Why has private equity fallen in love with the independent insurance agent? Many would be quick to tell you that the insurance broker and agent industry is steady. It weathers storms. Thus, private equity interest in this space has remained so high. While this sentiment is true, how do we know it’s true? How do we know that insurance agencies are more resilient, more consistent, and more recession-proof than other industries?

A simple exercise to shed light on this question is to observe how the nation’s largest insurance brokerages fared compared to the most popular barometer of the U.S. economy, the S&P 500. There have been 3 economic recessions since the turn of the century:

- The Dot-Com Recession (March – November 2001)

- The Great Recession (December 2007 – June 2009)

- The Covid-19 Recession (February – April 2020)

There are promising insights gleaned from the stock price changes from each of the three recessions for the insurance brokerage industry.

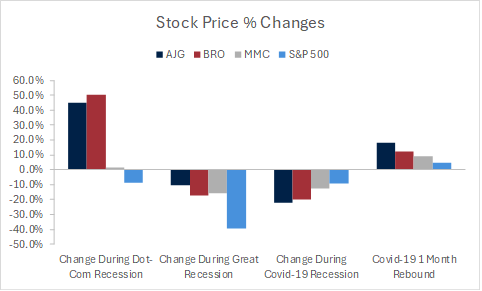

In this exercise, Arthur J. Gallagher & Co. (AJG), Brown & Brown, Inc. (BRO), and Marsh & McLennan Companies Inc. (MMC) represent the insurance brokerage industry and the S&P 500 will represent the rest of the economy.

During the eight-month Dot-Com recession, AJG, BRO, and MMC saw increases in their stock price while the S&P 500 saw a nine-point drop in its price. Over the course of the Great Recession, the S&P 500’s price dropped a whopping 39-points, while the three brokerages observed decreased prices, but only by half the points that the S&P dropped. Contrary to these two observations, the Covid-19 recession saw the insurance brokerages’ price drop more than the S&P 500’s did. However, what does speak to the insurance brokerage industry’s resilience is the one-month post-recession change where brokerages’ stock prices increased at a faster rate than the S&P 500’s.

In all three recessions, it is evident that the confidence in the insurance brokerage industry is unwavering. Although the information that is accessible for these large brokerages is not available for the small- to mid-sized agencies, we are confident that a similar resilience, consistency, and recession-proof nature applies to agencies of all sizes.

The low overhead and necessity of insurance contribute to the stability of an agency, but the real key to the success of the small- to mid-sized insurance agency is their position as a cornerstone of the communities they operate in. At an agency or brokerage’s core, all that really changes with scale is the market, or community, they serve. Insurance is complex, and personal lives and businesses will continue to get more complicated, so communities will increasingly need agents and brokers to help them navigate the insurance world.

IA Valuations has 5 suggestions for you to leverage this resiliency during some critical milestones in your career or in your agency’s life cycle.

- To the owner who wants to internally perpetuate – Identify who will be the people part of your succession plan. If you don’t do so in a timely manner, history and today’s market tells us that before you know it, the price of your agency could be too high for your successor to feasibly buy in. Your successor will want to pay you what you are owed, and you will not want to cash-strap them for the next 10-15 years. Do not wait to make and execute that perpetuation plan.

- To the agency owner who wants to sell externally – The past, present, and future all point to your agency’s value increasing. It can weather hard times when other industries cannot. Organic growth amongst agencies saw historically high marks in 2023 with the trend likely to continue into 2024. If you plan to sell externally, leverage history alongside the asset you have spent your life growing to be confident making a counteroffer.

- To the producer who wants to own someday – Be proactive. Do not wait for situation X, Y, and Z to become true before you consider buying in. By the time your perfect buying scenario comes around, the agency’s price may inhibit your lifestyle more than it would have when you first had the thought. Look at the past for comfort – yes, it’s risky to become an owner, but agencies are resilient. If you don’t sit on your hands, the investment will be worthwhile.

- To the producer who is not interested in owning right now – Would you reconsider? The industry needs young, capable producers to make internal perpetuation possible and expand current owners’ options beyond just an external sale. No current principal should be forced to sell externally if they do not want to. The insurance agency is an appreciating asset. History tells us that even throughout the hardest of times, the agency leaves its shareholders off better than others.

- To the professional who is not in the industry – Despite its resiliency and value, the industry is still in need of new talent. Look at the past, consider the present, and be hopeful for the future. Becoming an insurance professional with an agency could be the most profitable decision you make!

Whatever position you find yourself in at an agency today, consider what more you can get out of your agency by investing in it. The insurance agency has proven throughout time that it’s an asset with unmatched resiliency. Will you take the steps necessary to make the most of it?

If you fit any of these descriptions or want to learn more about how IA Valuations can help your agency business plan, reach out to me at jarod@iavaluations.com.

By: Jarod Steed, Business Planning and Valuation Analyst

About IA Valuations and Agency Link – Founded in 2017, the IA Valuations team has performed over 220 valuations to independent insurance agencies across the U.S. Our advisors have 25+ years of experience guiding agency owners on maximizing their agency value, planning, and legal needs for ownership transition. In addition, IA Valuations has provided perpetuation planning, financial modeling and business planning for independent insurance agencies. Finally, IA Valuations has advised dozens of agency owners on selling their agencies through our Agency Link process. Agency Link is a platform that connects buyers and sellers together to further the growth and strength of the IA system. To learn more about IA Valuations, please visit IAValuations.com or contact@iavaluations.com.

The information provided in these documents is general in nature and shall not be construed as personal legal, tax or financial advice for your situation. Please contact@iavaluations.com to discuss your personal situation.

Copyright ©2024 by IA Valuations and Ohio Insurance Agents Association (OIA). All rights reserved. No portion of this document may be reproduced in any manner without the prior written consent of IA Valuations or OIA. In addition, this document may not be posted as a link on any public or private website without the prior written consent of IA Valuations or OIA.