If age is just a number, then why does that number appear to have such a significant impact on agency performance and valuation? At IA Valuations, we study aggregate data on hundreds of agencies and we have found that the ownerships age has a direct correlation on growth and overall valuation.

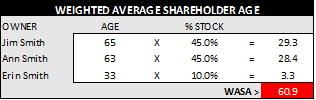

Weighted average shareholder age (WASA) is a useful way to understand the relative age of your ownership team. Understanding this number may spur you to consider planning for your perpetuation options. Additionally, comparing WASA with key growth metrics, will help you understand the need for continuous reinvestment in next generation talent and potential future owners.

To arrive at the weighted average shareholder age, we multiply each owner’s age by their ownership percentages, and then sum the results. For example, the agency in this graph shows 90% ownership concentration in the 60s and 10% in the 30s.

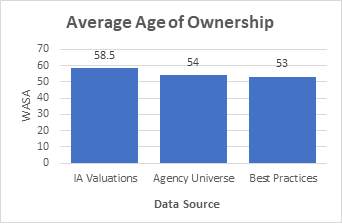

Reviewing all of our WASA data, we found the average WASA for our valuations was 58.5 years of age. For comparative purposes, we reviewed the WASA in 2022 Big I Agency Universe Study (54) and 2022 Big I and Reagan Best Practices Study (53).

Our data showed, a 4 – 5 year discrepancy between groups. The likely explanation is many agency owners completing valuations prior to an ownership transition rather than utilizing it for business planning purposes. While that is a logical explanation for the age differential, the practical impact of waiting to plan for ownership transition can be profound on the agency and next generation. Those 4 to 5 years may be the critical time period to groom producers to execute the internal perpetuation plan.

58.5 WASA is troubling because it indicates that many owners have waited too long to begin perpetuating their agencies to the next generation, and thus limiting their options to transition ownership to an external sale. Additionally, by failing to offer ownership opportunities to younger employees earlier, growth likely suffers and therefore agency value will be negatively impacted.

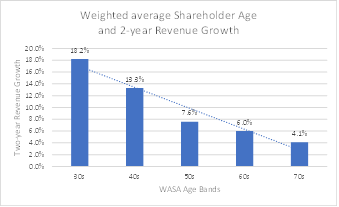

To better understand WASA and its influence on agency performance, we broke down the WASA by age band, and compared it with revenue growth over a two-year period.

What we found is that agencies with lower WASA were growing at a much higher clip than agencies with a higher WASA. In fact, our data shows that agencies with WASA in their 30s and 40s grew 2x to 3x more than agencies with their owners in their 50s, 60s, and 70s.

Intuitively, this makes sense as younger, hungrier employees will bring more energy to the agency compared to older employee who has one foot out the door. But, it goes beyond just having more energy. Giving younger employees a bite of the ownership apple will get them laser-focused on the activities that drive growth and success. Ownership is the IA systems secret weapon that is often underutilized.

The data suggest the need for continuous investment in future generations to drive the growth and thus the value of your agency. By empowering key younger employees with opportunities for ownership and its rewards, the agency will likely experience higher organic growth. Additionally, other employees that wish to be future owners, will likely perform at a higher level and with more focus, in order to be considered for stock ownership.

An agency that does not invest in their perpetuation, will likely see reduced value over time. Agency value is predicated on the ability of the agency to grow and generate profits in the future. Without a defined perpetuation plan, and by waiting too long to reinvest in younger owners, an agency will likely see their risk as outweighing that growth potential.

If you are thinking about selling your agency, we encourage you to connect with Craig Niess, CVA, MBA at craig@iavaluations.com to discuss your situation and how we may be able grow your agency value.

About IA Valuations and Agency Link – Founded in 2017, the IA Valuations team has performed over 200 valuations to independent insurance agencies across the U.S. Our advisors have 25+ years of experience guiding agency owners on maximizing their agency value, planning, and legal needs for ownership transition. In addition, IA Valuations has provided perpetuation planning, financial modeling and business planning for independent insurance agencies. Finally, IA Valuations has advised dozens of agency owners on selling their agencies through our Agency Link process. Agency Link is a platform that connects buyers and sellers together to further the growth and strength of the IA system. To learn more about IA Valuations, please visit IAValuations.com or contact@iavaluations.com.

The information provided in these documents is general in nature and shall not be construed as personal legal, tax or financial advice for your situation. Please contact@iavaluations.com to discuss your personal situation.

Copyright ©2023 by IA Valuations and Ohio Insurance Agents Association (OIA). All rights reserved. No portion of this document may be reproduced in any manner without the prior written consent of IA Valuations or OIA. In addition, this document may not be posted as a link on any public or private website without the prior written consent of IA Valuations or OIA.

By: Craig Niess, CVA, MBA