Unfortunately, you may be one of the many agencies not receiving profit-sharing due to the inflated loss ratios caused by the hard market. While this will have an impact on your value, the good news is the hard market is likely temporary and should not have a profound impact on the value of your agency in the long term. There are three areas of the agency valuation that are impacted by profit-sharing: annual revenue, profitability margin, and carrier relationships.

This segment of the “Help!” series will explore what effect the lack of profit-sharing in one or more years will have on your agency value and what you can do to improve your value as it relates to the profit-sharing component of the assessment.

First, profit-sharing, as it relates to agency values, is based on a three-to-five-year average. The agency is credited with the average annual revenue that profit-sharing produces over those three to five years. While your agency is credited with the average revenue produced over a three-to-five year period, you also lose that same bottom-line revenue when you do not get profit sharing.

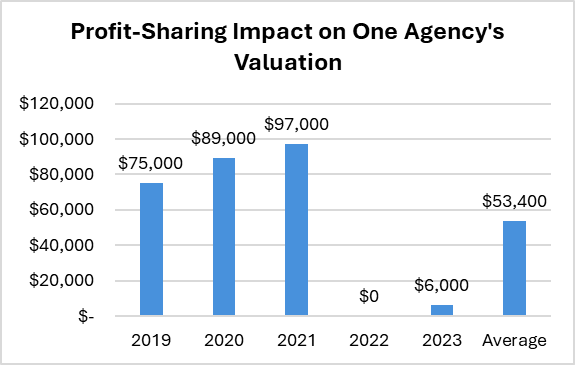

For instance, this graph shows an example of an agency that had a string of profitable years with profit-sharing, followed by two consecutive years of losses. As a result of the losses in 2022 and 2023, the agency went from an average amount of $87,000 from 2019 – 2021 down to $53,000 over the past 5 years. When you experience two bad years out of three consecutively, it is important to advocate for considering a longer period of time in your valuation, as your string of bad luck is likely attributable to the current hard market rather than your agency’s performance.

If this agency were to consider only the 3 most recent years of profit-sharing, the average would be $34,433 instead of the 5-year average of $53,400. By extending the consideration period to 5 years, the agency gets another $19,000 in annual revenue to be factored into the valuation analysis, which likely increases the value of the agency.

Second, the impact of the valuation varies based on the percentage of the agency’s annual revenue derived from profit-sharing. For most agencies, profit-sharing represents 6 – 10% of annual operating revenue. Since most agencies do not budget for profit-sharing, it does not affect annual operating revenue, but does have an impact on the profitability of the agency.

Independent agencies typically have a 25% EBITDA profitability margin when profit-sharing is factored into the P&L. In the case of the agency discussed above, losing approximately $87,000 from the agency’s annual revenue likely decreased its profit margin by 5 – 7%. Profitability margin is another key metric in determining agency value. When profit-sharing is good, it has a positive impact, but “when the wind blows” and profit-sharing is negative, it likely will impact the overall value of the agency.

Third, it will depend on how many years you have not received profit-sharing. If this is a one-year anomaly that can be attributed to the hard market, then it will likely not have a meaningful impact on agency value. However, as you analyze your loss ratios with your key profit-sharing producing carriers over the past three to five years and have consistently high ratios, then it will have a greater effect on your value.

A long string of high loss ratios will do more than just affect your profit sharing; it will also risk the agency agreement with some of your key carriers. While you do not have control over when losses happen, ensuring the protection of your key relationships and maintaining profitable business is critically important to both agency value and the ongoing relationship.

In conclusion, while the lack of profit-sharing will have some impact on your agency’s value, it should be minimal as long as the trends do not continue. If your agency has experienced a loss of profit-sharing in the past couple of years and are interested in how it has affected your agency value, please contact Jeff Smith at jeff@iavaluations.com.

By: Jeff Smith, JD, CIC, CAE, CEO of IA Valuations

About IA Valuations and Agency Link – Founded in 2017, the IA Valuations team has performed over 250 valuations to independent insurance agencies across the U.S. Our advisors have 25+ years of experience guiding agency owners on maximizing their agency value, planning, and legal needs for ownership transition. In addition, IA Valuations has provided perpetuation planning, financial modeling and business planning for independent insurance agencies. Finally, IA Valuations has advised dozens of agency owners on selling their agencies through our Agency Link process. Agency Link is a platform that connects buyers and sellers together to further the growth and strength of the IA system. To learn more about IA Valuations, please visit IAValuations.com or contact@iavaluations.com.

The information provided in these documents is general in nature and shall not be construed as personal legal, tax or financial advice for your situation. Please contact@iavaluations.com to discuss your personal situation.

Copyright ©2024 by IA Valuations and Ohio Insurance Agents Association (OIA). All rights reserved. No portion of this document may be reproduced in any manner without the prior written consent of IA Valuations or OIA. In addition, this document may not be posted as a link on any public or private website without the prior written consent of IA Valuations or OIA