Many agency owners are unsure of their exit plan, and many fail to take the time to consider their options as they are busy running their day-to-day agency operations. But, a time will come when they must decide whether they will sell externally to a third-party buyer or sell internally to family or key stakeholders.

Whether you choose to sell internally or externally, having a working plan in place will ensure that you have all options available to you when it is time to decide. The plan should address the following areas: hiring next generation talent, developing that talent, creating ownership opportunities, implementing a sales culture, finding a niche, and managing the book of business.

Hiring Next Generation Talent

If you are like most agencies, you are always searching for rising stars and often come up short in your quest. This is certainly a theme that is endemic to the independent agency space, and one of the biggest factors affecting an agency’s ability to perpetuate internally or sell for the highest multiple.

Those that were either born into or stumbled their way into the independent agency channel know that it is a best kept secret with potential for a high quality of life and high earning potential. Communicating these benefits effectively will help you recruit others who might not have considered insurance previously. Additionally, many agencies find success recruiting stars from other industries and teaching them insurance, instead of looking for latent talent in other agencies.

Developing Your Talent

Agencies can do many things to develop their talent. Pairing new talent with successful agents in a job shadowing or mentoring program will help teach them what makes a successful employee. For outgoing agency principals or producers, fostering the hand-off key accounts in a timely manner will ensure that the agency is positioned for success without a hit to retention.

Creating Ownership Opportunities

During the recruitment process and early in the careers of your next generation employees, you should demonstrate the financial rewards that will be available to them if they meet certain performance expectations. Set and communicate the criteria that would need to be met to be invited to own agency stock. Create models that show how agency stock could be transferred and the W-2 impact it would make. Lastly, draw a current and future organizational chart that shows what the agency could look like if the employees continue to perform at a high level.

Implementing a Sales Culture

Ultimately, agencies are sales organizations. Creating a culture focused on organic growth by establishing and enforcing various metrics will be key. These metrics may include requirements for minimum book size, new business written minimums, and trading down smaller accounts to the house or small business units.

Finding Your Niche OR Expanding to New Ones!

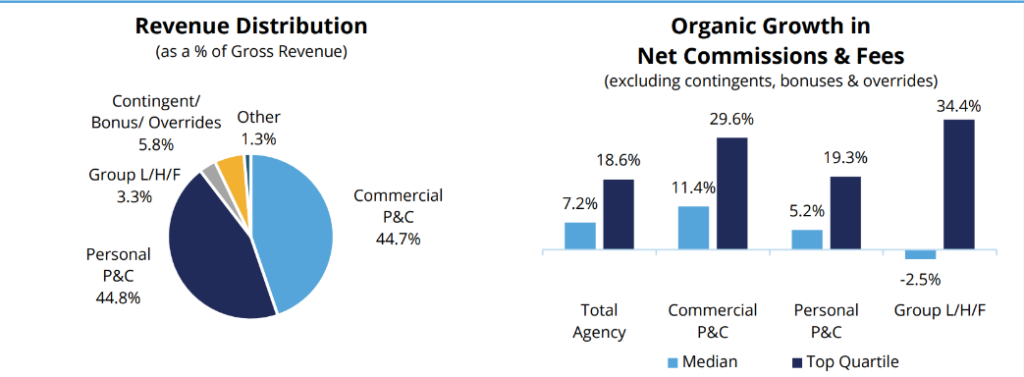

Depending on your geographic location, demographics, and many other factors, it is necessary for your agency to find the niche that will promote the most success. Maintaining a strong balance of personal and commercial P&C lines and avoiding oversaturating one specific area is key. For example, Agency A has an 80% personal lines to 20% commercial lines split whereas Agency B has a 50% personal lines 50% commercial lines split. Agency A carries much more risk than Agency B. The commoditization of personal lines is increasing the risk in the industry. Customers can now shop their coverage and change their minds at the drop of a hat to save money. Commercial lines on the other hand, have much more stability and businesses are more likely to stick with their coverage rather than shop around every chance they get. Balancing your agency’s P&C lines can significantly reduce risk and bring consistent revenue and contingencies into your agency.

Another option for your agency would be to expand your agency into a new niche market. According to the Reagan Best Practices study in 2022, Group Life & Health make up only 3.3% of gross revenue for agencies bringing in less than $1.25 million in revenue. Group L&H continues to be an untapped area of revenue for agencies. There is a tremendous opportunity for agencies to invest resources in this area of the market.

As you can see, the median agency in the study is seeing organic growth levels at -2.5%, whereas the top performing agencies are seeing organic growth at 34.4%. By investing in a niche with high growth potential, your agency could see increased organic growth that will take your agency to new heights.

Managing Your Book of Business

A vital aspect of agency growth that often gets overlooked is successfully managing your book of business. There are a few red flags to look out for when you review and analyze your book of business. One of the first things you should do is look at your agency’s top ten accounts, as this is a major indicator of the health of your agency. The top ten accounts will provide insight into whether your book is in a place to continue to grow and expand, or if there are risks that could bring about potential speed bumps down the road.

For example, how much revenue do your top ten accounts bring in as a percentage of your total gross commissions? A single account should not be generating over 5% of your agency’s total commissions. If, for example, the Smith Agency has an account with a local business that accounts for 17% of total commissions and they decide to look for other potential options, this would be a major blow to the Smith Agency. Keeping your top accounts well-balanced is essential. By ensuring that if one of these accounts leaves, and you have other similar accounts to fill the void, it shouldn’t cause a major impact on the agency.

Secondly, it is just as important to continue to bring in new top accounts with a variety of producers. Having your top revenue-generating accounts in the agency for 25+ years with the same producer creates excess risk to the agency. If unforeseen circumstances were to occur, your agency might not be prepared. It is vital to transition long-standing accounts to younger members of the agency to ensure the continued success and retainment of top clients.

By creating a plan that addresses these six key areas, agencies will put themselves in the best possible position when considering their future options. By planting the seeds of growth now, your agency will harvest the rewards in the years to come.

About IA Valuations and Agency Link – Founded in 2017, the IA Valuations team has performed over 200 valuations to independent insurance agencies across the U.S. Our advisors have 25+ years of experience guiding agency owners on maximizing their agency value, planning, and legal needs for ownership transition. In addition, IA Valuations has provided perpetuation planning, financial modeling and business planning for independent insurance agencies. Finally, IA Valuations has advised dozens of agency owners on selling their agencies through our Agency Link process. Agency Link is a platform that connects buyers and sellers together to further the growth and strength of the IA system. To learn more about IA Valuations, please visit IAValuations.com or contact@iavaluations.com.

The information provided in these documents is general in nature and shall not be construed as personal legal, tax or financial advice for your situation. Please contact@iavaluations.com to discuss your personal situation.

Copyright ©2023 by IA Valuations and Ohio Insurance Agents Association (OIA). All rights reserved. No portion of this document may be reproduced in any manner without the prior written consent of IA Valuations or OIA. In addition, this document may not be posted as a link on any public or private website without the prior written consent of IA Valuations or OIA.

By: Luke Hippler, MBA

I could use some help determining the best way for me to exit the role as agency owner and agent.