For many insurance agencies, the hard market yields a double-edged sword as it relates to agency values. Some of the impacts of the hard market can have a positive impact on agency value, while others will work to depress values. Understanding these impacts will be key to helping you navigate these uncertain times.

The Insurance Risk Management Institute (IRMI) defines a hard market as “an upswing in a market cycle when premiums increase and capacity (the supply of insurance available to meet demand) for most types of insurance decreases.” The net effect is that insurance is more expensive and harder to obtain.

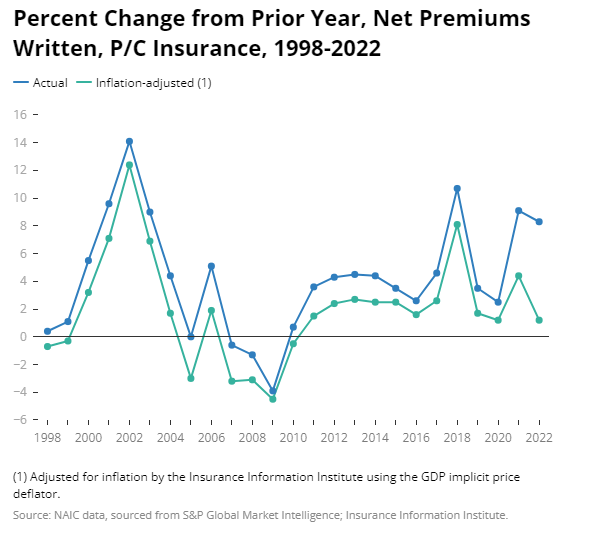

IRMI notes that during the last three hard markets, inflation-adjusted net premiums grew 7.7% annually (1975-1978), 10.0% (1984-1987), and 6.3% (2001-2004).

Key Drivers of Hard Markets

Carriers can experience pain and profit loss due to economic, political, and climate factors – or a combination of these factors. When they move to counteract the impacts of these factors and bolster their profitability, a hard market ensues. Some factors include:

- Stock market decline driving down investment returns

- A regulatory environment that is not friendly to carriers

- Increasing frequency and severity of losses

These factors will often change the carrier’s appetite for writing business in certain sectors, the fee structures they will have with agencies, and a re-focus on underwriting.

Characteristics of Hard Markets

When the market hardens, we are likely to see:

- Higher premiums

- A re-focus on underwriting with strict criteria, making it more difficult

- Reduced capacity and markets for insureds

- Less competition among carriers, ensuring higher premiums throughout the market

Positive Factors of the Hard Market on Agency Values

The first positive factor is that most agencies will likely see premium increases due to the rate being taken by their carriers. An increase in premiums goes hand-in-hand with an increase in commissions and annual revenue. This will result in overall premium growth that is not being driven by new business production.

The second positive factor is that the hard market makes it more difficult for clients to shop their coverage with competitors, as the pain is being distributed fairly evenly. Therefore, retention rates should be higher than normal for an agency.

Negative Factors of the Hard Market on Agency Values

While there are two positive factors, there are four negative factors of a hard market on agency values.

First, the increase in claims, the cost of claims, and loss ratios will have a negative effect on the profitability of the business. This will make it difficult for agencies as the typical level of profit-sharing they’ve received in the past few years will diminish substantially, and many agencies will be looking at no profit-sharing at all. This could result in a loss of agency revenue of 6%-10%, likely decreasing overall value of the agency, especially if this trend continues for 2 or more years.

Second, due to the financial strain and increased loss ratios that carriers are experiencing, they are taking action with their agency partners in order to lessen the burden of their financial stress. By introducing new underwriting restrictions and tightening what new business is written, carriers are also now decreasing the commission structure with their new agency partners. This will have a long-term impact on agencies as they experience a permanent loss of revenue. When the market stabilizes, agencies will likely be making 12% versus 15% on their renewal books of business, however rates will not be increasing by the same margin, therefore resulting in a loss of revenue.

Third, the underwriting restrictions are making new business growth incredibly difficult. While retentions are steady, organic growth is likely to be stagnant or slightly down because of the tight underwriting market. Even agencies with a strong organic growth culture will have difficulty matching the growth of prior years due to the underwriting restrictions.

Fourth, the strain and stress that the current insurance climate has on agency staff. The pressure that agency staff are experiencing is real. The result is that agencies are having to do more to retain their talent and avoid burnout, and doing so while their profits are being suppressed. This may be short-term, but cumulatively all of these items have an effect on profitability.

Agency profitability is one of the key metrics in determining its valuation. While we are still sorting out the long-term effect of the hard market on agency valuations, we believe the short-term is a mixed bag – some good and some bad. To learn more about how the hard market is affecting your agency’s value, please contact Jodie Shaw at jodie@iavaluations.com.

About IA Valuations and Agency Link – Founded in 2017, the IA Valuations team has performed over 220 valuations to independent insurance agencies across the U.S. Our advisors have 25+ years of experience guiding agency owners on maximizing their agency value, planning, and legal needs for ownership transition. In addition, IA Valuations has provided perpetuation planning, financial modeling and business planning for independent insurance agencies. Finally, IA Valuations has advised dozens of agency owners on selling their agencies through our Agency Link process. Agency Link is a platform that connects buyers and sellers together to further the growth and strength of the IA system. To learn more about IA Valuations, please visit IAValuations.com or contact@iavaluations.com.

The information provided in these documents is general in nature and shall not be construed as personal legal, tax or financial advice for your situation. Please contact@iavaluations.com to discuss your personal situation.

Copyright ©2023 by IA Valuations and Ohio Insurance Agents Association (OIA). All rights reserved. No portion of this document may be reproduced in any manner without the prior written consent of IA Valuations or OIA. In addition, this document may not be posted as a link on any public or private website without the prior written consent of IA Valuations or OIA.

By: Craig Niess, CVA, MBA