How Stress and Burnout are Contributing to Agency Sales

There are many factors why an agency owner sells their agency, including: retirement age, financial gain, and the 3-Ds (Divorce, Disability, and Death). However, the undocumented but growing reason that we are hearing about is stress and burnout.

In many industries, including insurance, the pandemic gave people an opportunity to reflect and reset their life goals, plans, and expectations. What we have experienced coming out of the pandemic is a feeling from agency owners that they do not have to continue to do this just because the previous generation did.

On top of the COVID pandemic, agency owners had the double whammy of dealing with the hardest market the industry has experienced in 40 years. This led to significant rate increases for existing insureds, markets shutting down, restrictive underwriting practices, and agents questioning carrier loyalty, partnerships, and practices.

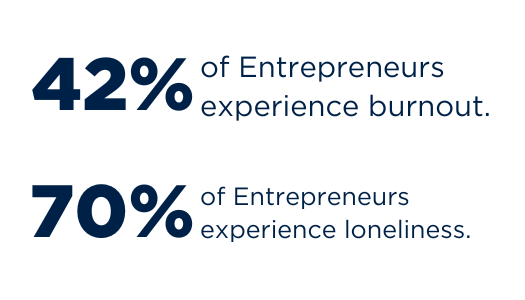

By its very nature, entrepreneurialism is a higher stress career choice than many others. According to recent studies, 42% of entrepreneurs experience burnout. In addition, 70% experience loneliness. Based on IA Valuations’ data, 90% of agency owners who sell their agency under the age of 55 cite stress and burnout as one of the determinative factors for selling. They love insurance and taking care of their clients, but do not enjoy managing people and operating a business.

These owners view selling as the only option to restore balance in their lives and offload all of the administrative and financial challenges of owning and operating a business. While this may be partially true, working for someone else comes with its own set of challenges, particularly for an entrepreneur who is accustomed to being their own boss. When you work for someone else, you are one piece of a larger puzzle and must fit within the rules and constructs that have already been established in the buying agency. From the processes to the sales and growth expectations and the HR policies, you are now subject to an environment that you’ve had no impact on creating.

This is not meant to be a somber message for the IA system as a whole. While there are many somber tones to it, this is just reality. IA Valuations is confident that for every legacy agency owner deciding to sell, there are 1 to 2 young entrepreneurs looking to get into agency ownership.

While selling your agency may feel like the only option, there are many other options to consider if stress and burnout are the primary drivers for a change in ownership. Those options include the following:

- Hiring an Operations Manager – Most agency owners cite the operations and management part of the business as the leading cause of stress and burnout. For agency owners who have a strong sales focus, an operations leader is the perfect partner to regain balance and change your trajectory. It’s like Batman and Robin, Jordan and Pippen, and Kosar and Newsome. Two work partners supporting and bringing out the best of each other.

- Take a Breath and Develop a Strategic Plan for the Agency – Most agencies operate YOY without a strategic plan for growth. This can feel overwhelming and uninspiring when all of your carrier partners are demanding growth to retain the relationship. Taking time to actually develop a plan will put you in a better position to understand what you need to do to grow the agency and restore balance in your life.

- Consider Bringing on a Partner – If you are a single agency owner, consider bringing on a partner to share in some of the leadership and management duties of the agency. A partner could also help shoulder some of the financial risk of agency ownership and give you a teammate to grow the business with.

- Merging with Another Agency – We believe this option should be explored before selling. There are many agencies with strong operational leaders who love the operations and management of an agency the same way that you do selling insurance and taking care of your clients. Finding the right partner to merge with could be the solution for providing you with relief from the duties and tasks causing you stress and burnout. Typically, in these situations, 1+1=2, meaning you find the right cultural fit for your agency and clients, relinquish the parts of the job that cause undue stress, and retain ownership in a larger entity.

- Develop a Strong Peer Network of Agency Owners – The independent agent community is one of the most giving, sincere, and supportive structures in business. The number of times we have heard an independent agent say, “there is enough business for all of us,” is remarkable. If you find yourself lacking a peer structure, this is the first solution we would recommend to combat burnout and stress. It is comforting to know there are non-competitor peers dealing with the exact same issues you have in your agency.

If you find yourself questioning your agency ownership plan, please reach out to Jeff Smith, CEO of IA Valuations, at jeff@iavaluations.com to explore and understand your options.

By: Jeff Smith, JD, CIC, CAE

About IA Valuations and Agency Link – Founded in 2017, the IA Valuations team has performed over 300 valuations to independent insurance agencies across the U.S. Our advisors have 25+ years of experience guiding agency owners on maximizing their agency value, planning, and legal needs for ownership transition. In addition, IA Valuations has provided perpetuation planning, financial modeling and business planning for independent insurance agencies. Finally, IA Valuations has advised dozens of agency owners on selling their agencies through our Agency Link process. Agency Link is a platform that connects buyers and sellers together to further the growth and strength of the IA system. To learn more about IA Valuations, please visit IAValuations.com or contact@iavaluations.com.

The information provided in these documents is general in nature and shall not be construed as personal legal, tax or financial advice for your situation. Please contact@iavaluations.com to discuss your personal situation.

Copyright ©2025 by IA Valuations and Ohio Insurance Agents Association (OIA). All rights reserved. No portion of this document may be reproduced in any manner without the prior written consent of IA Valuations or OIA. In addition, this document may not be posted as a link on any public or private website without the prior written consent of IA Valuations or OIA.