Change management is often overlooked but it is vital to preserving your culture, business, and stress level when contemplating significant changes. Having a process will help you slow down, think through the changes, avoid costly mistakes, and when they do happen, ensure that you learn from them.

Develop a Business Plan

It is highly likely that your father was operating the business year after year without much of a plan. If he had one at all, it was likely to grow more than the agency did the year before. This will not drive success in the future. You must take time to develop a business plan for the agency. IA Valuations has templates to get you started. We also recommend you take a day or two strategy session where you develop your plan and start moving it forward.

Leverage Your Father as a Mentor

Find a role for your father as a mentor in the agency. Identify his strongest qualities and leverage those in the transition from owner to advisor/mentor. If it is networking, focus on that. Carrier relations, technical insurance coverages, market changes, managing employees, recruiting, whatever it is, leverage that passion and experience in a mentoring relationship. Have a structure to the mentorship, meaning schedule consistent times when the two of you meet to discuss various items on the business. Keep an agenda and notes and make it an evolving discussion.

Retirement is a scary event for many independent agency owners. Owning this business was a huge part of their identity, it is likely all they have ever known. If one of your goals in this transition is to strengthen the relationship between you and your father, then being an active participant in transitioning your father from owner/boss to mentor is critically important. Have open conversations from the outset about what you are looking for; make sure you both understand the roles in the mentorship and abide by those as you get into it.

Sometimes mentorship and engagement will be work for the new owner. You’ve already made up your mind and may believe your father’s advice is no longer relevant. While that may be true, there will always be something your father can share with you as a mentor that will improve the business. It may not be your new marketing strategy, software solution, or recruiting a new producer, but be sure to find parts of the business where your father can still weigh in, provide value, and enhance your relationship together.

Enjoy the Precious Moments of Working with Your Father

I have visited with so many agency owners that perpetuated internally and heard the following sentiments – “I treasured working with my father. It was the best time of my professional life.” Write down your goals for this transition in advance of how you want the next years of working with your father to be and keep that in mind as you enter this transition. It will be bumpy as you both get accustomed to new roles but just work towards making these years some of the most special moments of your professional life. You do not know when it will end, so be sure to treasure each moment.

We wish you the best of luck and are confident you can build on the success of your father. If you find yourself in this situation, we encourage you to reach out to IA Valuations CEO, Jeff Smith, JD, CIC, CAE at jeff@iavaluations.com to help you prepare for this transition.

By: Jeff Smith, JD, CIC, CAE

About IA Valuations and Agency Link – Founded in 2017, the IA Valuations team has performed over 250 valuations to independent insurance agencies across the U.S. Our advisors have 25+ years of experience guiding agency owners on maximizing their agency value, planning, and legal needs for ownership transition. In addition, IA Valuations has provided perpetuation planning, financial modeling and business planning for independent insurance agencies. Finally, IA Valuations has advised dozens of agency owners on selling their agencies through our Agency Link process. Agency Link is a platform that connects buyers and sellers together to further the growth and strength of the IA system. To learn more about IA Valuations, please visit IAValuations.com or contact@iavaluations.com.

The information provided in these documents is general in nature and shall not be construed as personal legal, tax or financial advice for your situation. Please contact@iavaluations.com to discuss your personal situation.

Copyright ©2024 by IA Valuations and Ohio Insurance Agents Association (OIA). All rights reserved. No portion of this document may be reproduced in any manner without the prior written consent of IA Valuations or OIA. In addition, this document may not be posted as a link on any public or private website without the prior written consent of IA Valuations or OIA.