Today’s insurance landscape is facing a “talent desert,” and agencies that want to thrive are shifting their focus from chasing revenue to acquiring growth-minded professionals. These sellers, often younger, ambitious, and hungry for scale, are the oasis in this dry terrain. When you find one, the impact can be transformative. A well-aligned talent acquisition doesn’t just add value; it can launch your agency into a new growth orbit.

This 3-part case study dives deep into the financial realities of three growth strategies over a 10-year horizon:

- A revenue acquisition

- A Talent Acquisition

- Growing Organically

In our first case, we analyzed the value of a revenue acquisition for an agency. We defined a revenue acquisition as one where the purchaser does not expect the staff of the selling agency to stay or produce in a meaningful way. An example would be a seller who is at or near retirement and no producers with career runway are part of the deal.

In this second edition of our Business Case series, we are going to analyze a case of growth for the control agency through “talent acquisition.” A talent acquisition would be a situation where the seller is at an age or point in their career where post-sale there is a mutual expectation that the seller will grow organically and be part of the buyer’s organization for the mid-to-long term, approximately 10 years.

A talent acquisition scenario can add rocket fuel to your agency’s growth journey.

Talent acquisitions occur when the seller needs access to more markets, offload back-office jobs, or capital to grow in ways they could not independently. The primary driver to sell is not the age of the owner, which is typically the primary driver in a revenue acquisition.

If you can foresee yourself being a seller in this scenario someday, congratulations, you are one of the most highly valued and sought-after individuals in this space. Knowing that, you should only consider selling if a potential partnership is the best path to help you execute on your 10 or 15-year growth or strategic plan. Otherwise, you can build immense value for yourself over the next 10-15 years while building an agency independently. This thought process implies you have a growth plan. If you do not, pause now to create one before continuing to read the rest of this article.

Acquirers seek talent acquisitions aggressively due to the current industry talent desert. A seller with a long career runway and growth mindset is an oasis.

Agencies focused on building value are relentlessly committed to finding talent, and oftentimes the best way to do so is by acquiring it. The acquirer’s primary benefits are twofold; one benefit is revenue, but their true second benefit is the talent and the long-term horizon of organic growth after an acquisition. Due to this long career runway, the value of a seller in a talent acquisition is much higher than in a revenue acquisition. Keep that in mind as we continue this study.

Key Variables to a Talent Acquisition

In our last case study, we laid out the key variables that will matter to any acquisition, regardless of whether it is revenue or talent-focused. The shift to a talent acquisition begs the question, what more should an acquirer and seller consider?

Cultural Alignment

A talent acquisition is a true partnering, rather than a one-time transaction, due to the long career runway of the seller. It is not a true talent acquisition unless the goal for the acquirer is to have the talent of the seller for at least 10 years. Thus, it puts the utmost importance on there being a mutual vetting of agency culture heading into a deal. Two reasonable parties can work through any tactical or strategic issue. What cannot be worked out by reasonable parties is a misalignment of values, morals, and expectations.

Core Question: As the acquirer or seller, can I foresee working alongside the other party for 10 years?

This can be a hard question for many to answer. Take this advice to give you the framework to answer it as best as possible. First, make sure you have signed a mutual NDA with any party you are considering partnering with. This will give you peace of mind that you are legally protected to be open and honest, especially in the event you decide not to partner with a particular party. Next, try to make the focus of your first two conversations with a party almost entirely about understanding the other person(s) involved, not the agency’s operations or book. Why do they want to grow? What motivates them? What’s their 5, 10, 15-year vision for their business? How do they treat the waiter at the restaurant as you break bread? How do they talk about others? Who are the rising stars? These are just a taste of what the acquirer and seller want to understand about the other as you consider partnering for the long term.

Strategic Vision

The most successful partnerships we have witnessed are ones where the seller and acquirer understand how they will fit into one another’s business plan. Earlier, we laid out that if you are the seller, then you should only be considering this path because you need a partnership with a larger firm to execute on your growth goals for the next 10-15 years. Well, your future partner needs to understand and be aligned with those same goals. As the seller, you need to make sure the acquirer understands what makes your operation valuable.

Core Question: Does the seller/acquirer demonstrate an understanding of what’s made my business successful, and do those same characteristics match what the other party needs to achieve the goals they had before this partnership was an option?

To determine this, each party should ask the other, “If this partnership took place, how does the acquirer/seller help the other party achieve its 5, 10, 15-year goals?” The specific question is unimportant, but the idea is; make sure the other party can articulate your business’s strengths and how they match their plan. Culture mismatches can derail a deal, but so can misaligned expectations for the future. For example, if a seller wants to sell and then not be pushed to grow but an acquirer expects 15% organic growth year over year, then that can quickly cause issues.

Compensation Alignment

For a long-term partnership, the incentives created through compensation are crucial to success. In these cases, where PE-backed agencies or large independent agencies are typically the acquirers, equity in the acquiring company is offered to the selling owners. Sellers in this situation understand the value of ownership and the alignment that it creates to perform their role well. If the acquirer is in a position to offer equity to a seller, it is arguably the best agency acquisition tool in their belt.

Core Question: How does the compensation package being considered align with the strategic vision of success for the partnership?

This question applies to an agency’s staff always, not just in this scenario. But this major milestone in two agencies’ lifecycles can be a chance to revisit compensation strategy. A seller in a talent acquisition is going to need a piece of their package with an open-ended earning ceiling – either commission, equity, or both. Incentivizing the seller with equity will create mutual alignment with both parties. This is a moot point if there is not a cultural and strategic fit.

Succession Potential

Ideally, a partnership such as this creates more exit options for both the seller and acquirer down the road. The acquirer is bringing talent onto their team that has the potential to purchase more equity in the future. The seller is partnering with a company where they have more career flexibility than they would if they remained the independent owner of an agency.

Core Question: What are my current exit options if I head down my agency’s current trajectory, and do I want more flexibility?

Many agents today are being forced to sell externally because they don’t have an internal perpetuation option. If you are 55 and don’t have an internal perpetuation plan, consider supercharging your agency over the last 10-15 years of your career by seeking a talent acquisition that would then at least give you the talent on your team to consider internal perpetuation in the future. Another major benefit to the acquirer of offering equity is that they can reduce their cash burden at the time of sale. This is described in the financials of the case study later.

Multiplier Effect or Silo

A talent acquisition should not look like two parties entering a partnership with everything else the same, except behind the scenes with some equity shuffled. This would be operating in siloes. A successful talent acquisition should be highly integrated between the agencies post-partnership. There should be synergies achieved that enable exponential growth for the post-partnered agency.

Core Question: Will the talent being acquired raise the bar for the broader post-partnership team, or will they operate in a silo?

The multiplier effect could look like one party having a commercial lines niche and the other party having a broader reach to funnel more business to the niche. It could look like one party having a back-office support system that enables one party to continue to focus on producing business rather than getting bogged down with managerial tasks. Whatever the multiplier effect may be, a successful talent acquisition should be one where the partnering parties become intimately intertwined rather than siloed; that is how you really benefit from acquiring talent.

Case Study Framework – Talent Acquisition

Imagine two agencies:

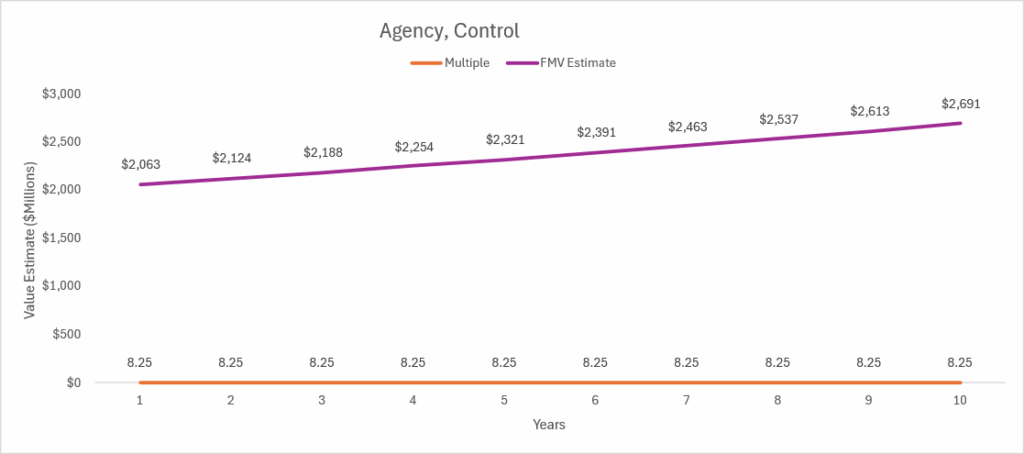

- The acquirer, a $1 million revenue agency with a 25% EBITDA margin and an 8.25x EBITDA multiple applied as their control valuation.

- The acquirer is a strong independent agency – exceptional customer service, a steady stream of referral business, and a team including two validated producers.

- The seller, a $250,000 revenue agency with two partners, both aged 35, with no service staff, and they have demonstrated strong growth in the preceding 3 years.

- The seller represents an up-and-coming agency, but they are at a crossroads. The partners must decide to either hire internally to free their time to produce, or they can partner externally, seeking equity in a future partner and gain the benefits of more markets and back-office support.

- This is the profile of an agency that private equity (PE) funded agencies will target aggressively due to the age and growth mindset of the owners.

This case study will look at two scenarios over the course of 10 years.

- Control scenario – the acquirer continues organic growth at 3% annually.

- Acquisition scenario – the acquirer buys the $250,000 agency in year one. The acquired book of business has a top-performing sales velocity of 15% the following 10 years.

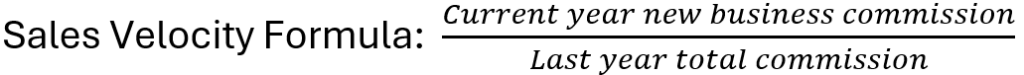

For our case study, our “Fair Market Value (FMV) Estimate” is this simple equation:

Case Study Value Estimate = EBITDA cash flow * multiple of EBITDA – Liabilities

Purchase Price for Seller

For simplicity’s sake, we will use a revenue multiple, even though value is derived from an agency’s cashflow or EBITDA.

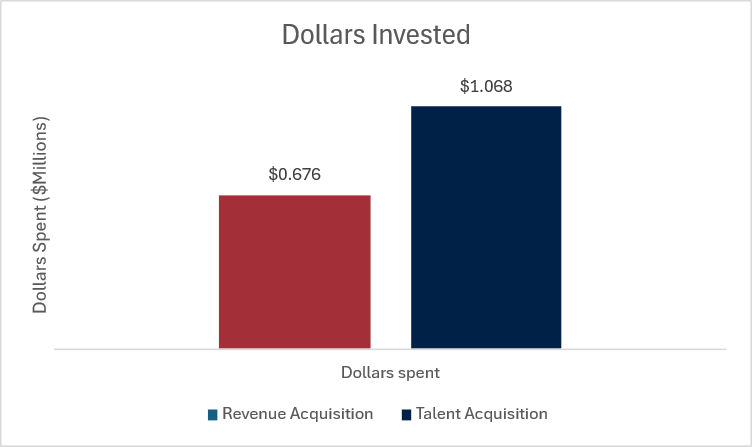

In our revenue acquisition, we used a purchase price of 2.25x revenue because this is around what we are seeing as a baseline revenue acquisition. For a talent acquisition of the selling agency that has $250k in revenue with two young producers who are growing, we are going to use a revenue multiple of 3x for a purchase price. An agency with this profile is certainly more valuable than a revenue transaction.

The sellers accepted a deal where they were paid $650,000 in cash and $100,000 in equity. They accepted a 5% equity interest in the post-acquisition entity. This lowered the amount the acquirer had to borrow by $100,000.

Financial Results

Control Scenario

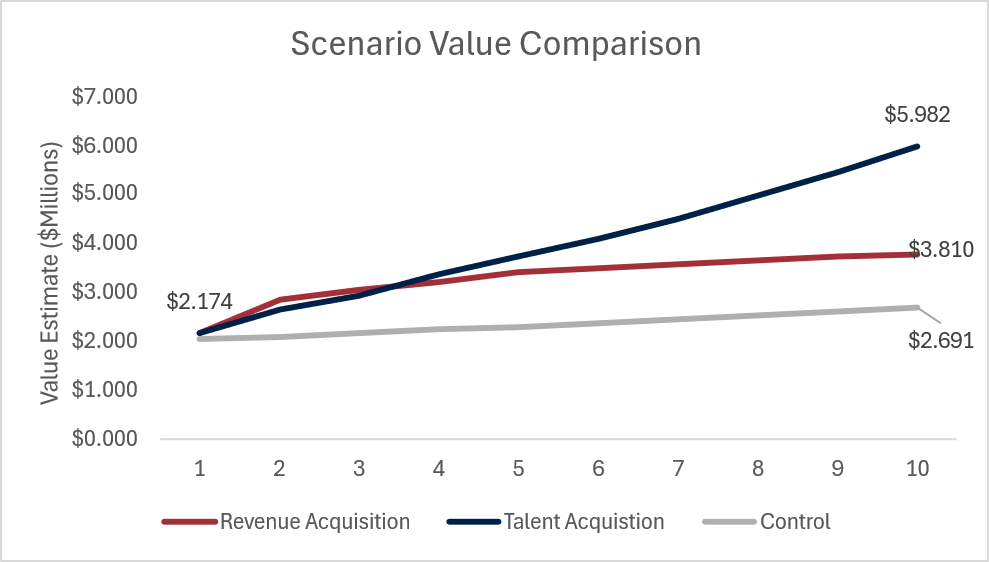

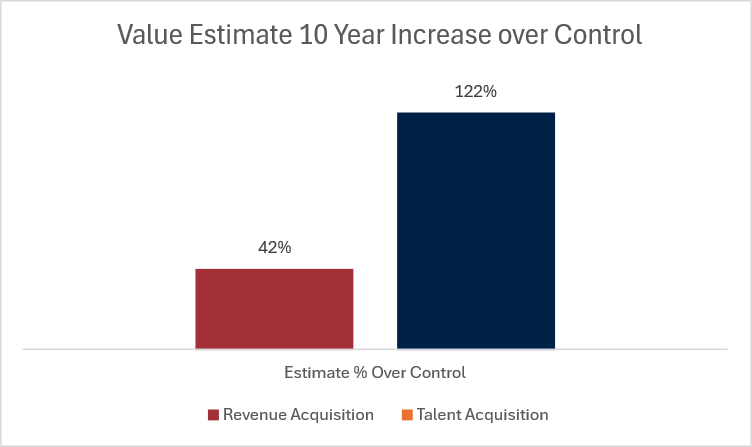

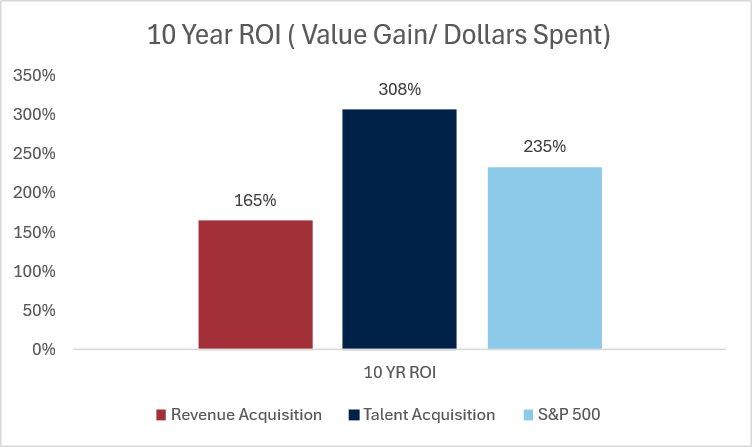

As demonstrated above, a revenue acquisition does not come close to the 10-year value-add of a talent acquisition. You may be wondering, “But the acquirer gave away 5% of their equity, so how?” They did, and that still yields a 10-year value estimate for the acquirer of $5,682,900, which is a 111% increase over the control scenario. The key driver in this talent acquisition is the organic growth of the sellers. The sellers grow their book of business at a 15% sales velocity over the next 10 years. While this may be wishful thinking, realistically, the sellers will have some years below this pace and some above. In a situation where there is high cultural, strategic, and compensation alignment, it is not unreasonable to expect this growth trajectory. The book begins at $250,000 in revenue and ends at $650,000 in revenue by the end of year 10. This suggests the partnership had a strong multiplier effect. As a result of a multiplier effect, an assumption in our model is used that increased the acquiring agency’s annual growth rate from 3% to 4% for years 1-10 as they benefitted from the seller’s organic growth prowess.

Acquisition Scenario Comparison

As you can see, the talent acquisition nearly tripled the performance of the revenue acquisition, which speaks to the importance of organic growth and the value of acquiring talent with a long runway.

While it cost the acquirer about $250,000 more dollars over the life of the loan, the benefit far outweighs the cost. A key way to reduce the cost of financing is to offer equity in a talent acquisition. This saved the acquirer from borrowing $100,000. That drove the financing cost down $142,442 as opposed to if the deal was all cash and the loan was $750,000. Be willing to negotiate with equity.

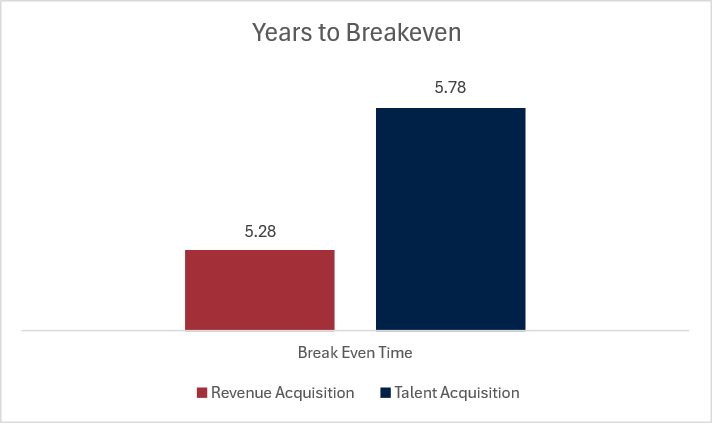

The figure above is only considering cash flow from the acquired book of business and the difference between the cost of financing the acquisition. Between using equity and the organic growth of the sellers, although the agency paid about $250,000 more over the life of the loan, they broke even within the same year as the cheaper revenue acquisition.

Results: Is This a Good Investment?

At IA Valuations, we want to promote agency owners and other agency professionals to view their business as an investment that earns a rate of return. As a result, let’s compare these investments to the S&P 500’s 10-year return as of September 2025. The ROI of a talent acquisition not only drastically outperforms a revenue acquisition, but also beats the S&P 500! Investing in talent at your agency is well worth the effort. However, there needs to be a commitment to creating and sticking to a strategic plan for acquiring and developing talent for the most success. In our scenario, the agents acquired had a 15% sales velocity year over year for 10 years. That will not just happen without planning.

Final Thoughts: Why Talent is the Smartest Investment You’ll Ever Make

In today’s insurance landscape, talent isn’t just a resource; it’s the catalyst for transformation. Revenue acquisitions may offer short-term gains, but they rarely deliver the sustained momentum that comes from aligning with growth-minded professionals. Talent acquisitions, when done right, create synergy, unlock new markets, and elevate the entire agency.

The numbers don’t lie: acquiring talent with a long runway and strategic alignment can outperform traditional investments, even including the S&P 500. But this kind of growth doesn’t happen by accident. It requires intentional planning, cultural fit, and a shared vision for the future.

If you’re an agency owner looking to build real, lasting value, start by asking: Who do I want to grow with for the next decade? In a talent-starved industry, the right partnership isn’t just a good deal – it’s a game-changer.

We are in a talent tundra, and when an agency stumbles across an oasis, they should be quick to consider acquiring it. If you have questions about this case study or what IA Valuations to look at specific attributes of your agency, please contact Jarod Steed at jarod@iavaluations.com to get started.

By: Jarod Steed, Business Planning & Development Analyst

About IA Valuations and Agency Link – Founded in 2017, the IA Valuations team has performed over 270 valuations to independent insurance agencies across the U.S. Our advisors have 25+ years of experience guiding agency owners on maximizing their agency value, planning, and legal needs for ownership transition. In addition, IA Valuations has provided perpetuation planning, financial modeling and business planning for independent insurance agencies. Finally, IA Valuations has advised dozens of agency owners on selling their agencies through our Agency Link process. Agency Link is a platform that connects buyers and sellers together to further the growth and strength of the IA system. To learn more about IA Valuations, please visit IAValuations.com or contact@iavaluations.com.

The information provided in these documents is general in nature and shall not be construed as personal legal, tax or financial advice for your situation. Please contact@iavaluations.com to discuss your personal situation.

Copyright ©2025 by IA Valuations and Ohio Insurance Agents Association (OIA). All rights reserved. No portion of this document may be reproduced in any manner without the prior written consent of IA Valuations or OIA. In addition, this document may not be posted as a link on any public or private website without the prior written consent of IA Valuations or OIA.