To know where you are going, you must first know where you are currently. The biggest step in business planning each year is having a clear metric for the agency’s success. We believe the most effective metric and report is to get an independent fair market valuation of your agency.

The valuation report will give you a full comprehensive view of your agency and the true, fair market value of your agency. You will learn about 25+ factors that bring risk to your agency’s success and can ultimately drive the value down.

A valuation can be used as a roadmap and blueprint for the future success of your agency. Whether you are an owner who is just getting started or a tenured veteran in the industry nearing retirement age, the best time to get a valuation is now so you can start using it as a part of your business planning process.

No matter the plans in place, a valuation is a tremendous instrument to utilize in order to maximize your agency’s value now, and most importantly, when it comes time to retire. To prove this point, let’s take a look at three totally different examples of agencies that use the valuation reports as a central business planning document.

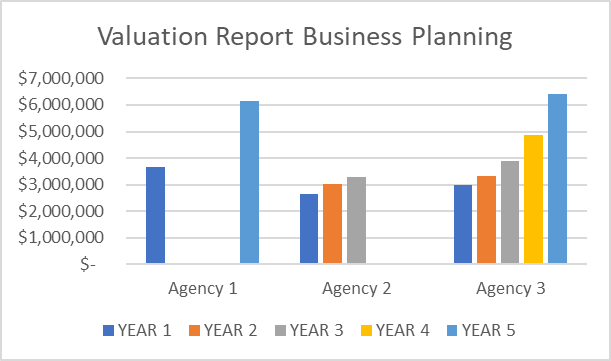

Agency 1 conducted two valuations, four years apart. Agency 2 completed three consecutive valuations, and Agency 3 completes a valuation as part of its annual review process. As you can see, these three agencies saw growth over a five-year span, some more significant than others, but growth nonetheless.

These agencies use the valuation report to understand their weaknesses and the risks involved in their agency and focus on what is hurting their value. For example, after the first valuation, Agency 1 learned they needed to clean up their balance sheet, reduce costs, and improve profitability. Over a five-year span, they did just that. They retained earnings to strengthen their balance sheet which led to the opportunity to acquire a book of business without taking on significant debt. Between their growth by acquisition, strong balance sheet, and improved profitability, the agency increased their value by almost 50%!

Agency 2 uses the annual valuation to continue their steady march to profitable growth and increasing value. Agency 3 has consistently grown over the five-year span as a result of being informed of their risks, focusing on improving those risks through diligent business planning, and thereby boosting their agency’s value by millions of dollars.

We are not claiming that doing a valuation report will lead to 50% growth in agency value, however we do believe they will give you an important tool to start your path towards increased growth and value.

These examples show the critical role a valuation plays in business planning. We have seen agencies take the knowledge they get from the valuation report and use it to maximize their value and be prepared for anything the future may hold.

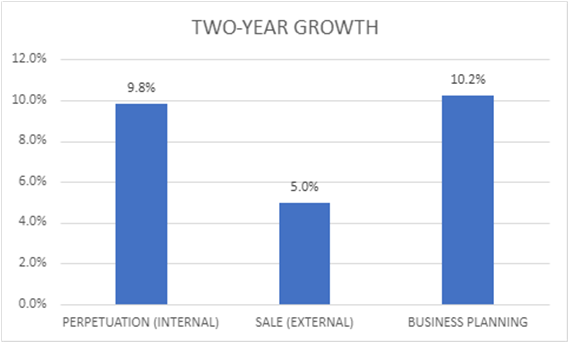

For further proof, we have studied the reasons why the 200+ agency owners have completed a valuation with us over the past couple of years. The IA Valuations team discovered that those principals that use an agency valuation for business planning see an average growth of 10.2% over a two-year period.

On the other hand, those using a valuation because they are getting ready to sell are only seeing growth at 5% over two years.

There are many advantages to planning early. This data shows us that while getting a valuation before you sell is critically important, it may be too late to implement the changes and overcome weaknesses that are identified in an agency valuation to significantly improve value.

Preparation and timing play a huge role in maximizing your agency’s value. To discuss how you can use a valuation report as the centerpiece to your business planning efforts, please reach out to Luke Hippler, MBA at luke@iavalutions.com.

About IA Valuations and Agency Link – Founded in 2017, the IA Valuations team has performed over 200 valuations to independent insurance agencies across the U.S. Our advisors have 25+ years of experience guiding agency owners on maximizing their agency value, planning, and legal needs for ownership transition. In addition, IA Valuations has provided perpetuation planning, financial modeling and business planning for independent insurance agencies. Finally, IA Valuations has advised dozens of agency owners on selling their agencies through our Agency Link process. Agency Link is a platform that connects buyers and sellers together to further the growth and strength of the IA system. To learn more about IA Valuations, please visit IAValuations.com or contact@iavaluations.com.

The information provided in these documents is general in nature and shall not be construed as personal legal, tax or financial advice for your situation. Please contact@iavaluations.com to discuss your personal situation. Copyright ©2023 by IA Valuations and Ohio Insurance Agents Association (OIA). All rights reserved. No portion of this document may be reproduced in any manner without the prior written consent of IA Valuations or OIA. In addition, this document may not be posted as a link on any public or private website without the prior written consent of IA Valuations or OIA.

By: Luke Hippler, MBA